Before anyone has a heart attack, the items listed below are not my reasons but Jim Puplava's from his June 24, 2005 Storm Watch Update. Here is Jim's list, point by point in italics, each point immediately followed by my reply:

Ten Reasons for Hyperinflation

1.Global oil production will peak between 2005-2008. Economic growth ceases to exist as global economies and markets are thrown into chaos and turmoil.

1A. Sorry Jim, peak oil is a resource phenomenon not a monetary phenomenon. It is no more inflationary than is soybean blight. BTW rising oil prices are probably deflationary if anything. Excess driving will come to a halt as will hotel bookings and airline travel. Bankruptcies and layoffs will both soar. The net affect of that is deflationary unless you are going to tell me that wages and jobs will rise to meet rising gas prices. Since that has not happened on the rise in crude from $25 to $60, pray tell why will wages rise if crude rises to $100?

2.The War on Terror escalates into a resource war over oil pitting the great powers the US, China, and Russia in a replay of “The Great Game.”

2A. My answer is the same as in 1A above.

3. Debt creation and monetization hyperinflates as the government’s deficit spirals out of control with a war and a depression.

3A. What about debt creation in Japan, China, Europe, and the UK? Exactly who is going to war against who? Prices are going to rise in this "depression"? Why? Is China going to raise prices? If so, where are the jobs going to come from for US consumers to buy Chinese goods?

4.Foreigners begin to bail out of the dollar setting off a dollar crash.

4A. They are going to bail and buy what? Euros? The pound? Yen? Why, why, and why? Japan has debt equal to 250% of GDP, the UK is 6 months ahead of us in their housing bust and has a huge % of public sector workers to boot, and the EU seems to be in political shambles at the moment. Tell me exactly what everyone is going to buy when they start bailing.

5.The US puts in place capital controls to corral US and domestic money. The War on Terror will be given as the reason.

5A. I am not exactly sure what this would do so I take a pass and will think about this one later.

6.The government takes over GSEs owning most American mortgages.

6A. Even assuming this happens how does that lead to hyperinflation? (see my answer to #7 for more clarification)

7. A national mortgage bailout bill is passed lengthening mortgage payments in an effort to forestall debt defaults. A new restructuring agency will be set up to repurchase impaired mortgages from the banking system and renegotiate terms of the debt to avoid default. The 100-year mortgage is born.

7A. Ok so a 100-yr mortgage is born. How does that cause prices to rise? Furthermore, a near universal criticism of Japan was the fact that Japanese banks kept bad loans on the books for years, refusing to write them off. Now you are suggesting that when we do the same thing it will cause hyperinflation even though it clearly prolonged the deflation in Japan. Sorry Jim, I do not buy it.

8. A national retirement security act is passed forcing private pensions to buy long-dated zero-coupon government bonds that will be inflated away. The reason given will be for plan protection against bear markets.

8A. Assuming such a bill is passed (I seriously doubt it) but for the sake of argument I will assume it happens. Pray tell exactly how is that hyperinflationary? How and to what extent would it increase the money supply or cause prices to rise?

9.As the US economy goes into a hyperinflationary depression the rest of the world’s economies follow suit. Money printing on a grand scale occurs in western and Asian economies as governments wrestle and try to satisfy the demands of a social welfare state and an angry, aging populace.

9A. The entire world goes into a hyperinflationary depression at the same time. Hmmm do home prices head to infinity? Is everyone buying homes at these prices taking out 125% loans going to be bailed out? Are jobs going to be so abundant in this worldwide depression that everyone has enough money to buy things with? In your model do Congress, bankers, and the credit card companies all stand back and watch this happen? How nice of inflation to bail out all of the debtors at the expense of powerful creditor like banks.

10. As governments hyperinflate and debase their currencies, gold will take on its true role as money rising in value against all currencies. The world will move towards a global currency backed by gold.

10A. Here is how I see it: As debt everywhere is repudiated in a deflationary crash, the grand experiment in Fiat money backed by nothing will lead to reinstatment of the gold standard or a gold/silver standard and once that debt is all wiped clean and we start over from a complete K-Cycle deflationary debt purge, then we can see inflation take off.

Jim Puplava continues....

