Before we build the deflation case, I think it's time for a new feature. We will call this feature the "Laugh of the Week". I will be loose with this. There might be three a week or none a week depending on how I feel. The first must see laugh of the week is The Reverse Revolution! by Mark Fiore.

The Case for Deflation: Background History

To understand the case for deflation we must turn back the hands of time.

The year is 1914. WWI was breaking out in Europe and the US stayed out of it for three years. As a result of being a "safe haven" gold poured into the United States and US gold reserves rose 64% as Europe exchanged its gold for American goods. By the time the US entered the war much of Europe was ravaged. The US escaped unharmed. After the war ended the US trade surplus remained high and allies began repaying their war debts.

The US experienced rapid credit expansion as a result of the surge in gold reserves. Between 1914 and 1920 the US doubled its expansion of credit. During those war years, investment in machinery and equipment rose by 205% and the value of durable goods output increased in excess of 250% This surge in capacity led to general oversupply of goods by 1926. During the second half of the "roaring 20's" credit expanded at moderate rate but the damage had already been done. The economy was no longer able to profitably invest in equipment so increasing amounts of money poured into the stock markets. The bubble finally burst in 1929 when profit growth (earnings) could not keep pace with rising stock market valuations. Share prices plunged, credit contracted, and bankruptcies proliferated.

Fast forward to 1980. Following the collapse of the Bretton Woods agreement in 1971 with Nixon closing the "gold convertibility window" coupled with huge output expansion in Japan, Japanese currency reserves increased 260% between 1985 an 1988. Those dollars triggered a lending boom in Japan as well as incredible property bubbles and stock market bubbles. In 1989 the Nikkei index peaked above 38,000. Just as in the US in the late 1920's, earnings could not keep pace with market valuations and share prices started plunging. Japan repeatedly tried to stabilize the markets with injections of liquidity but Japanese property values plunged for 18 consecutive years and are still falling at the time of this writing. Japan peaked in 1989 and may just now finally be coming out of it.

Meanwhile back in the states, this was the 1990's outlook:

In 1990 there was no property bubble, no global wage arbitrage, no China factor, no fiber revolution, no PC revolution, and most importantly no internet. However, there was plenty of credit to fuel the boom of a lifetime in all of those in the aftermath of the collapse of Bretton Woods.

Greenspan declared irrational exuberance in 1996 then took it back and proclaimed a "productivity miracle" in 1999 and pundits proclaimed the "end of the business cycle" and other such silliness. That was the beginning of the end.

Outlook 2000.

Here are some highlights of the May 2000 FOMC minutes:

The members saw substantial risks of rising pressures on labor and other resources and of higher inflation, and they agreed that the tightening action would help bring the growth of aggregate demand into better alignment with the sustainable expansion of aggregate supply. They also noted that even with this additional firming the risks were still weighted mainly in the direction of rising inflation pressures and that more tightening might be needed.

Looking ahead, further rapid growth was expected in spending for business equipment and software. ... Even after today's tightening action the members believed the risks would remain tilted toward rising inflation.

Here is the full text for anyone wanting to look at the details.

How could they have possibly been more wrong? Over the next 18 months CPI dropped from 3.1% to 1.1%, the US went into a recession and capex spending fell off the proverbial cliff.

Outlook 2002

Talk about going from one extreme to another. In 2002 FED Governor ($Ben) Bernanke openly discusses defeating deflation via the Helicopter Drop. "... the U.S. Government has a technology, called a printing press ... A money-financed tax cut is essentially equivalent to Milton Friedman’s famous 'helicopter drop' of money." Actually the Greenspan and the FED were total wimps. They would not even use the "D-word". Instead of saying deflation they called it "an unwelcome drop in inflation" aka "Liquidity Trap".

Here is an article on how the US can escape "The Liquidity Trap".

For the record, you may wish to check out

Deflation: Making Sure "It" Doesn't Happen Here, the complete text of "Helicopter Drop" Bernanke's infamous speech in 2002.

