The Washington Post is reporting EU Will Not Improve on Farm Trade Offer.

The European Union said Wednesday it will not enhance its offer on farm trade, calling on the United States and others to match its concessions in talks to liberalize global trade through the World Trade Organization.

"I have no plan to make a further offer in agriculture," EU Trade Commissioner Peter Mandelson told the European Parliament.

He said the farm trade concessions he has put on the table in the WTO talks were "the most substantial offer" the EU has ever made, and that making more "would further unbalance the (WTO) negotiations" that head for a ministerial round in Hong Kong in two weeks.

The EU has offered cuts of 70 percent in trade-distorting subsidies to farmers and farm produce exporters and cutting the EU's average agricultural tariff to 12 percent from 23 percent.

"Taken as a whole, this is the most substantial offer ever made by the European Union in any trade round," said Mandelson.

Mandelson accused the United States and others of dawdling, posturing and focusing excessively on farm trade issues at the expense of progress in other areas of liberalizing world trade. He said a global trade deal can only happen if Europe's partners "stop hiding behind unfounded criticism of the EU, or patently unrealistic and tactical demands ... If they continue merely to ask for more from Europe, without paying into the pot themselves, they _ not we _ risk destroying" the current round of negotiations.

Is that the biggest finger pointing episode since Babe Ruth's famous point in the 1932 World Series between the Cubs and the Yankees?

Probably not, but even if so, I doubt anyone makes a movie out of it.

There are neither legends nor heroes in this round of finger pointing.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Wednesday 30 November 2005

Tuesday 29 November 2005

Is it 1966 again?

Flashback 1966: Just as the US was sinking ever deeper into the quagmire known as Vietnam, Vermont Senator George Aiken delivered a famous speech in which he said that "we should declare victory and go home." Unfortunately the war dragged on for six more years and eventually North Vietnam won.

Take a look at North Vietnam today: Three decades later, Vietnam is a quasi-capitalist country, cultivating US investment, consumer markets, and tourism. How might history have changed if only we had the guts to admit a stupid mistake in 1966, declaring the war "won" and going home? For starters we would have spared countless American and Vietnamese lives. The outcome of history would have been far different and we would have had one less huge black spot on the soul of the US.

At the time, "staying the course" was posed as a test of American credibility. I was in the 7th grade at the time. Our science teacher, Harry Don Wirth told us "I do not think we should have entered this 'conflict', but It's too late to pull out now". As Lyndon Johnson liked to say: Who would follow the lead of a superpower who "tucked tail and ran"?

Harry Don Wirth was drafted and left in the middle of our 7th grade year. I have no idea what happened to him. He was the single best teacher I ever had. Mr. Wirth was simply amazing. He even had the class dunces motivated to work. The class in general was disappointed if we did not receive enough homework. We ran roughshod over his replacement. I can not even remember his name.

Public sentiment changed against the war in 1968 and Nixon decided to masquerade as the "peace candidate", on a "peace with honor" campaign. By the time I reached senior year in high school, however, the stupid war was still going on. Then on January 23, 1973 Nixon gave his "Peace with Honor" television broadcast announcing the initialing of the Paris 'Agreement on Ending the War and Restoring Peace in Vietnam'.

Fighting between South Vietnamese and Communists continued despite the peace agreement until North Vietnam launched an offensive in early 1975. South Vietnam's requests for aid were denied by the U.S. Congress, and after Thieu abandoned the northern half of the country to the advancing Communists, a panic ensued. South Vietnamese resistance collapsed, and North Vietnamese troops marched into Saigon Apr. 30, 1975. Vietnam was formally reunified in July, 1976, and Saigon was renamed Ho Chi Minh City. U.S. casualties in Vietnam during the era of direct U.S. involvement (1961–72) were more than 50,000 dead; South Vietnamese dead were estimated at more than 400,000, and Viet Cong and North Vietnamese at over 900,000.

Is it 1966 again?

It sure feels like it.

All this talk of "cutting and running" is as much horse hockey today as it was in 1966 when George Aiken proposed doing the same. The only difference is that Senator Aiken was smart enough to package his proposal as a "victory". The sad truth of the matter is that we can no more win this war than we could win the Vietnam War. The entire basis for the Vietnam War was based on one stupid theory and one big fat lie.

Back in the 60’s that Stupid theory was known as "The Domino Effect" whereby if we lost South Vietnam, Communism would spread over all of Asia. The lie was the Gulf of Tonkin incident in which supposedly North Vietnam supposedly attacked the US in international waters.

One can only ask, would Vietnam be any better off today if the US managed to win the war? I think the question is moot because winning was not possible. Vietnam had more willpower and stamina to fight the US than the US public had stamina for sending masses of soldiers to their graves. In short, winning the war was not possible because there was nothing ever to win.

Today’s Stupid Theories and Stupid Lies

Today’s stupid theory is that we can cram Democracy down the throats of people that do not want it and/or are ill equipped to deal with it. President Bush campaigned against "nation building" in the 2000 election yet violated that pledge. It is obvious that he has learned nothing from either the Vietnam War or Russia’s miserable failure in Afghanistan, as he now seems bound and determined to continue his failed policies of "nation building".

Everyone knows today’s lies: Weapons of mass destruction, mushroom clouds, uranium "yellow cake" from Niger, and trumped up charges by Colin Powell in a speech to the UN that he now regrets.

Reminiscent of Aiken’s 1966 speech, Congressman John P. Murtha, in a press conference as well as in a speech before Congress Murtha had this to say...

Chickenhawk Scorecard

In marked contrast, here is the administration scorecard:

“A few minutes ago I received a call from Colonel Danny Bubp, Ohio Representative from the 88th district in the House of Representatives. He asked me to send Congress a message: Stay the course. He also asked me to send Congressman Murtha a message, that cowards cut and run, Marines never do. Danny and the rest of America and the world want the assurance from this body – that we will see this through.”

By the way, exactly who is this "Colonel Danny Bubp", some kind of war hero like Murtha? No, all of his time was spent in the reserves. In other words, this was a self serving stunt by Jean Schmidt on behalf of a state legislator who never served active duty. Bubp's big claim to fame is receiving a plaque along with Schmidt in support of keeping public displays of the Ten Commandments.

Harmy on the Motley FOOL had this to say about Danny Bubp:

"Danny Bubp is typical of many military and political types who do the tub-thumping that sends young men to war. It has always sickened me the way these people manage to stay out of the real war and yet suddenly appear on the dais when it's all over complete with immaculate shiny shoes and a chest full of medals for the military and civic honours showered upon the politicians. You needn't think that the US is unique in this respect. It happens and has happened in every country. At the conclusion of WW1 the British held a victory parade with the King and Queen, Generals and Politicians all on the dais. The parade took hours to pass but shamefully a battalion of the war's maimed were not allowed to participate because the extent of their injuries might offend people."

Vice President Cheney also attacked Murtha, to which Murtha responded:

“I like guys who have never been there to criticize us who have been there. I like that. I like guys who got have five deferments and never been there and send people to war and then don't like to hear suggestions about what needs to be done.”

Let’s return to reality.

Here is that reality:

CNN/USA Today/Gallup Poll. Nov. 11-13, 2005

Q: "Do you approve or disapprove of the way George W. Bush is handling the situation in Iraq?"

A: Approve: 35% Disapprove:63% Unsure:2%

Q: "In view of the developments since we first sent our troops to Iraq, do you think the United States made a mistake in sending troops to Iraq, or not?"

A: Mistake: 54% Not a Mistake: 45% Unsure: 1%

Q: "All in all, do you think it was worth going to war in Iraq, or not?"

A: Worth it: 38% Not worth it: 60% Unsure : 2%

Q: "Do you approve or disapprove of the way Bush is handling the situation in Iraq?"

A: Approve: 30% Disapprove: 65% Unsure 5%

Q: "Do you think Dick Cheney deliberately misused or manipulated pre-war intelligence about Iraq's nuclear capabilities in order to build support for war with Iraq?"

A: Cheney deliberately misused 52% Did not deliberately misuse: 33% Unsure 15%

Whether or not you agree with this war or not, the reality of the situation is clear.

We made a horribly foolish mistake to enter the Vietnam War and an equally stupid mistake to not just admit it and leave.