MY ARGUMENTS FOR DEFLATION:

1. Elimination of the Federal Reserve

2. Gold backing of the U.S. dollar

3. Honesty returns as a virtue in Washington

4. World peace

Need I say more?

Jim Puplava

============================================================

Yes you do need say more because you completely failed to address the questions posed by deflationists such as myself in a believable scenario. Furthermore, the above four points simply can not be considered a serious attempt to consider or understand the deflation arguments especially those presented in Same Data / Different Interpretation.

On the other hand, I freely agree with much (but not all) of what you have had to say about the CPI being understated, that deflationists (and others) do not understand what money is, and that hedonics, imputations and productivity all need to be appropriately factored in. We seem to also be in general agreement about gold, but for reasons that are 180 degrees apart.

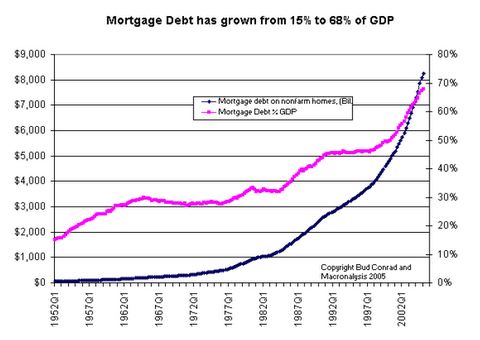

Not a single hyperinflationist (most of them oddly enough point to the debt bubble and expect a housing crash, both of which are inherently deflationary in nature) has been able to explain how home prices keep rising, jobs are lost in the upcoming recession, wages keep falling because of outsourcing, bankruptcies soar, etc etc etc and we end up with inflation. I still feel that I have not gotten a credible reply, given my challenges to the 10 reasons for hyperinflation presented above.

I will repeat the key paragraph from Same Data / Different Interpretation:

Falling home prices, and the resultant slowdown in trade jobs coupled with rising unemployment are the Achilles’ heel of inflationists. They can not explain how this scenario leads to further inflation. Nor can inflationists tell me how home prices can keep rising as long as we have global wage arbitrage, falling wages, and loss of jobs. Home prices can NOT rise above wage growth over the long haul! The destruction of credit and money along with an increasing number of bankruptcies that will accompany a significant downturn in housing is the very essence of deflation.

Now perhaps the above 10 items were meant to address the issue but I believe most of the 10 points are easily refuted as I did above. Oil is easily dismissed and is in fact an argument for deflation if you come right down to it.

I am not the only one who feels this way. It seems Bill Gross is in my corner with his July 2005 outlook entitled Fire!

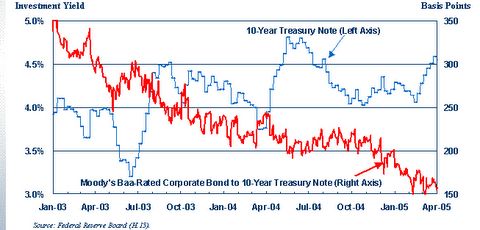

"The Fed may soon be out of fuel, despite hints of Bernanke-style helicopter money. Stocks and houses are already at low yields and high prices reflective of European economies nearing Japan-style liquidity traps.

If the asset pumps run dry and the kerosene cans empty, the inevitable path of the U.S. economy will reflect slow growth at best and recession as a realistic alternative. Inflation then would return to low 1% levels in the ensuing years and be pressing the deflationary crossover line. Nominal Treasury paper would enter the 3-4% zone for 10-year maturities and lower still for shorter intermediates. Such an analysis argues for capturing yield via duration extension now in the face of admittedly artificially low current yields. If Rome burns, long maturity bonds will rule the day and that day may come sooner than many imagine possible."

The theory that the entire world going into hyperinflation at once certainly seems to require massive world-wide hiring and wage growth. Unless that happens where are people going to get money to buy things?

The argument that forestalling of debt is hyperinflationary must be dismissed since it did nothing but prolong Japan's agony.

The last stand of hyperinflationist seems to be some scenario in which governments all over the world do some sort of "helicopter drop" to bail out all the debtors.

Sorry Jim that is just not plausible if one considers the real world implications. Hyperinflation would bail out debtors at the expense of banks, credit card companies, and other creditors. Are banks going to want or allow that? Would Congress allow it? No, in fact Congress went the other way. Congress passed a bankruptcy reform bill that will have consumers owing money to the company store from now until doomsday.