Fast Forward 2004-2005

The FED that was worried about inflation and spiraling wages right in front of the biggest stock market crash and declining real wages since the great depression, a scant two years later started worrying about deflation although there were huge tax cuts (approved by Greenspan himself), a war stimulus, business tax credits, and GSEs that were expanding credit like mad. At that time, with that record stimulus deflation was not YET an issue. Fueling the seeds of deflation, the FED cut interest rates to 1% and in 2004 Greenspan declared "victory over deflation". Apparently he now believes the business cycle has been defeated.

Present Situation

"Wrong-Way Greenspan" (how I believe history will refer to the worst FED manager in history is once again worried about inflation. We are now in period of what might be called "pseudo-inflation" since it is an unsustainable mirage. Inflation is there alright. How can one deny the expansion of credit, absurd home prices, a re-inflated stock market bubble, and irrational exuberance in properties exhibited by "flipping houses"? Greenspan and the FED fueled this boom by attempting to defeat the deflationary business cycle. All this did was fuel an enormous expanse of credit that went into property values just as happened in the late 1980's in Japan.

The hopes of this FED was that 1% interest rates would fuel a jobs boom. It did, but NOT where the FED wanted it. There was a jobs boom but it was in China not the US. We discussed this sad state of affairs in Searching for Jobs and in Outsourcing the Soul of the US. Unfortunately for the FED, they can only provide liquidity. They can NOT determine where it goes. In this case it accelerated the transfer of jobs to China and went into an unsustainable consumption binge fueled by ever-rising property values in the US (and worldwide too). Now the FED is worried about the property boom, but it is too late. They have blown their last bubble and there is NO hope of slowly deflating it. We discussed some of this in Signs of Economic Stress and in It's a Totally New Paradigm.

The Mish top ten reasons why deflation is inevitable:

1) Enormous consumer debt

2) Falling wages

3) Global wage arbitrage

4) Credit expansion that can not be maintained

5) Mal-investments

6) Over capacity

7) A world-wide housing bubble

8) A re-inflated stock market bubble

9) The normal business cycle

10) Past history

Consumers are going deeper and deeper in debt and real wages are falling due to the outsourcing of jobs and global wage arbitrage. Meanwhile spending has been maintained because of a seemingly (for now) endless supply of credit based on rising home prices. 1% interest rates and easy credit re-inflated the stock market and created a housing bubble. Prices of imported goods are falling (electronics, TVs, PCs, etc) because of 18-1 to 30-1 wage differentials in China and India vs. the US.

Stock market prices rose because earnings increased in this environment. People are now getting rich "flipping houses" just as they flipped stocks in 2000. Everywhere you look (outside of imported goods from China), prices are going up. Oil is rising, home prices have skyrocketed, insurance is going up as are medical expenses. Money supply is expanding and inflationists are alarmed and hyper-inflationists are gloating "I told you so".

OK Mish how the heck do you get DEFLATION out of that mess?

Simple: Just as the FED could not have possibly been more wrong in 2000, hyper-inflationists could not possibly be more wrong today! What can not be maintained will not be maintained by definition. We noted some problems in Signs of Economic Stress. Here are additional signals to consider.

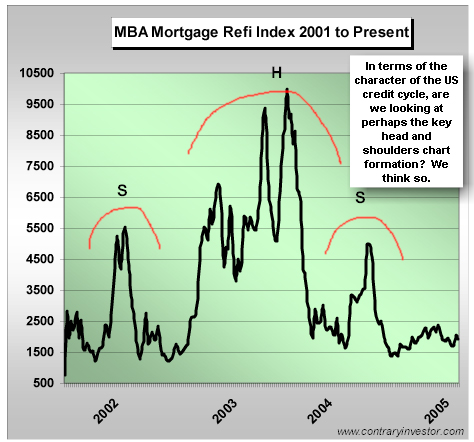

Refis no longer support continued consumption

Cosumers keep spending money they do not have

Bankruptcies Rise with rising interest rates

This is the scenario I envision:

Wages continue to fall due to outsourcing, mergers, and global wage arbitrage

Home prices level off then fall sharply

Home equity loans stagnate as result of stagnating home prices

Home building stalls because affordability finally starts to matter

Trade jobs fall with falling home starts

Expansion of Walmarts, Home Depots, ect. stops with the slowdown of new home subdivisions

Retail expansion peaks and stalls

Consumer sales slow with the slowing economy

Bankruptcies increase

Consumer lending based on rising home prices falls flat

Credit growth declines

The US goes into a recession

Layoffs in the financial sector increase

Layoffs in the real estate sector increase

Credit is destroyed in more bankruptcies

Deflation is finally recognized in hindsight

Hyper-inflationists throw in the towel

OK Mish what are the inflationist counter-arguments to this?

That is a good question. Let's discuss them.

1) Since we left the gold standard money supply has never gone down.

Mish answer: That is like saying because GM has not gone bankrupt yet it will never go bankrupt. Obviously this argument is feeble at best.

2) The FED will increase the money supply to "defeat deflation".

Mish answer: This is what Greenspan and Bernanke foolishly believe. In fact Both think that the failure of Japan to defeat deflation was caused by Japan's reluctance to "inflate" soon enough in response. Having learned from "Japan's Mistake", the FED slashed interest rates to 1% fueled a housing bubble, re-inflated the stock market bubble and this is key "Greenspan declared Victory Over Deflation".

NO! This is where my long historical introduction finally comes in handy. There was no "Victory Over Deflation". All the FED did was increase the mal-investments and debt that needs to be DEFLATED away. Flashback 1929......... One can NOT defeat deflation by the very thing that caused it! What caused the Great Depression was an un-abated supply of credit that finally imploded. More credit would not have solved a thing! Where would money supply have gone in 1929? What credit worthy customer would have wanted to borrow? Who would have wanted to lend? For what purpose in a world of over capacity?

Fast forward one more time to 2005.

Most inflationists expect home prices to fall. The thinking ones also realize that falling home prices will slow home demand and cause layoffs in plumbing, carpeting, appliances, grass seed, windows, roofing, lumber, and in trucking all of the above.

Unemployment will rise and so will bankruptcies. Bankruptcies are the essence of deflation.

Once housing prices collapse who will want to lend? We are already at 100% or even 125% funding of mortgages. What lender will go to 150% to a person without a job? None will IMO. Business lending? Forget about it! We have a capacity glut. What credit worthy customers will want to borrow? Do we need more cars, houses, TVs, computers, anything? This is THE NUT that inflationists and hyper-inflationist can not defeat. Credit and money supply will fall flat if not out and out plunge. Debts will be wiped clean and monetary creation will go negative. The government is trying to avoid this situation with an absurd bankruptcy bill but I believe it will backfire. For a discussion of this absurd bill please see The Deflation Guarantee Act of 2005.

Falling home prices, and the resultant slowdown in trade jobs coupled with rising unemployment are the Achilles’ heel of inflationists. They can not explain how this scenario leads to further inflation. Nor can inflationists tell me how home prices can keep rising as long as we have global wage arbitrage, falling wages, and loss of jobs. Home prices can NOT rise above wage growth over the long haul!

There it is in a nutshell. From where we are, continued inflation, or wimpy forecasts of stagflation are simply not possible. Show me rising wages and I will accept that inflation might be a possibility. I see no reason to believe rising wages are about to happen and although Housing may (for some time) continue to support consumption, WHEN not IF housing turns the result can NOT be anything other than DEFLATIONARY.

I will gladly debate anyone on this issue. I have a great deal of respect for Jim Puplava and we both agree about gold over the long haul. However, the next move is not towards hyper-inflation it is towards DEFLATION.

That said, I believe gold will rise as the FED attempts to fight deflation just as they attempted to fight it by slashing rates to 1%. This FED has learned NOTHING from history. The root cause of the great depression was an over-expansion of credit. One can NOT defeat the business cycle by throwing more money at it. All hyperbolic credit expansions end the same way. It will NOT be different this time.

Deflation is in the cards.

The FED's attempt to fight it will ultimately be good for gold.

Book it.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment