In a dramatic sign of its ailing economy, Michigan's household income dropped, more children joined the ranks of poor people and the number of people living below the poverty level jumped in the suburbs, according to census figures released Tuesday.Following is a chart showing the income drop of Michigan vs. other states.

The figures show Michigan's median household income fell more than any other state's during the last six years. It was $46,039 in 2005 -- 12% less than what it was in 1999 when adjusted for inflation. None of the 28 counties and 21 municipalities for which data were reported showed a rise in median household income between 1999 and 2005, the estimates show.

The news was grim in other areas, too. In 2005:

• 19% of children in Michigan lived in poverty, up from six years ago.

• Almost a third of the state's African Americans lived below the poverty level.

• Detroit remained one of the poorest big cities in the country with almost a third of its residents living below the poverty line.

• Cities and townships posted drops in median household incomes ranging from 24% to 6% and poverty rates increased in all but three cities.

"I hate to superimpose worse news on top of bad news, but this is not a cycle," said David Littman, a senior economist for the Mackinac Center for Public Policy, a Midland-based think tank. "We're in a secular decline here in Michigan. As the economy slows nationally, we're going to sink much farther relative to the other states. We've only just begun.

"We're going to see Michigan sink to levels that no one has ever seen. We're going to be looking at the highest unemployment rates in the nation for the next five to 10 years."

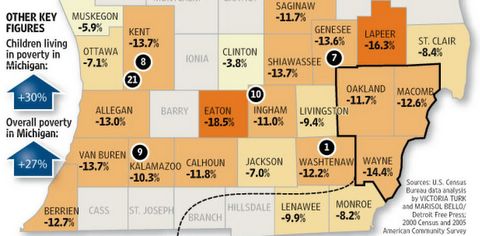

The next two charts show how various counties in Michigan have fared.

Thanks to the Detroit Free Press for all of the above charts.

More statistics and a better chart can be found in this PDF.

I believe Michigan is a harbinger of times to come for much of the US. So do a few others.

Regli on Silicon Investor writes "Michigan will be called unrepresentative until people realize in a few years to a decade that it is not. The only advantage it has is that it came first."

John Vosilla on Silicon Investor is asking "Is Florida going to follow in Michigan's footsteps?"

Vosilla was referring to the St. Petersburg Times article Economic gloom tightens grip

Battered by fuel prices, a housing slump and storm fears, Floridians are less confident in the economy than at any time since 1993.Hmmm. People can't afford to come in and get their hair done if they're working to pay an electric bill like that." She worries about being able to keep her salon open.

Floridians' confidence in the economy plunged this month to its lowest level in 13 years, University of Florida economists said Tuesday.

The chill in the housing market, higher interest rates and fuel prices appear to be taking their toll. National confidence numbers also fell in August, but not as much as they did in Florida.

The Florida Consumer Confidence Index fell 11 points to 76, while the national index, compiled by the Conference Board, went from 107 to 99.6.

The Florida drop is very similar to the one that occurred last September in the wake of Hurricane Katrina, only this time there was no hurricane to blame. Chris McCarty, director of survey research at the University of Florida's Bureau of Economic and Business Research, thinks the changed outlook for housing is at least partly responsible.

"Florida is in a position to really be affected by a decline in housing," McCarty said.

"There are a lot of overvalued markets in Florida, and there are a lot of risky loans, some of which are going to readjust right about now," he said. "Also, a lot of employment increases over the last few years have been related to housing."

When projects get canceled or put on hold, that has a direct impact on jobs and a secondary impact on sales of appliances and furniture, he said.

Many consumers also are feeling the pinch of higher energy prices at the gas pump and in their utility bills.

"The feedback I get from people when they cancel their appointments at the last minute is that they're broke," said Valerie Bohr, 41, who owns Brilliance Color and Hairstyles in Largo. "Just this week I had two people tell me they got electric bills over $400. People can't afford to come in and get their hair done if they're working to pay an electric bill like that."

She worries about being able to keep her salon open.

Translation: Regardless of what it costs to run that salon, Brilliance Color and Hairstyles in Largo simply is in no position to even attempt to raise prices.

Bennigan's restaurant dropped the price of their half pound burger from $7.99 to $4.99.

That's a drop of $3 or 37.54 percent! That can't happen can it? At least that is what I am told with rising input costs on food and energy. OK, Bennigan's is just one restaurant, big deal. No, it's not just one restaurant, and yes it is indeed a very big deal. It is all about discretionary spending and a slow change from consumption to saving.

I talked about that idea recently (along with Kevin Depew) and was mainly scoffed at judging by the blog responses to The Psychology of Deflation.

The facts are what they are and here they are:

- Prices of homes are dropping.

- Land prices are dropping.

- Prices at restaurant are dropping.

- Prices at some nail salons are dropping.

- Now we see that hair salon owners might not be able to stay in business.

Concrete prices rising, energy prices rising, copper prices rising?

The solution is simple: Just raise your prices!

I am told that "must" happen.

Meanwhile I watch the opposite happen.

I talked about PPI prices in Intermediate vs. Finished PPI.

Input prices rising?

What's the problem?

Just raise output prices.

It has to happen. Right?

Well why isn't it?

Am I declaring victory in my call for deflation?

No way. I will instead sit back (probably for quite some time) and watch the inflationists explain away things that "can not happen" that are happening.

Here are a couple more facts to consider.

- The $CRB just busted a 5 year trendline.

- Changes in secular trends do not change easily or overnight.

Will the Fed counteract? Yes they will. Indeed, the reaction to the next few moves by the Fed over the next year or so will be the proof of the pudding. That makes it too early to declare victory even as all sign are currently pointed "down town".

We will see what "Helicopter Drop" Bernanke has up his sleeves (or not).

We are now at an economic inflection point. There may be a headfake at this point in either direction.

I will offer this prediction.

It is an easy one, yet one that few believe.

Many more states will follow the path of Michigan.

We are indeed on the cusp..... of deflation.

It is ironic that the Fed unleashed the very beast they feared by fighting it too early, at a time when there simply was no threat. Now that the threat is real, no one sees it.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/