Everywhere, everyday someone is offering advice to China or Japan or Malaysia to sell their US$ reserves while they are “still worth something”.

Nouriel Roubini weighed in just today with his viewpoints on why China should stop building US$ reserves and remove the RMB peg.

Ten Reasons why China should move its peg and pull the plug on the US reckless policiesNouriel has valid points, perhaps ten of them.

But is it as simple as that?

Certainly we have seen a lot of confused and conflicting statements from central bankers lately on what they might or might not do.

I addressed this yesterday in

“Currency Madness”.Here are 12 reasons why I think China should NOT float the RMB (for now), with a detailed explanation following.

Twelve Reasons Why China Should Delay Floating the RMB1) The Chinese central bank does not want to trigger a currency crisis by floating the RMB too soon.

2) There is too much “hot money” flowing into China in hopes of making a quick killing on a currency repeg or float.

3) China thinks in terms of years or decades on policy changes. This is in contrast to US corporations that only care about “beating the street” by a penny for the upcoming quarter. There are far more risks associated in rushing things than in eventually getting them right.

4) Chinese banks might not be in a position to take the stress of floating the RMB at this time, even if other factors were conducive.

5) Just who is China and Japan or anyone else supposed to off load their reserves to in the face of ever growing US current account balances? Mars?

6) Fundamentals such as slowing worldwide growth do not favor floating the RMB at this time

7) There is no WTO requirement for China to float the RMB by 2007 as is commonly believed.

8) The Asian principle of “face saving” suggests that China can not be forced into premature action and that “Snowtalk” is counterproductive.

9) The peg has served China well. China did not blow up in the last Asian currency crisis because of that peg. The peg has provided stability and that stability is still useful.

10) The US has bigger problems that need addressing first.

11) Like it or not, a worldwide recession is in the cards. Throwing a float of the RMB on top of that problem might have severe unintended and undesirable consequences.

12) Paper losses on paper currencies look far bigger on paper than they actually are in the grand scheme of things that central bankers consider.

Let’s backtrack a moment to the World Economic Forum in Davos, Switzerland in January when Yu Yongding, an advisor to the monetary policy committee at the central bank of China told journalists attending forum that given the dollar's recent weakness,

"now is the time to revalue ... We need more flexibility. That means revaluation."Those statements were immediately retracted. An official in the People's Bank of China's information office said Friday that Yu was an academic adviser, not an official, and that his opinion did not reflect official policy. "(Yu Yongding's) remarks are only his personal view, and the opinions of an academic. It does not represent the central bank's policy"This was not the first time Yu's remarks created friction with the central bank Yu previously came under pressure after he was quoted as telling an academic seminar that China was reducing its holdings of US treasuries because of the sagging US dollar. Those remarks triggered a steep sell-off of US treasuries. Yu later insisted he was misquoted and that he had actually said that China had reduced its treasury holdings as a proportion of its rapidly growing foreign reserves.

At any rate, there is far more to this story because things just are not as simple as they seem.

Let’s take a look at why China will be slow to float and why China needs adequate foreign reserves.

The following articles help explain the situation.

They are not available in English, but those who speak Chinese can read the full reports here:

http://news.hexun.com/detail.aspx?ID=1006782http://news.hexun.com/detail.aspx?ID=1008521Those articles contain statements made by Zhou XiaoChuan, Governor of the People’s Bank of China. When dealing with China one must separate official policy and statements made by those who set policy from those who do not. Zhou XiaoChuan sets policy, other often quoted officials such as Yu Yongding do not.

Perhaps after a second incident, we just might be hearing a little less from Yu Yongding.

Most of us can not read Chinese (myself included), so bloggers everywhere can thank my friend Yiwu for the translated highlights below.