Flash forward 29 years.

Oddly enough it seems to be 1966 all over again.

We have a chance to admit we were wrong as Congressman Murtha is asking us to do or we can play politics with "Cut and Run" speeches as the chickenhawks are doing.

Can We Win?

Politics aside, we can no more "win" in Iraq than we could "win" in Vietnam. For starters our original goals were too high, based on lies, and we fought the war with to few resources without ever planning for the aftermath. We have made far too many mistakes to "Win their hearts and minds". It was a serious misjudgment to think we could EVER win their hearts and minds at gunpoint. Current polls reveal that 80% of Iraqis want us out of there. Unless we can turn those numbers around it is impossible to win either their hearts or their minds let alone both. Can those numbers possibly be turned around given our use of white phosphorous on civilians, prison torture by US soldiers, and countless collateral damage on civilians? I think not. It is simply too late.

Yes, Iraq is likely to break out into Civil war if we leave. Then again we can stay six more years, waste another $800 Billion dollars on top of the $200-$300 billion we have already wasted, waste possibly 6,000 more US lives, and then leave only to find Iraq break out in Civil war as we eventually toss in the towel. If it plays out like that, it will be an exact repeat of Nixon's "Peace with Honor" victory, only to see South Vietnam overrun the moment we left.

The bottom line is this war can not be won for multiple reasons.

We can no longer "win" as defined by our original goals, but perhaps we could escape with some semblance of a "draw" if we could just manage to turn our problems into an Arab problem. The first step in correcting a problem is to admit you have a problem and admit the many mistakes that caused it. It simply must be done to have any chance. We have made dozens of mistakes but refuse to admit any of them. Nor has anyone but low level scapegoats been held accountable for those mistakes. Here is my four step proposal.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Take a look at North Vietnam today: Three decades later, Vietnam is a quasi-capitalist country, cultivating US investment, consumer markets, and tourism. How might history have changed if only we had the guts to admit a stupid mistake in 1966, declaring the war "won" and going home? For starters we would have spared countless American and Vietnamese lives. The outcome of history would have been far different and we would have had one less huge black spot on the soul of the US.

At the time, "staying the course" was posed as a test of American credibility. I was in the 7th grade at the time. Our science teacher, Harry Don Wirth told us "I do not think we should have entered this 'conflict', but It's too late to pull out now". As Lyndon Johnson liked to say: Who would follow the lead of a superpower who "tucked tail and ran"?

Harry Don Wirth was drafted and left in the middle of our 7th grade year. I have no idea what happened to him. He was the single best teacher I ever had. Mr. Wirth was simply amazing. He even had the class dunces motivated to work. The class in general was disappointed if we did not receive enough homework. We ran roughshod over his replacement. I can not even remember his name.

Public sentiment changed against the war in 1968 and Nixon decided to masquerade as the "peace candidate", on a "peace with honor" campaign. By the time I reached senior year in high school, however, the stupid war was still going on. Then on January 23, 1973 Nixon gave his "Peace with Honor" television broadcast announcing the initialing of the Paris 'Agreement on Ending the War and Restoring Peace in Vietnam'.

Fighting between South Vietnamese and Communists continued despite the peace agreement until North Vietnam launched an offensive in early 1975. South Vietnam's requests for aid were denied by the U.S. Congress, and after Thieu abandoned the northern half of the country to the advancing Communists, a panic ensued. South Vietnamese resistance collapsed, and North Vietnamese troops marched into Saigon Apr. 30, 1975. Vietnam was formally reunified in July, 1976, and Saigon was renamed Ho Chi Minh City. U.S. casualties in Vietnam during the era of direct U.S. involvement (1961–72) were more than 50,000 dead; South Vietnamese dead were estimated at more than 400,000, and Viet Cong and North Vietnamese at over 900,000.

Is it 1966 again?

It sure feels like it.

All this talk of "cutting and running" is as much horse hockey today as it was in 1966 when George Aiken proposed doing the same. The only difference is that Senator Aiken was smart enough to package his proposal as a "victory". The sad truth of the matter is that we can no more win this war than we could win the Vietnam War. The entire basis for the Vietnam War was based on one stupid theory and one big fat lie.

Back in the 60’s that Stupid theory was known as "The Domino Effect" whereby if we lost South Vietnam, Communism would spread over all of Asia. The lie was the Gulf of Tonkin incident in which supposedly North Vietnam supposedly attacked the US in international waters.

One can only ask, would Vietnam be any better off today if the US managed to win the war? I think the question is moot because winning was not possible. Vietnam had more willpower and stamina to fight the US than the US public had stamina for sending masses of soldiers to their graves. In short, winning the war was not possible because there was nothing ever to win.

Today’s Stupid Theories and Stupid Lies

Today’s stupid theory is that we can cram Democracy down the throats of people that do not want it and/or are ill equipped to deal with it. President Bush campaigned against "nation building" in the 2000 election yet violated that pledge. It is obvious that he has learned nothing from either the Vietnam War or Russia’s miserable failure in Afghanistan, as he now seems bound and determined to continue his failed policies of "nation building".

Everyone knows today’s lies: Weapons of mass destruction, mushroom clouds, uranium "yellow cake" from Niger, and trumped up charges by Colin Powell in a speech to the UN that he now regrets.

Reminiscent of Aiken’s 1966 speech, Congressman John P. Murtha, in a press conference as well as in a speech before Congress Murtha had this to say...

"The war in Iraq is not going as advertised. It is a flawed policy wrapped in illusion. The American public is way ahead of us. The United States and coalition troops have done all they can in Iraq, but it is time for a change in direction. Our military is suffering. The future of our country is at risk. We cannot continue on the present course. It is evident that continued military action is not in the best interests of the United States of America, the Iraqi people or the Persian Gulf Region.Unlike the chickenhawks in this administration, Murtha won two Purple Hearts as a combat Marine in the Korean and Vietnam wars, and then tacked on 23 more years in the Marine Reserve. In Congress he has been a huge supporter of the Pentagon, and since 1989, he has been either chairman or the ranking Democrat on the Appropriations Subcommittee on Defense. In other words this was a stunning switch for Congressman Murtha.

"We spend more money on Intelligence that all the countries in the world together, and more on Intelligence than most countries GDP. But the intelligence concerning Iraq was wrong. It is not a world intelligence failure. It is a U.S. intelligence failure and the way that intelligence was misused.

"I said over a year ago, and now the military and the Administration agrees, Iraq can not be won "militarily." I said two years ago, the key to progress in Iraq is to Iraqitize, Internationalize and Energize. I believe the same today. But I have concluded that the presence of U.S. troops in Iraq is impeding this progress.

"Our military has done everything that has been asked of them, the U.S. can not accomplish anything further in Iraq militarily. It is time to bring them home."

Chickenhawk Scorecard

In marked contrast, here is the administration scorecard:

- President Bush hid out in the guard and arguably did not even bother showing up for duty.

- Cheney had 5 deferments.

- Ashcroft had 7 deferments.

- Rove did not serve.

- Hastert? Frist? Did not serve.

- DeLay Did not serve. In fact, in one of the silliest assertions ever, Delay actually said: "So many minority youths had volunteered that there was literally no room for patriotic folks like myself."

- There is not a single member in Congress with a son or daughter actively serving in Iraq

“A few minutes ago I received a call from Colonel Danny Bubp, Ohio Representative from the 88th district in the House of Representatives. He asked me to send Congress a message: Stay the course. He also asked me to send Congressman Murtha a message, that cowards cut and run, Marines never do. Danny and the rest of America and the world want the assurance from this body – that we will see this through.”

By the way, exactly who is this "Colonel Danny Bubp", some kind of war hero like Murtha? No, all of his time was spent in the reserves. In other words, this was a self serving stunt by Jean Schmidt on behalf of a state legislator who never served active duty. Bubp's big claim to fame is receiving a plaque along with Schmidt in support of keeping public displays of the Ten Commandments.

