San Diego County California and Las Vegas Nevada

San Diego Home Prices and Sales

San Diego Home Sale Trends

In San Diego County year over year sales are down 20.8% and average sale time (days on the market) has risen 50% from 40 days to 60 days. Somehow the median price has risen by 18%. Is the average buyer now being priced out of the market and some of the froth coming off? It sure seems like it.

Las Vegas Nevada

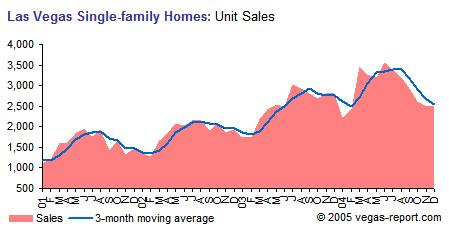

Las Vegas Home Sales

Las Vegas Home Sale Trends

In Las Vegas year over year sales are down 10.5% and average sale time (days on the market) has risen 45% from 33 days to 48 days. Again we see a divergence in median sales price. Those figures are as of December. Current figures are not yet available.

That is just a snapshot of two markets but it is indicative of nationwide trends: Sales times are ticking up along with inventories. At some point rising inventories will put price pressures on houses if in fact it has not started already. In a sense median prices can be misleading, especially in a declining sales environment as affordability rises above the qualifications of low end buyers. For example, two houses selling for $1 million each is quite a bit different than 8 sales, 6 at $250,000 and 2 at $1.2 million each. The signs are in place that the average buyer is no longer willing to chase prices. It is just a matter of time before gravity sets in.

Here is a trend well worth following.

Mortgage Debt and the Trade Deficit

Condo Mania in Florida

Condo boom worries Wall Street

"By way of anecdotal reports, we believe as much as 85 percent of all condominium sales in [the downtown Miami] market are accounted for by investors and speculators," Raymond James stated in a report issued by its equity analyst Rick T. Murray.

Downtown developers have brushed off worries about rampant speculation and rejected Thursday's reports. They note that buyers must place a 20 percent down payment on preconstruction condo units priced anywhere from $500,000 to more than $1 million.

"You don't put 20 percent down on a $500,000 condo when you are a speculator," said Martin, who has two other high-rise projects in downtown Miami along Biscayne Boulevard.

Yeah right! And someone putting 100% down on JDSU at $100 a share was not speculating either. It seems the excuses for this mania get sillier and sillier.

Finally, we need to be aware of possible upcoming distortions in the trend of home sales figures: Starting February 25, 2005, home sale figures will include condos and co-ops in addition to single-family homes.

It will be interesting to see how this affects the medium price, numbers of homes sold, and "affordability". Will these changes add to the confusion in the bond markets? Please be alert to that possibility.

Mish

No comments:

Post a Comment