A key point to remember is that when Greenspan slashed rates to 1% he was bailing out banks not consumers. Corporations owed money to banks as did numerous foreign nations. Greenspan kept rates low enough, long enough to enable corporate balance sheets to be restored and bank loans to corporations to be repaid. Now it is consumers not corporations that are deepest in hock, and the primary creditor is GSEs not banks. That is a huge difference and I find it silly at best to think that money will be dropped from helicopters (or given away in massive quantities) to bail out consumers at the expense of banks and other creditors. Bill Gross does not find the Bernanke Helicopter Drop theory plausible and neither do I.

Here is the nut hyperinflationists need to crack:

- Falling home prices

- Falling wages

- Stagnant employment or rising unemployment

- Slowing world economy

- No incentive for the FED to bail out consumers at the expense of banks

- The K-Cycle is not likely to be defeated by throwing more money at the problem.

- At some point lenders refuse to lend or borrowers stop borrowing. That time will be at hand when housing plunges. Look at current events in the UK as a prelude for what will happen here.

"The Bank of England will today issue one of its clearest warnings to date of the risk to the UK's financial system from the surge in consumer borrowing.

In its key twice-yearly review of financial stability, the Bank says banks had been caught unawares by a sudden jump in the number of debts that had to be written off, particularly on credit cards. It says lenders reacted by tightening their criteria - a move which could aggravate the current sharp slowdown in consumer spending.

The warning comes as the Bank for International Settlements (BIS) - the central banks' central banker - warned that rich countries' financial sectors faced 'significant macroeconomic risks'.

Sir Andrew Large, the Bank's deputy governor, said recently while the near-term outlook was 'generally healthy', there were some concerns on the horizon. He said: "There are signs that areas of credit risk may be underpriced and the liquidity of some assets could prove illusory in stressed conditions."

Hmmm. Bankruptcies increasing and credit standards tightening. Sounds like classic liquidity trap action to me. Perhaps hyperinflationists believe "It's different this time".

Here is another point of view to consider. Stephen King: Low interest rates can point to deep-rooted weaknesses.

"Interest rate cuts are back on the agenda. It's a surprising result, given how low interest rates already are. Not everyone has got there yet. Only two of the nine members of the Bank of England's Monetary Policy Committee have so far voted in favour of a rate cut. And, although Jean-Claude Trichet, the president of the European Central Bank, seems to be willing to think the previously unthinkable, his colleagues are likely to delay a move downwards in European interest rates until later this year.

Low interest rates are not the cause of high inflation; they are a consequence of low inflation and, for that matter, low inflationary expectations.

Overall, the US looks a bit like the UK a year ago: growing imbalances but a lack of transparency on precisely when the economy will begin to stumble.

Underneath all this is a failure to come to terms with the post-bubble world we are living in. The basic truth is that, post-bubble, life is tougher. No longer do people have the supposed guarantee of ever-lasting capital gains and, hence, endless jam today, tomorrow and for ever. But how have we reacted to this new truth? Consumers pretended it wasn't there: they continued borrowing, helped along by rising house prices. Policymakers hoped it wasn't there: by setting interest rates at low levels, they created the illusion of ever-rising house prices to offset the earlier illusion of ever-rising stock prices. Pension funds assumed it wasn't there: they were happy to pretend the 1990s would return because otherwise their unfunded future liabilities would begin to look extremely daunting.

As reality dawns, there is a price to pay. High debt and low savings will be gradually replaced with low debt and high savings. As economies structurally come to terms with this change, interest rates will end up at very low levels. But low interest rates will not be an indication of monetary laxity. Instead, they will simply be telling us people would rather save than spend. Low interest rates might seem to be desirable but, in these circumstances, they point to deep-rooted fundamental economic weaknesses. Just ask anyone living in Japan.

Stephen King is managing director of economics at HSBC"

Sorry Jim, but a housing bust will lead to a deflationary recession not a hyperinflationary one. All signs point that way. Your 10 points fail to address the above 7 deflation arguments in any sort of plausible manner. My offer to bet a box of steaks on the outcome is still on.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/