Harmy on the Motley FOOL had this to say about Danny Bubp:

"Danny Bubp is typical of many military and political types who do the tub-thumping that sends young men to war. It has always sickened me the way these people manage to stay out of the real war and yet suddenly appear on the dais when it's all over complete with immaculate shiny shoes and a chest full of medals for the military and civic honours showered upon the politicians. You needn't think that the US is unique in this respect. It happens and has happened in every country. At the conclusion of WW1 the British held a victory parade with the King and Queen, Generals and Politicians all on the dais. The parade took hours to pass but shamefully a battalion of the war's maimed were not allowed to participate because the extent of their injuries might offend people."

Vice President Cheney also attacked Murtha, to which Murtha responded:

“I like guys who have never been there to criticize us who have been there. I like that. I like guys who got have five deferments and never been there and send people to war and then don't like to hear suggestions about what needs to be done.”

Let’s return to reality.

Here is that reality:

CNN/USA Today/Gallup Poll. Nov. 11-13, 2005

Q: "Do you approve or disapprove of the way George W. Bush is handling the situation in Iraq?"

A: Approve: 35% Disapprove:63% Unsure:2%

Q: "In view of the developments since we first sent our troops to Iraq, do you think the United States made a mistake in sending troops to Iraq, or not?"

A: Mistake: 54% Not a Mistake: 45% Unsure: 1%

Q: "All in all, do you think it was worth going to war in Iraq, or not?"

A: Worth it: 38% Not worth it: 60% Unsure : 2%

Q: "Do you approve or disapprove of the way Bush is handling the situation in Iraq?"

A: Approve: 30% Disapprove: 65% Unsure 5%

Q: "Do you think Dick Cheney deliberately misused or manipulated pre-war intelligence about Iraq's nuclear capabilities in order to build support for war with Iraq?"

A: Cheney deliberately misused 52% Did not deliberately misuse: 33% Unsure 15%

Whether or not you agree with this war or not, the reality of the situation is clear.

- The public has turned against this war.

- The public thinks we were misled about the war.

- The public thinks it was a mistake to enter this war.

- Support for this war even by some former Congressional hawks has ended.

- This administration is blowing up in scandal after scandal and senators are distancing themselves from the president.

We made a horribly foolish mistake to enter the Vietnam War and an equally stupid mistake to not just admit it and leave.

Flash forward 29 years.

Oddly enough it seems to be 1966 all over again.

We have a chance to admit we were wrong as Congressman Murtha is asking us to do or we can play politics with "Cut and Run" speeches as the chickenhawks are doing.

Can We Win?

Politics aside, we can no more "win" in Iraq than we could "win" in Vietnam. For starters our original goals were too high, based on lies, and we fought the war with to few resources without ever planning for the aftermath. We have made far too many mistakes to "Win their hearts and minds". It was a serious misjudgment to think we could EVER win their hearts and minds at gunpoint. Current polls reveal that 80% of Iraqis want us out of there. Unless we can turn those numbers around it is impossible to win either their hearts or their minds let alone both. Can those numbers possibly be turned around given our use of white phosphorous on civilians, prison torture by US soldiers, and countless collateral damage on civilians? I think not. It is simply too late.

Yes, Iraq is likely to break out into Civil war if we leave. Then again we can stay six more years, waste another $800 Billion dollars on top of the $200-$300 billion we have already wasted, waste possibly 6,000 more US lives, and then leave only to find Iraq break out in Civil war as we eventually toss in the towel. If it plays out like that, it will be an exact repeat of Nixon's "Peace with Honor" victory, only to see South Vietnam overrun the moment we left.

The bottom line is this war can not be won for multiple reasons.

- It was never really winnable in the first place given that its foundation was based on hopeless intelligence at best and a pack of lies at worst, all on top of a false premise that we could cram Democracy down their throats at gunpoint while they would shower us with flowers in glee.

- We made far too many mistakes to ever win their hearts and minds now, and without doing that there is no way to win.

- The Iraqi "insurgents" have more willpower as an occupied nation than we do as occupiers

- Even if you disagree about the above, history is clear about what happens once public support for a war wanes. We will eventually pull out, consequences be dammed. The public seems likely to insist upon a pullout, voting out anyone that gets in the way.

- Just as in the 1983 movie "War Games" , the only way to win was to not play. It's too late to adopt that strategy now. Seriously, if you have not seen that movie, I suggest you check it out soon.

We can no longer "win" as defined by our original goals, but perhaps we could escape with some semblance of a "draw" if we could just manage to turn our problems into an Arab problem. The first step in correcting a problem is to admit you have a problem and admit the many mistakes that caused it. It simply must be done to have any chance. We have made dozens of mistakes but refuse to admit any of them. Nor has anyone but low level scapegoats been held accountable for those mistakes. Here is my four step proposal.

- Apologize to the world and Iraq for the mistakes we a have made.

- Offer to turn Iraq over a consortium of Arab nations including Saudi Arabia and Iran as well as the UN.

- Agree to let that consortium set Iraq policy regardless of what happens or how we feel.

- Hold accountable some higher up military and administration officials for mistakes that have been made.

- The Arab nations refuse to take on the problem. Far from being a total disaster we could immediately wash our hands of this sordid affair and begin pulling our troops out. We would at least be able to say we made a good faith effort.

- They accept the proposal and ask we withdraw our troops. This is likely the best case scenario. We effectively hand over our problems to someone else. We relinquish all control of course, but it is a mistake to assume we ever had any in the first place.

- They accept the proposal but still want a US military presence in Iraq. This is highly unlikely and not realistic. The consequence would be that US military would be under control of UN or Arab command. I doubt that would be acceptable to the US.

- The Arabs want to study the plan for something like forever. If this happened we could force a choice by setting a timetable to withdraw forces in nine months or so if agreement was not reached. In the end, it would probably be better to have the plan rejected upfront rather than after we waste more money and lives.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Do GSEs help make housing affordable?

Reuters is reporting the GSE Mortgage limit raised to $417,000 for 2006.

U.S. mortgage finance regulators on Tuesday raised the limit for loans that can be bought by government-sponsored mortgage enterprises Fannie Mae and Freddie Mac to $417,000 for 2006, in most areas.

Stephen Blumenthal, acting director of the Office of Federal Housing Enterprise Oversight (OFHEO), announced the rise in what is called the conforming loan limit for single-family mortgages purchased by Fannie Mae and Freddie Mac. The 2005 limit is $359,650.

Excuse me but I have a few of questions:

By charter, the GSE mission is to provide liquidity, stability and affordability to the nation’s mortgage markets. Well we sure have witnessed (for now) success on the liquidity front, but as for price stability and affordability I doubt the failure could possibly have been any greater.

If anyone really wants to make housing affordable, they should scrap nonsense about the "ownership society", eliminate the housing deduction, cancel 280 government programs to "make housing affordable", not cut interest rates to 1% in a silly panic, and with tears in my eyes (I am a sentimental kind of guy), finally bury Aunt Fannie and Uncle Fred.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

U.S. mortgage finance regulators on Tuesday raised the limit for loans that can be bought by government-sponsored mortgage enterprises Fannie Mae and Freddie Mac to $417,000 for 2006, in most areas.

Stephen Blumenthal, acting director of the Office of Federal Housing Enterprise Oversight (OFHEO), announced the rise in what is called the conforming loan limit for single-family mortgages purchased by Fannie Mae and Freddie Mac. The 2005 limit is $359,650.

Excuse me but I have a few of questions:

- Weren't we trying to limit the mortgages going to Aunt Fannie and Uncle Fred?

- Wasn't the whole point of Fannie and Fred to make "housing affordable"?

- Aren't Fannie Mae's books still so screwed up that they can not make heads or tails out of their derivative mess?

- Shouldn't Aunt Fannie at least have to get her books in order before we start raising loan limits on conforming loans?

By charter, the GSE mission is to provide liquidity, stability and affordability to the nation’s mortgage markets. Well we sure have witnessed (for now) success on the liquidity front, but as for price stability and affordability I doubt the failure could possibly have been any greater.

If anyone really wants to make housing affordable, they should scrap nonsense about the "ownership society", eliminate the housing deduction, cancel 280 government programs to "make housing affordable", not cut interest rates to 1% in a silly panic, and with tears in my eyes (I am a sentimental kind of guy), finally bury Aunt Fannie and Uncle Fred.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Monday 28 November 2005

Now and Then

Let's take a look at what David Lereah, chief economist for National Association of Realtors is saying now :

Well not quite but it was February of this year when David Lereah published

Are You Missing the Real Estate Boom?

The Boom Will Not Bust and Why Property Values Will Continue to Climb Through the End of the Decade - And How to Profit From Them

"It’s not too late to increase your stake in the greatest real estate boom of our generation. Whether you are a first-time buyer or already own your home, Are You Missing the Real Estate Boom? will show you how you can dramatically increase your overall wealth. Author David Lereah, chief economist for the National Association of Realtors, shows why the real estate market is poised to climb higher over the next decade—and explains what you can do to profit from it."

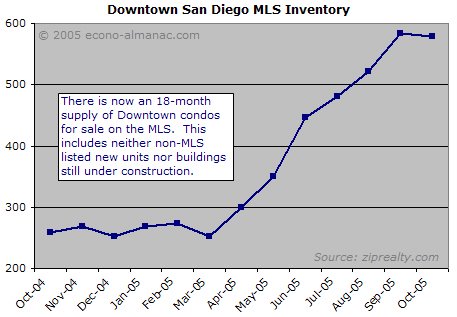

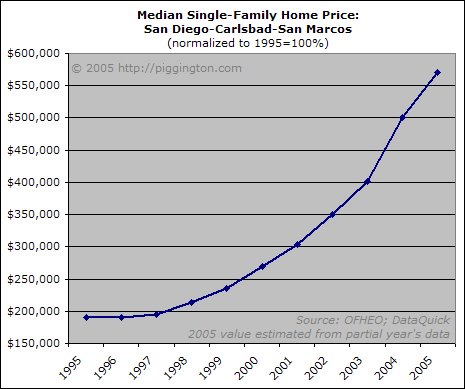

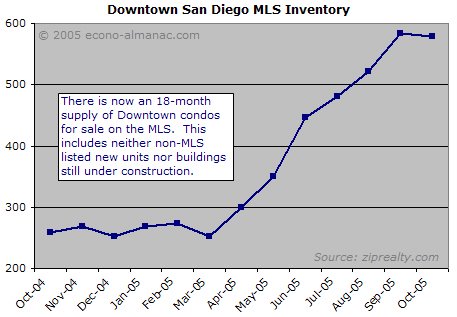

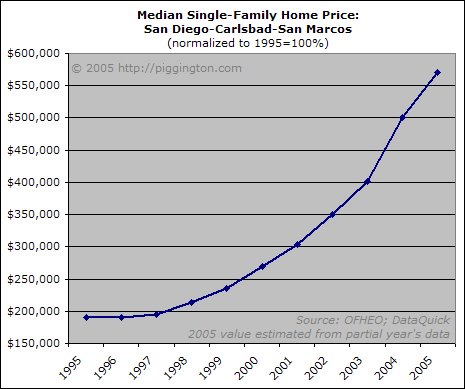

Let's look at a couple of charts from my friend Professor Piggington:

The professor lays out the evidence of the bubble for everyone to see.

Take a look at the charts above, read the professor's case, and decide for yourself.

Is it really a "Once-in-every-other generation opportunity"?

I happen to think that it is.

For all the bubble areas especially California and Florida, it is perhaps a once in a lifetime chance to cash out.

Actually, it WAS last spring and summer just as David Lereah's book was rolling hot off the presses.

For those that bought several years ago it's still a great time to cash out.

Unfortunately many of those that recently bought into the hype are finding that they are now underwater.

Heaven help those underwater in condos in bubble areas.

The once in a lifetime opportunity to buy came about 10 years ago. But that was then and this is now. Now it's time to sell.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

- "The drop in sales and rise in inventories in October signals that the housing sector has likely passed its peak"

- "Make no mistake, slowing has occurred"

- "We expect further cooling in coming months"

Well not quite but it was February of this year when David Lereah published

Are You Missing the Real Estate Boom?

The Boom Will Not Bust and Why Property Values Will Continue to Climb Through the End of the Decade - And How to Profit From Them

"It’s not too late to increase your stake in the greatest real estate boom of our generation. Whether you are a first-time buyer or already own your home, Are You Missing the Real Estate Boom? will show you how you can dramatically increase your overall wealth. Author David Lereah, chief economist for the National Association of Realtors, shows why the real estate market is poised to climb higher over the next decade—and explains what you can do to profit from it."

Let's look at a couple of charts from my friend Professor Piggington:

The professor lays out the evidence of the bubble for everyone to see.

Take a look at the charts above, read the professor's case, and decide for yourself.

Is it really a "Once-in-every-other generation opportunity"?

I happen to think that it is.

For all the bubble areas especially California and Florida, it is perhaps a once in a lifetime chance to cash out.

Actually, it WAS last spring and summer just as David Lereah's book was rolling hot off the presses.

For those that bought several years ago it's still a great time to cash out.

Unfortunately many of those that recently bought into the hype are finding that they are now underwater.

Heaven help those underwater in condos in bubble areas.

The once in a lifetime opportunity to buy came about 10 years ago. But that was then and this is now. Now it's time to sell.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Parties, Gifts, and Bonuses

The USA Today is reporting firms are cutting back on parties, gifts, and bonuses.

Picture Number 1:

76% of the GDP is directly related to consumer spending but consumers are going deeper in debt every day. Only rising asset prices on houses and stocks have kept the consumer going. Signs are everywhere that housing and autos have both peaked.

Cutbacks in corporate parties, bonuses, and gifts are still more signs of tougher times to come. It remains to be seen if consumers throw one last Christmas bash before the light go out in 2006. Recession dead ahead.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

This year marks the first drop in companies holding holiday parties since 2001, when the weak economy and terrorist attacks caused companies to pare festivities. Even long-held traditions, such as the free company turkey, are going by the wayside: Just 2% of employers will give their employees turkeys this year, according to the Washington, D.C.-based Bureau of National Affairs (BNA).Hmmmm. Let's compare pictures.

"The findings were quite startling to us," says Dale Winston, CEO of executive search firm Battalia Winston International, whose yearly holiday survey found a decline in year-end company parties. "It is significant, and it's also probably reflective of the spirit of the country. We're at war, there's uncertainty about the economy."

• Parties. 87% of employers will have some type of holiday celebration down from the 95% who had parties last year. Only 17% of companies expect to have more expensive parties this year.

• Bonuses. In keeping with a recent trend toward basing pay on employee performance, more companies are doing away with the year-end bonus. About 60% of companies will not award them this year, according to human resources firm Hewitt Associates.

"They're seeing that as a way to reduce their costs in some places," says Ken Abosch, compensation business leader at Hewitt. "Some might think employers are taking a Scrooge mentality, but they're putting it into a different form."

• Gifts. More than half of companies gave gifts in 1988, the Battalia survey found. But this year, 62% say celebrations will not include gift giving.

Picture Number 1:

- Corporation cash coffers are extremely high

- Profits and earnings growth have been favorable

- Share buy-back announcements are extremely high

- Outsourcing continues unabated adding to corporate profits

- One time enormous windfall by repatriating cash from overseas

- CEO pay and bonuses skyrocketing

- Foreward guidance has generally been favorable

- Productivity is up

- Corporations are not expanding their businesses

- Corporations are not really hiring compared to normal recoveries

- Corporations are being extremely stingy at sharing profits with employees

- Corporations are shifting more benefit costs to employees

76% of the GDP is directly related to consumer spending but consumers are going deeper in debt every day. Only rising asset prices on houses and stocks have kept the consumer going. Signs are everywhere that housing and autos have both peaked.

Cutbacks in corporate parties, bonuses, and gifts are still more signs of tougher times to come. It remains to be seen if consumers throw one last Christmas bash before the light go out in 2006. Recession dead ahead.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Wednesday 23 November 2005

Another Mish Household Tip

Once again it is time for practical posts for the practical homeowner.

That could only mean one thing......

Yes Mish bloggers, here is another long awaited and long overdue Mish Household Tip.

[Note: This is strictly off track and certainly has nothing whatsoever to do with global economics. I periodically post my "tips" on a couple of stock message boards that I am on and they generally have been received well. Previous posts have been on how to catch raccoons living under one's porch, why it matters the order in which one paints their front porch vs. sealing their driveway, how to fix a flat on a wheelbarrow, and other such helpful advice. Actually my advice is generally practical advice on how NOT to do something. As a public service announcement and without further ado I am pleased to announce my latest set of household tips.]

Mish's Tips For Today.

1) Do not attempt to thaw out a frozen bottle of Pompeian Red Wine Vinegar on a high setting in your microwave. Even if you think you can watch it, the phone just might ring and you just might leave to take the call, only to return to the kitchen and find that the label on the bottle of vinegar actually caught fire with smoke billowing out of the microwave.

2) This is a taste preference kind of thing but I prefer Pompeian over some of the crappier brands.

3) Enquiring minds might wonder how that bottle of vinegar got frozen in the first place. That of course leads to tip number three: Do not turn the settings on your freezer and refrigerator to max and leave them there for extended periods of time.

4) Some feeble minds might leave it at that. But many Mish readers are made of sterner stuff and would not easily be satisfied with such fluff answers. More inquisitive readers just might be enquiring as to why Mish turned up the settings in the first place. This of course leads to tip number 4: Do not go on a rampage buying pork chops and steaks and other stuff that is on sale, so much so that it does not really fit in one's freezer compartment. If you do, you might be tempted to cram it all in to the point there is no cold air circulation and stuff starts to thaw out. In time this leads to one's freezer compartment and ice maker dripping water all over the floor, forming big puddles that have to be mopped up. Then, in an attempt to stop the dripping, one just might be tempted to turn the refrigerator dials to the "cold side".

Here is the bottom line: If you overstock your freezer you just might end up with the label on a bottle of Pompeian Red Wine Vinegar catching fire in your microwave to nicely compliment the puddles of water all over the floor the day before.

As always, I speak from practical experience on these matters.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

That could only mean one thing......

Yes Mish bloggers, here is another long awaited and long overdue Mish Household Tip.

[Note: This is strictly off track and certainly has nothing whatsoever to do with global economics. I periodically post my "tips" on a couple of stock message boards that I am on and they generally have been received well. Previous posts have been on how to catch raccoons living under one's porch, why it matters the order in which one paints their front porch vs. sealing their driveway, how to fix a flat on a wheelbarrow, and other such helpful advice. Actually my advice is generally practical advice on how NOT to do something. As a public service announcement and without further ado I am pleased to announce my latest set of household tips.]

Mish's Tips For Today.

1) Do not attempt to thaw out a frozen bottle of Pompeian Red Wine Vinegar on a high setting in your microwave. Even if you think you can watch it, the phone just might ring and you just might leave to take the call, only to return to the kitchen and find that the label on the bottle of vinegar actually caught fire with smoke billowing out of the microwave.

2) This is a taste preference kind of thing but I prefer Pompeian over some of the crappier brands.

3) Enquiring minds might wonder how that bottle of vinegar got frozen in the first place. That of course leads to tip number three: Do not turn the settings on your freezer and refrigerator to max and leave them there for extended periods of time.

4) Some feeble minds might leave it at that. But many Mish readers are made of sterner stuff and would not easily be satisfied with such fluff answers. More inquisitive readers just might be enquiring as to why Mish turned up the settings in the first place. This of course leads to tip number 4: Do not go on a rampage buying pork chops and steaks and other stuff that is on sale, so much so that it does not really fit in one's freezer compartment. If you do, you might be tempted to cram it all in to the point there is no cold air circulation and stuff starts to thaw out. In time this leads to one's freezer compartment and ice maker dripping water all over the floor, forming big puddles that have to be mopped up. Then, in an attempt to stop the dripping, one just might be tempted to turn the refrigerator dials to the "cold side".

Here is the bottom line: If you overstock your freezer you just might end up with the label on a bottle of Pompeian Red Wine Vinegar catching fire in your microwave to nicely compliment the puddles of water all over the floor the day before.

As always, I speak from practical experience on these matters.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Lumber Dispute Resolved?

The New York Times is reporting

U.S. to Accept Nafta Ruling to Cut Duties on Lumber.

In spite of 5 separate NAFTA rulings the US is still saying "We start off with the premise that Canada subsidizes lumber".

Furthermore the US is going to continue to collect 20% tariffs for 6 weeks or so until the case is "final", then issue an "extraordinary challenge" to further extend the case.

Does this come close to "accepting" the decision?

I think not.

In one of the silliest statements on free trade yet, Harry Clark, lawyer for "The Coalition for Fair Lumber Imports", said Nafta is "flouting" its obligation to enforce U.S. trade laws. Flouting? Mr. Clark, why shouldn't NAFTA want the US to enforce its treaties? If ever there was "flouting" it was blatant flouting by President Bush on behalf of US lumber companies to collect mammoth tariffs in spite of 5 arbitration rulings in favor of Canada. That is the essence of "flouting" and that is why there has been little or no progress in reaching new trade accords earlier this year in South America. Point blank: The US is not afraid to play the bully in one-sided agreements, and that is why the US and EU are becoming increasingly isolated on free trade issues while China, Australia, and others forge ahead.

One more thing: Anytime one sees there is a Coalition for "Fair" Anything, rest assured it is in reality a Coalition for Increased Protectionism, Unfair Subsidies, and/or other Government Handouts, all at taxpayer expense. That Mr. Clark, is exactly what you and your coalition are all about.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

U.S. to Accept Nafta Ruling to Cut Duties on Lumber.

The Commerce Department said Tuesday that it would accept a Nafta dispute panel ruling in a long-running dispute with Canada and would substantially reduce hefty duties on Canadian softwood lumber.I am not sure if the word "accept" is exactly correct.

But while the United States government accepted the settlement's finding that countervailing duties should fall from about 16 percent to less than 1 percent, it did not endorse it. And John Sullivan, general counsel for the Commerce Department, said that the acceptance of the ruling did not prevent the United States from starting an extraordinary appeal later.

"We start off with the premise that Canada subsidizes lumber," Mr. Sullivan told reporters during a conference call. "We're complying with the panel's decision, but we don't agree with it."

The United States will continue to collect its 20.96 percent tariff on Canadian softwood - which includes a separate antidumping duty of about four percentage points - until the Nafta panel completes the case, which may take more than six weeks. Any extraordinary challenge would further extend that period.

Mr. Sullivan also said that the ruling had no impact on duties that have been collected to date but set aside because of the trade dispute. Canada estimates that those funds total about 5 billion Canadian dollars, and it is demanding their return.

At the heart of the case are differences in the sources of lumber. In Canada, the vast majority of lumber comes from logs harvested from government land, while private land is the primary source in the United States. American producers contend that Canadian provinces subsidize their industries by charging artificially low cutting fees.

While Tuesday's move is far from the final word in the dispute, it may provide some political relief for the Canadian prime minister, Paul Martin, and his Liberal Party. His minority government could be facing an election shortly, and early Tuesday, before the Commerce Department announcement, he was attacked by the opposition Conservative Party for failing to advance the softwood case.

The Coalition for Fair Lumber Imports, a group representing American producers involved in the dispute, condemned the move to reduce the duty.

"I could go on for hours about how outrageous this subsidy decision is," said Harry Clark, a Washington-based lawyer for the group. "What we have here is a Nafta panel that simply decided to flout its obligation to enforce U.S. trade laws."

In spite of 5 separate NAFTA rulings the US is still saying "We start off with the premise that Canada subsidizes lumber".

Furthermore the US is going to continue to collect 20% tariffs for 6 weeks or so until the case is "final", then issue an "extraordinary challenge" to further extend the case.

Does this come close to "accepting" the decision?

I think not.

In one of the silliest statements on free trade yet, Harry Clark, lawyer for "The Coalition for Fair Lumber Imports", said Nafta is "flouting" its obligation to enforce U.S. trade laws. Flouting? Mr. Clark, why shouldn't NAFTA want the US to enforce its treaties? If ever there was "flouting" it was blatant flouting by President Bush on behalf of US lumber companies to collect mammoth tariffs in spite of 5 arbitration rulings in favor of Canada. That is the essence of "flouting" and that is why there has been little or no progress in reaching new trade accords earlier this year in South America. Point blank: The US is not afraid to play the bully in one-sided agreements, and that is why the US and EU are becoming increasingly isolated on free trade issues while China, Australia, and others forge ahead.

One more thing: Anytime one sees there is a Coalition for "Fair" Anything, rest assured it is in reality a Coalition for Increased Protectionism, Unfair Subsidies, and/or other Government Handouts, all at taxpayer expense. That Mr. Clark, is exactly what you and your coalition are all about.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Monday 21 November 2005

No Social Security Number? No Problem!

It's the American dream : owning a home.

This is how I see it.

There is nothing illegal about foreigners owning property in the US but it an entirely different matter when they lie about their status, lie about income earned illegally, and lie about their owner occupied status in order to get a lower rate. Then again, they will be occupying that house, so who cares if they do so in a legal or illegal manner? Certainly not Citicorp who is more than happy to process the loan sell it for a fee to Fannie Mae. As long as someone can make money on these loans no one really cares if they are aiding and abetting illegal aliens or not.

Here is the bottom line.

http://globaleconomicanalysis.blogspot.com/

With the recent spike in housing costs, it's become more difficult for many Valley families to qualify for a home loan. But some local banks are giving out loans, and they don't even require a social security number.The attorney general refused to answer a question as to whether or not the practice is illegal?! What kind of nonsense is this?

David seems like your typical first-time homeowner. The house is small, money's tight. But his family is happy. "It was our dream." he said. "So it was like our dream became true, finally."

But getting a loan from the bank almost didn't happen. An employee from the bank called and said it seemed they had a problem. The problem was David's social security number ... it's a fake.

He is undocumented, an illegal immigrant. David thought it was a dead end, but not in California. It's among a few states where banks are offering mortgages to people who they know are illegal.

David got a 30-year, $135,000 loan. He pays $950 a month for his house in the South Valley.

The Valley non-profit group Acorn is helping people like David. They set him up with Citibank in Fresno, where a social security number is not required.

Instead, it asks for an Individual Taxpayer Identification Number, or I-TIN. It proves they pay taxes to the IRS. Applicants also have to have a bank account, proof of US residency for two years, and two years of credit references.

Diana Hull, an illegal immigrant opponent and president of a group called Californians For Population Stabilization says against the law. "There is a law against aiding and abetting illegal aliens to continue to live in the United States. Issuing a mortgage to an illegal alien is helping him establish himself and remain the United States, which is clearly illegal. It's a felony," she says.

Despite the accusations that what they're doing is illegal, Citigroup and Acorn stand by the program.

Acorn issued a statement saying everything about their program is legal. They say in the United States, it is perfectly legal for non-citizens to own property.

When asked about its opinion on whether the program is indeed legal, or unlawfully entices illegal immigrants to stay, the U.S. Attorney's office refused an answer.

This is how I see it.

There is nothing illegal about foreigners owning property in the US but it an entirely different matter when they lie about their status, lie about income earned illegally, and lie about their owner occupied status in order to get a lower rate. Then again, they will be occupying that house, so who cares if they do so in a legal or illegal manner? Certainly not Citicorp who is more than happy to process the loan sell it for a fee to Fannie Mae. As long as someone can make money on these loans no one really cares if they are aiding and abetting illegal aliens or not.

Here is the bottom line.

- Money speaks louder than principles.

- The US Attorney General is a wimp.

- Unless there is a huge tightening of our borders, illegal aliens will come pouring in.

- Neither the Democrats nor the Republicans have the backbone to face this issue right now.

- The problem is likely to simmer until one of two things happen: 1) there is a massive public outcry against illegal immigration over jobs 2) some sort of disaster happens such terrorists slip over our porous, poorly guarded border and cause some sort of huge problem somewhere.

http://globaleconomicanalysis.blogspot.com/

Thursday 17 November 2005

What card does your pet carry?

It seems that distinguished cats prefer American Express.

Last month Marilyn Hecox's 4-year-old black domestic short-hair, Samson, received an offer for the American Express Rewards Plus Gold Card.

Mish note: Click on the above link to see "samson".

"At first it's funny. Then you get a little nervous about it," Mrs. Hecox said, sitting in her dining room and thumbing through the application with a puzzled look on her face while Samson sat at the door waiting to be let outside.

"As the membership criteria at American Express remains stringent, the Rewards Plus Gold Card is difficult to acquire for all but the most financially disciplined," the application letter starts off.

"Only a select group of people will ever carry the Rewards Plus Gold Card. It instantly identifies you as someone special - one who has earned a superior degree of financial freedom."

According to the Federal Reserve, Americans were carrying $2 trillion in credit card debt in September, a $300 billion increase since 2000.

How much of that is carried by cats?

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Last month Marilyn Hecox's 4-year-old black domestic short-hair, Samson, received an offer for the American Express Rewards Plus Gold Card.

Mish note: Click on the above link to see "samson".

"At first it's funny. Then you get a little nervous about it," Mrs. Hecox said, sitting in her dining room and thumbing through the application with a puzzled look on her face while Samson sat at the door waiting to be let outside.

"As the membership criteria at American Express remains stringent, the Rewards Plus Gold Card is difficult to acquire for all but the most financially disciplined," the application letter starts off.

"Only a select group of people will ever carry the Rewards Plus Gold Card. It instantly identifies you as someone special - one who has earned a superior degree of financial freedom."

According to the Federal Reserve, Americans were carrying $2 trillion in credit card debt in September, a $300 billion increase since 2000.

How much of that is carried by cats?

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Wednesday 16 November 2005

Can GM be saved?

The problems at GM continue. Its stock price is near 52 week lows and GM is reportedly looking to sell a stake in its consumer financing unit to raise some $11-15 billion dollars to fund operations.

Not so fast says the Pension Benefit Guaranty Corp. It seems The PBGC may seek additional pension funding from GM to safeguard against a taxpayer bailout should GM go bankrupt sometime down the road according to the Wall Street Journal article Pension Agency Casts Shadow on GM Sale.

Meanwhile GM has sustained $3 billion in losses this year, its debt has been downgraded several times to junk status, GM is losing market share, and it appears the economy and car sales are both slowing as well. Although GM Chairman and Chief Executive Rick Wagoner has repeatedly stated that bankruptcy isn't an option, the S&P has placed the bankruptcy odds at 30%. GM's stock price is hovering near 52 week lows around $25.

The real question then should be how to handle the upcoming bankruptcy in the most equitable manner possible rather than wasting money trying to prevent it. I would not wish for GM pensioners to go through the torture that the airline industry employees just went through.

In that regard Mish actually has a five step plan to "save" GM.

Here it is:

The Mish proposal is unlikely to be implemented as Chairman and Chief Executive Rick Wagoner has declared repeatedly that "bankruptcy isn't an option". Furthermore GM stockholders and bondholders would not particularly be pleased with my plan to say the least. If a CEO has a duty to shareholders, then as a practical matter what anyone deems "fair" to pensioners or taxpayers is irrelevant. What that means of course is that regardless of the obvious benefits (or lack thereof) depending on your viewpoint as a GM shareholder or UAW worker, the Mish plan to save GM in a "fair and equitable manner" was a purely theoretical exercise that favored pensioners while ignoring huge implications to GM stockholders and bondholders. In that regard it can not be viewed as a serious proposal.

That said, to the extent that the PBGC is willing to force GM to fund its pension plan rather than fund its operations, we just might be following the proposed 5 steps anyway. If my read is correct, then the PBGC is determined to prevent an enormous mess from being dropped in its lap down the road. Given that forcing GM to fund its pension plan is likely to have negative shareholder implications, the PBGC just might be steering GM to a smaller taxpayer bailout sooner rather than a bigger taxpayer bailout later. Furthermore it would not surprise me to see new legislation protecting pensioners in the next Congress. Such a law would certainly not do GM share prices any good. For now, $31 billion seems like a lot of cash for GM to come up with and that does not take into consideration what might happen to its pension investments or its ongoing operational funding requirements in an economic downturn either. Hmmm. Are we back to square one? I believe we are.