Yiwu's comments are italicized in brackets (The bolding is mine)……

Zhou said on Jan. 18th that "

In 2004 China's foreign reserve increased a little fast, but the increase is not unreasonable. The year over year increase in China's foreign reserve grew at more than 50%, now standing at $609.9 billion.” [

This is total reserves not just US$ reserves]. “We were keeping 3 months in reserve, but now the suggestion is to keep as much as 6 months of imports. So that means China needs to keep plenty of foreign reserves.

Plus our imports have been increasing at an annual rate of 30%. Does that mean we should also increase our foreign reserves? This question is very complicated, and will influence our currency policy a lot.”

Zhou also said that “

China should be prepared for the reversal of foreign investment.” Usually, foreign investors expect an annual return of 10%. [

My own take, is if that expectation is not met that investment will leave. This might occur if the Chinese economy slows down or the US increases their interest rate].

Zhou said “

Foreign investment would have to leave sooner or later. China has to make sure to be able to meet their demand when they want their money back.” [

My own take, China is fully prepared for the exit of FDI in case China slows down]

Zhou said most of short-term foreign debt comes from the loan of foreign banks. And some of them are from foreign reserve of the enterprises. He thinks that this short-term foreign debt may very possibly have been changed into RMB now. So when conditions are right, “

these short term debts might have to be exchanged back to foreign currency.” [

My read, disappointed that China is not going to revalue or float the RMB].

"China has to prepare some foreign reserves to meet the possible reversal of foreign money, to prevent what had happened during Asian currency crisis from happening here in China". [

Avoiding a currency crisis from happening in China is obviously a high priority.]

“

Considering all of the above, the current foreign reserve of China ($609.9 billion and counting) is not high after all”, Zhou said.

[

The main points of Zhou’s speech are to prepare for the possible expatriation of foreign investment and the avoidance of a potential currency crisis.]

I would like to thank Yiwu for that translation as well as her comments, and I have a few comments of my own to add.

First let’s settle the question as to whether or not the RMB peg breaks WTO rules. I have seen many reports saying that China HAS to float by 2007. I believe those reports to be inaccurate.

China yuan peg doesn't break WTO rulesNEW YORK - US Trade Representative Robert Zoellick said on Wednesday that he did not think CHINA's exchange rate policy violated World Trade Organisation (WTO) rules. 'There's really no WTO obligation not to have a fixed exchange rate,' he said before speaking to the Asia Society. His remarks appeared to squash US manufacturers' hopes for the United States to challenge CHINA's exchange rate policy at the WTO.'You will recall the United States had a fixed exchange rate until 1971, when we were a member of the Gatt,' he said, referring to the predecessor organisation to the WTONext let’s consider just how vast China’s reserves are.

According to the US Treasury, China as of November 2004 held $191.1 billion in US debt.

To me, that is not an enormous sum of money, all things considered.

Three Reasons Why China Will Not Lift Its US$ PegOne, China won't be pushed around. What Snow hasn't grasped is that a nascent superpower like China can't be seen as bowing to Washington. Among China's 1.3 billion people, many U.S. policies like the invasion of Iraq are highly unpopular. Every time Snow pushes China publicly to let the yuan rise, he merely delays such a step. This issue requires thoughtful, behind-the-scenes economic diplomacy, not podium thumping for the world's television cameras.

Two, China's financial system is still fragile, and debt has everything to do with it. Its 9 percent growth and seemingly bottomless appetite for commodities masks the fact China's banking system remains hobbled by bad loans. That China refuses to revalue the yuan even slightly suggests things may be more precarious than we know. China also faces a dual challenge unprecedented in modern economics. Not only must it slow growth to avoid an inflationary boom-and-bust cycle, but it also needs to create jobs for hundreds of millions of people displaced by the transition from socialism to capitalism. Since the currency peg is a key source of stability, it won't go away anytime soon, no matter what the U.S. says.

Three, the U.S. has its own public relations woes. When finance ministers from the Group of Seven industrial nations meet in London next month, the U.S. currency is likely to attract more criticism than China's. The dollar's weakness against the euro is irking Europeans, who fear slowing growth.

What Snow may not realize is that the more the dollar falls, the less likely a Chinese revaluation becomes. China grows more competitive along with the U.S. as the dollar drops. Also, the U.S. must consider how Japan will respond to all this. If Tokyo starts selling yen to boost the dollar, China, fearing a loss of competitiveness to Japan, will be slower to let the yuan rise.

Following is a not so polite way of telling Bush and Snow to take a hike.

China´s Ruogo asserts autonomy in yuan decisions Li Ruogo, deputy governor of the Chinese central bank, told global economic pundits that the country was fully capable of handling the transition to a floating exchange rate by itself. Ruogo said China alone would decide when the time was right to dismantle the peg that keeps the yuan fixed to the US dollar, a move some economic commentators believe is necessary to correct growing imbalances in the global economy. "Leave this issue (of floating the yuan) to the Chinese people and the Chinese government. We will certainly figure out what is the most suitable approach for China's economic development," he said in a trenchant address to business leaders at the World Economic Forum here.The deputy governor of the People's Bank of China said foreign monetary policy commentators were generally ignorant of economic conditions within the country. Their advice would therefore have little bearing on when the dollar peg would be removed. "Outsiders don't know what exactly is happening in China. We are happy to listen (to outside advice) but don't ask us to practice what you say," he said. "If we think it is correct (to float the currency) we'll go ahead, and if we think the time is not correct we will wait," regardless of "how heavy the outside pressure is." Ruogo rubbished arguments that allowing the yuan to rise in value against the US dollar would reduce the US' burgeoning trade deficit, regarded by many as the main threat to global economic stability"The idea that China has the key to the balance of the whole world's economy is totally wrong. The imbalances are attributable to many reasons, but not whether the yuan exchange rate is flexible or not flexible," he said. The deputy governor reiterated Deputy Prime Minister Huang Ju's pledge to allow the yuan to float freely at some point, but not before structural improvements and banking reform were enacted.My friend Yiwu offers this comment: [Li GuoGu (not Li Ruogo) is the right hand man of Zhou XiaoChuan. So what he said definitely reflects the official government position. The US should not expect to make China’s $1.4 trillion economy a scapegoat for the $20 trillion combined economy of the US and EU.]

The Northern Trust weighs in on the issueCHINA: DETERMINING THE YUAN’S FUTURENow there's renewed talk out of Washington suggesting that the yuan should be revalued at the earliest possible time, while some economists are digging out their overheating scenarios. All this is happening while Beijing digs in its heels and says everything's fine and the renminbi yuan rate is not going anywhere for the moment. Now that the discussion has started up again, which side has the stronger argument?After weighing both sides, there is some validity in Beijing's claim that things are under control. First off, inflation has decreased markedly over the last half of the year, ending 2004 at a comfortable 2.4% on-the-year. This accomplishment alone implies some success in conquering the overheating issue, even though the CPI is a compiled statistic gathered from state and regional sources that may or may not be a reasonable representation of reality. However, the more convincing argument comes from figures out of the People's Bank of China (PBoC), namely money supply. This series shows a significant drop-off starting in Q2 2004, and only turning around as of last quarter. M2 data are also generally more accurate as they are maintained from the PBoC.At the G-7 meeting during the first weekend in February, the topic of the yuan will be brought up along with the weakening dollar, and the Chinese renminbi will likely be part of the US response to criticisms about the faltering greenback. Understandably it would be dangerous for China to change its currency regime in the middle of a slowdown, assuming one is on the way, as a revaluation would exacerbate a slowing economy significantly. More importantly, there's no reason to believe Beijing will be persuaded by the industrialized nation's complaints and consider a near-term shift in the value of its currency. Strong words from the industrialized nations have rarely made much of an impact on China's internal decision making process, and right now Beijing's numbers are making the most convincing argument of all.For all this talk of “not accumulating” reserves or selling reserves or whatever, no one has ever been able to tell me exactly what China or Japan or whoever is supposed to do with their current account surpluses. They can sell US$ but to who? Exactly who is the counter party that China and Japan and Malaysia are going to be selling their reserves to? It certainly will not be to the US. Can they offload their surpluses to France, Germany, or Mars? What will Mars do with them?