Here is the bottom line: No matter what CEO Wagner believes about bankruptcy, it seems likely the market or the PBGC or perhaps even a new law protecting pension benefits over bondholders will force him to change his mind. If history is any guide, not only will GM go bankrupt, but pensioners will get the shaft and taxpayers will end up footing some of the bill. Right now, the PBGC seems like it is trying to minimize that taxpayer bill that will be coming due.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Not so fast says the Pension Benefit Guaranty Corp. It seems The PBGC may seek additional pension funding from GM to safeguard against a taxpayer bailout should GM go bankrupt sometime down the road according to the Wall Street Journal article Pension Agency Casts Shadow on GM Sale.

If General Motors Corp. raises $11 billion to $15 billion by selling a stake in its highly profitable consumer-finance arm, the U.S. agency that partly guarantees defined-benefit pension plans could demand that a chunk of the windfall go to GM's pension funds rather than to shareholders or to the development of new auto models.At the heart of the issue is whether or not GM's pension funds are fully funded now. GM claims that its pension plans are fully funded. The PBGC calculates that the plans are underfunded by an estimated $31 billion. Technically both are correct under the arcane rules that govern pension accounting. On a practical basis, however, the PBGC is correct: GM's pension funds are enormously underfunded.

Douglas Elliott, president of the Center on Federal Financial Institutions, a nonpartisan think tank, said a termination of GM's $100 billion pension plan could result in a claim on the PBGC larger than the total of all the previous claims on the agency since it was created in 1974.

"The PBGC could get some agreement on what GM will do with the proceeds from GMAC in return for protecting the buyer or approving the [General Motors Acceptance Corp.] transaction," said Brian Johnson, an analyst with Sanford C. Bernstein & Co.

Separately, the Securities and Exchange Commission is investigating whether the assumptions GM has used to calculate its pension liabilities are overly optimistic. Even a relatively small change in those assumptions could drop GM's pension funds into the red, according to GM's own measures.

Meanwhile GM has sustained $3 billion in losses this year, its debt has been downgraded several times to junk status, GM is losing market share, and it appears the economy and car sales are both slowing as well. Although GM Chairman and Chief Executive Rick Wagoner has repeatedly stated that bankruptcy isn't an option, the S&P has placed the bankruptcy odds at 30%. GM's stock price is hovering near 52 week lows around $25.

The risks involved with GM spinning off part of GMAC and relying more on its core auto business are considerable, says Standard & Poor's Corp. auto analyst Scott Sprinzen. "We have a B-minus rating on, and we're still reviewing that rating," said Mr. Sprinzen. "It's still on credit watch, and we could lower the rating further, even if there's a transaction with GMAC. The risks are high, that's how we see it."I think what Mr. Wagner means is "What GM is forced to do with the proceeds is to be determined." It will also be interesting to see if the PBGC or the bond markets forces GM to cut its dividend. Were that to happen in a timely enough manner (as in now), GM's stock would likely plunge but its bonds would likely gain. If the market forces the issue at a later date it might not be good for either. The point is all moot however, since in my mind the real debate is not whether GM will go bankrupt, but whether said bankruptcy occurs sooner rather than later.

Mr. Wagoner acknowledged in a recent interview that spinning off GMAC will put more pressure on GM's auto business to perform, but said the spinoff is needed to secure GMAC a better credit rating.

"We're going at it to get GMAC back to an investment-grade credit rating, and, frankly, support the business purpose of GMAC, which is to support GM and its growth options," Mr. Wagoner said. "That's sort of step one in the discussion. What we will do with the proceeds is to be determined."

The real question then should be how to handle the upcoming bankruptcy in the most equitable manner possible rather than wasting money trying to prevent it. I would not wish for GM pensioners to go through the torture that the airline industry employees just went through.

In that regard Mish actually has a five step plan to "save" GM.

Here it is:

- GM should sell off all its profitable units

- Fully fund its pension plan

- Declare bankruptcy

- Dissolve the union agreements

- Start all over on a smaller scale

- The plan would protect GM pensioners.

- The plan would protect US taxpayers from a bailout.

- The plan would reduce much of GM's cost disadvantage.

- The plan would give a future GM some semblance of a fighting chance at competing in a global marketplace. Those that believe GM knows how to design and manufacture cars that people want would have their chance to prove it, without fighting excessive cost overheads.

- The plan would remove unneeded auto manufacturing capacity that is depressing the sector.

The Mish proposal is unlikely to be implemented as Chairman and Chief Executive Rick Wagoner has declared repeatedly that "bankruptcy isn't an option". Furthermore GM stockholders and bondholders would not particularly be pleased with my plan to say the least. If a CEO has a duty to shareholders, then as a practical matter what anyone deems "fair" to pensioners or taxpayers is irrelevant. What that means of course is that regardless of the obvious benefits (or lack thereof) depending on your viewpoint as a GM shareholder or UAW worker, the Mish plan to save GM in a "fair and equitable manner" was a purely theoretical exercise that favored pensioners while ignoring huge implications to GM stockholders and bondholders. In that regard it can not be viewed as a serious proposal.

That said, to the extent that the PBGC is willing to force GM to fund its pension plan rather than fund its operations, we just might be following the proposed 5 steps anyway. If my read is correct, then the PBGC is determined to prevent an enormous mess from being dropped in its lap down the road. Given that forcing GM to fund its pension plan is likely to have negative shareholder implications, the PBGC just might be steering GM to a smaller taxpayer bailout sooner rather than a bigger taxpayer bailout later. Furthermore it would not surprise me to see new legislation protecting pensioners in the next Congress. Such a law would certainly not do GM share prices any good. For now, $31 billion seems like a lot of cash for GM to come up with and that does not take into consideration what might happen to its pension investments or its ongoing operational funding requirements in an economic downturn either. Hmmm. Are we back to square one? I believe we are.

Here is the bottom line: No matter what CEO Wagner believes about bankruptcy, it seems likely the market or the PBGC or perhaps even a new law protecting pension benefits over bondholders will force him to change his mind. If history is any guide, not only will GM go bankrupt, but pensioners will get the shaft and taxpayers will end up footing some of the bill. Right now, the PBGC seems like it is trying to minimize that taxpayer bill that will be coming due.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

Monday 14 November 2005

Bank Lending Practices

The October 2005 Federal Reserve Survey on Bank Lending Practices shows that most banks still haven't altered lending standards for home equity lines of credit even after the FED raised concerns about whether lenders were adequately weighing risks.

The report shows domestic commercial banks reported a further net easing of lending standards and terms over the past three months.

In response to the special question about changes in terms on mortgage loans to purchase homes, notable net fractions of domestic institutions reported that over the past two years they had eased a number of terms, including the maximum size of primary and second mortgages, spreads of mortgage rates over an appropriate market base rate, and the maximum loan-to-value ratio.

Here are some highlights of the survey:

The LA Times recently discussed The hidden perils of pay-option loans. Let's take a look.

What this most assuredly boils down to is:

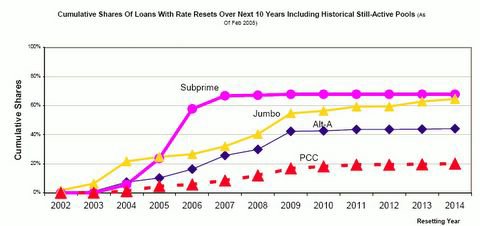

It seems like this is starting to matter right now, but even if not, it is going to matter sooner rather than later. Much sooner in fact, as evidenced by this chart.

Some time within the next year 60% of all of the outstanding subprime adjustable loans are going to reset. This is going to be a rude awakening to many who will see monthly mortgage payments skyrocket. Worse yet, given rising inventories and falling or stagnant home prices it is going to be hard to sell.

Right now it does not seem to matter. That is the way it always is. Nothing matters until it matters, and the corollary is that it never matters until the bitter end. Right now it seems that the fat lady is singing but few hear the tune.

Mish, Saxon Capital just reported, what did they have to say?

That is a good question so let's take a look.

Saxon Capital, Inc. Reports Third Quarter 2005 Operating Results .

"During the third quarter, we continued to see the unfavorable market conditions that we discussed in the second quarter", said Michael L. Sawyer, Chief Executive Officer of Saxon. "The continued rise in short-term interest rates, and accelerated prepayment speeds, coupled with the extended period of muted market pricing increases continue to adversely effect our results. We remain committed to prudent management through these times, concentrating on reducing general and administrative expenses, growing our centralized retail origination platform, focusing on capital preservation, and ensuring a strong balance sheet."