How can everyone dump (or not add to reserves) as long as the US current account deficit keeps expanding?This statement by Li GuoGu, deputy governor says it all: "

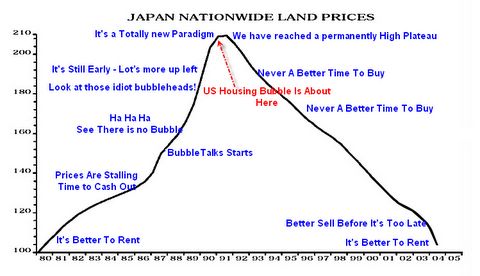

The idea that China has the key to the balance of the whole world's economy is totally wrong. The imbalances are attributable to many reasons, but not whether the yuan exchange rate is flexible or not flexible." I believe Li GuoGu has this correct. The world’s imbalances are so severe that attempting to correct them solely via exchange rates can not possibly work. In fact it might precipitate another Asian currency crisis.

With the US government running massive budget deficits,

$113.9 billion in February alone and with the balance of trade showing no signs of improvement in spite of a 40% drop in the US$ any notions of fixing the problem via exchange rates is pure fantasy.

The problem is that the US is still on a consumption binge at the consumer lever and federal level and until a legitimate effort is made to correct that situation, the problems are only going to get worse.

Historically imbalances such as these have only been corrected by recessions and this time will be no different. China is likely to hold (and should hold in my opinion) substantial US$ reserves until some of the hot money is forced out and until the US makes some effort to correct its own problems first.Finally, it is high time for currency traders and others to realize that

paper profits or losses are not even close to the top of the list of problems for central bankers to worry about in this fiat world. I would place trade issues, exports, and financial stability ahead of concerns over paper losses in paper fiat currencies. Quite simply it is in everyone’s best interest right now to hope and pray that the US takes action on its own to correct those imbalances. Unfortunately those hopes are misguided.

The Bush administration is spending recklessly on military excursions and now appears to want to front load a social security problem 30 years from now into the current deficits. No effort has been made to rein in reckless spending on the part of US consumers. The problem is beyond repair except via destruction of debt and a massive US consumer led recession. When that happens it is entirely possible for the US$ to RISE opposite everyone’s expectations. If that forces hot money out of China, then China will be in a better position to consider major changes.

Let's recap the reasons:

Twelve Reasons Why China Should Delay Floating the RMB1) The Chinese central bank does not want to trigger a currency crisis by floating the RMB too soon.

2) There is too much “hot money” flowing into China in hopes of making a quick killing on a currency repeg or float.

3) China thinks in terms of years or decades on policy changes. This is in contrast to US corporations that only care about “beating the street” by a penny for the upcoming quarter. There are far more risks associated in rushing things than in eventually getting them right.

4) Chinese banks might not be in a position to take the stress of floating the RMB at this time, even if other factors were conducive.

5) Just who is China and Japan or anyone else supposed to off load their reserves to in the face of ever growing US current account balances? Mars?

6) Fundamentals such as slowing worldwide growth do not favor floating the RMB at this time

7) There is no WTO requirement for China to float the RMB by 2007 as is commonly believed.

8) The Asian principle of “face saving” suggests that China can not be forced into premature action and that “Snowtalk” is counterproductive.

9) The peg has served China well. China did not blow up in the last Asian currency crisis because of that peg. The peg has provided stability and that stability is still useful.

10) The US has bigger problems that need addressing first.

11) Like it or not, a worldwide recession is in the cards. Throwing a float of the RMB on top of that problem might have severe unintended and undesirable consequences.

12) Paper losses on paper currencies look far bigger on paper than they actually are in the grand scheme of things that central bankers consider.

China will “eventually” float, but “eventually” might be a long time.

Mish