Well so much for honesty as the following chart shows.

Is Saxon being punished for honesty while CFC is taking on more risk?

Unfortunately I have no answer to that question other than perhaps CFC's day of reckoning is coming.

Mish readers might recall that we previously discussed Saxon Capital in Are we headed for a "credit derivatives event"?

In their last conference call Saxon was saying:

Meanwhile, from The Economist Global Agenda, Buttonwood is asking With a pfffffffft or a fizzle?

Take what you can when you can and pass the trash if you can.

Can this go on forever?

Not likely if the following headline is the start of any kind of trend:

Swiss pension fund shifting away from U.S.

I couldn't have said that better myself.

But the party continues. Right now money is still flowing into stocks and the market seems bound and determined to have a year end party. Who am I to argue? All I can say is that it will be one hell of a hangover when the party ends.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

The report shows domestic commercial banks reported a further net easing of lending standards and terms over the past three months.

In response to the special question about changes in terms on mortgage loans to purchase homes, notable net fractions of domestic institutions reported that over the past two years they had eased a number of terms, including the maximum size of primary and second mortgages, spreads of mortgage rates over an appropriate market base rate, and the maximum loan-to-value ratio.

Here are some highlights of the survey:

- Nearly 10 percent of respondents, on net, reported having eased their credit standards on loans to large and middle-market firms.

- About 30 percent of domestic respondents reported that they had reduced the costs of credit lines in October.

- Almost all domestic banks that reported having eased their lending standards and terms in the October survey cited more-aggressive competition from other banks or nonbank lenders as an important reason for doing so

- Almost 40 percent of domestic banks, on net, reported that over the past two years they had increased the maximum size of primary mortgages they were willing to provide.

- About 30 percent, on net, indicated that over the same period they had increased the maximum size of second mortgages.

- Adjustable-rate loan fundings for the month were $23 billion, up 42 percent from October 2004. Year-to-date adjustable-rate fundings totaled $214 billion.

- Nonprime loan fundings totaled $3.9 billion in October, which compares to $3.3 billion for the same period last year. Year-to-date nonprime fundings were $36 billion.

- Pay-option fundings for the month were $8.5 billion, as compared to $3.4 billion in October 2004.

- Interest-only loan volume was $8.9 billion for the month of October 2005, which compares to $5.9 billion, for the same period a year ago.

The LA Times recently discussed The hidden perils of pay-option loans. Let's take a look.

Borrowers with dangerous adjustable rate mortgages that give them the option of paying just about any way they like may find the loans even more perilous — and more expensive — than they ever imagined.Mish, is that what this is all about: greed on behalf of the lender and stupidity on behalf of the borrower? That seems likely but it really is impossible to say. Perhaps it is more like stupidity on behalf of both the lender and borrower to be taking risks like this at the pinnacle of this bubble in the face of repeated FED warnings. At any rate please remember the excuse the lemmings gave in the survey before they followed each other off the cliff: "Almost all domestic banks that reported having eased their lending standards and terms in the October survey cited more-aggressive competition from other banks or nonbank lenders as an important reason for doing so."

For starters, borrowers may find that as the rates on their mortgages adjust, they could be paying as many as three or four percentage points more than they would had they chosen a different type of adjustable mortgage.

Perhaps even worse, once borrowers realize they acted unwisely, they may not be able to get out of their loans without paying a hefty penalty. Even if you sell your house, you could be required to pay a prepayment fee totaling six months' interest to terminate the mortgage.

In exchange for all this, the broker who put his client in this precarious position is getting paid three times as much as he would had he placed the borrower in a more consumer-friendly adjustable mortgage.

Typically, lenders who actually fund the mortgage pay brokers a half-point — 0.5% of the loan balance — when they bring in borrowers who want a so-called payment-option ARM. But if the loan carries a prepayment penalty, they'll pay the broker a larger incentive.

These kinds of extreme charges are not attached to any mortgage other than pay-option ARMs, a loan that allows the borrower to choose from four different payment options each month.

Borrowers can pay the absolute minimum as calculated by a complicated formula. They can make an interest-only payment based on the fully indexed rate but with nothing going toward the outstanding balance. Or they can make a full interest and principal payment based on either a 15- or 30-year payment schedule.

Borrowers are drawn to pay-option ARMs because of their 1% start rate. But what they often don't realize — and sometimes aren't being told — is that while their payment doesn't change for a year, the rate starts adjusting after the first 30 days.

Of course, with these loans, the payment doesn't change until after 12 months. But because the rate moves on a monthly basis, the result is what's known as "negative amortization." That means that whatever the difference between what you pay and what you owe is added to the loan balance.

For pushing such an unfriendly loan on uninformed borrowers, mortgage brokers are paid handsomely, as are loan reps who work for lenders themselves.

"The kind of stuff going on out there is wrong," says Mitch Ohlbaum, a West Hollywood mortgage broker. "I think these loans work well when explained and priced properly. The problem is that no one is educating borrowers on what they are getting into."

A regular person with a regular job will fall behind very quickly if he makes interest-only payments. "People who know what they make each month have no business in a loan like this. They will get demolished."

What this most assuredly boils down to is:

- Fear of losing a deal

- Desire to increase market share or "make the numbers" regardless of risk

- Plain out and out greed

- Belief that Greenspan (or Bernanke) will bail them out if anything goes wrong

It seems like this is starting to matter right now, but even if not, it is going to matter sooner rather than later. Much sooner in fact, as evidenced by this chart.

Some time within the next year 60% of all of the outstanding subprime adjustable loans are going to reset. This is going to be a rude awakening to many who will see monthly mortgage payments skyrocket. Worse yet, given rising inventories and falling or stagnant home prices it is going to be hard to sell.

Right now it does not seem to matter. That is the way it always is. Nothing matters until it matters, and the corollary is that it never matters until the bitter end. Right now it seems that the fat lady is singing but few hear the tune.

Mish, Saxon Capital just reported, what did they have to say?

That is a good question so let's take a look.

Saxon Capital, Inc. Reports Third Quarter 2005 Operating Results .

"During the third quarter, we continued to see the unfavorable market conditions that we discussed in the second quarter", said Michael L. Sawyer, Chief Executive Officer of Saxon. "The continued rise in short-term interest rates, and accelerated prepayment speeds, coupled with the extended period of muted market pricing increases continue to adversely effect our results. We remain committed to prudent management through these times, concentrating on reducing general and administrative expenses, growing our centralized retail origination platform, focusing on capital preservation, and ensuring a strong balance sheet."

Well so much for honesty as the following chart shows.

Is Saxon being punished for honesty while CFC is taking on more risk?

Unfortunately I have no answer to that question other than perhaps CFC's day of reckoning is coming.

Mish readers might recall that we previously discussed Saxon Capital in Are we headed for a "credit derivatives event"?

In their last conference call Saxon was saying:

- "At the point in time WHEN the credit event comes, AND IT WILL we will be very well placed to take advantage of what happens next"

- "I am concerned about the level of capital" of our competitors "to service the bonds as those portfolios age"

Meanwhile, from The Economist Global Agenda, Buttonwood is asking With a pfffffffft or a fizzle?

What could give this scenario an uglier twist is the sharp increase in funny loans to funny borrowers over the past few years. “Subprime lending” to people who would not normally be able to make the grade is running at about $500 billion a year. Much of it takes the form of variable-rate, interest-only and negative-amortisation loans. Both debtors and creditors are now more exposed to interest-rate changes.Indeed. Hot potato is the name of the game.

Banks have been happy to lend to marginal debtors, safe in the knowledge that they could unload many of the loans either on one of the quasi-governmental housing agencies (Fannie Mae, Freddie Mac) or to private investors in asset-backed securities. Many of these loans end up in collateralised debt obligations (CDOs, which slice up bundles of referenced loans into tranches of different riskiness for different investors). Japanese and European investors have been especially enthusiastic buyers of this sort of paper, but there are signs of battle fatigue now: spreads have widened sharply over the past couple of weeks.

Take what you can when you can and pass the trash if you can.

Can this go on forever?

Not likely if the following headline is the start of any kind of trend:

Swiss pension fund shifting away from U.S.