American senators could vote this week to slap tariffs of 27.5 per cent on all Chinese goods, amid a rising clamour of protectionist anger on Capitol Hill.You are not saying yes and you are not saying no?

The sponsors of the so-called Schumer-Graham Bill were in Beijing last week - Chuck Schumer's first official trip overseas in 25 years - to press home the message that China's cheap currency gives it an unfair advantage over the Americans. Schumer, a Democrat who represents New York, and his Republican co-sponsor, Lindsey Graham of South Carolina, have been promised a vote on the measure by the end of March.

The US ran a trade deficit of more than $200bn with China last year, as shoppers sucked in low-cost consumer goods from the fast-growing economy. Like Japan in the Eighties, China is the target of protectionist rhetoric.

Schumer and Graham will hold talks with colleagues in Congress to decide whether to press their bill to a vote. 'The jury's out,' Schumer said. 'We're going to make a decision next week. We're not saying yes, we're not saying no.'

So what exactly are you saying? That this may or may not be a bluff?

Let's backtrack a bit and look at statements made by China on March 13.

China Daily is reporting Renminbi reform on sound track.

China will reform its foreign exchange system in an orderly way and will not bend to pressure from the US to float the yuan, said Zhou Xiaochuan, governor of the People's Bank of China.No Currency Changes

China has its "own principles" to carry out its exchange rate reform and the current rate is appropriate, Zhou told reporters at the sideline of the annual session of National People's Congress (NPC) on Saturday.

US Treasury Secretary John Snow again urged China to float its exchange rate on Friday. There are reports that he is under mounting pressure from the US lawmakers to label China a currency manipulator in a report due in April. US President George W. Bush also said that he would adopt further movement to press China to appreciate its currency soon.

Premier Wen Jiabao said in this year's government report that China will improve the system of managed floating foreign currency exchange rates and keep the Renminbi exchange rate basically stable at an appropriate and balanced level.

A tougher stance yet was announced by the Chinese premier in China: No More Plans for Currency Changes.

Premier Says China Has No Plans for More Administrative Changes to Currency's ValueI suppose those statements should be clear enough but that did not stop two US senators from parading to China on a fool's mission to attempt to persuade China to float the RMB or repeg it substantially higher. The threat is a 27.5% tariff on goods coming from China.

Premier Wen Jiabao said Tuesday that China sees no need for further one-time administrative changes in the exchange rate of its currency following a decision last July to drop its direct link to the dollar.

"There will be no more surprises," Wen said at a news conference.

"It is no longer necessary for us to take a one-off administrative means to affect the movement of the renminbi either upward or downward," he said.

Supposedly this will bring jobs back to the US.

At 20-1 or 15-1 wage differentials it will not do anything of the kind but it will plunge the US headlong into a recession. A recession is headed our way anyway but such nonsense would of course make it worse.

Smoot-Hawley & Xenophobia

Phillip Swagel of the American Enterprise Institute said that unless Schumer drew back from the brink this week, he could become known as the Smoot of the 21st century: 'He would go down in history as the man who crashed the US economy.' He said the anti-China senators were likely to 'declare victory', having delivered their message to the Chinese in person.

Wikipedia discusses Smoot-Hawley and its effect on the Great Depression.

"I think we're riding a wave of xenophobia," says William Reinsch, president of the National Foreign Trade Council, a pro-trade group.

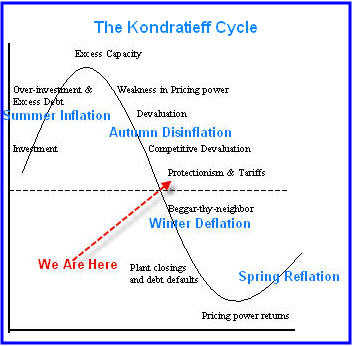

One thing I would like to emphasize is that trade wars, protectionism, and repudiation of credit excesses are all hallmarks of deflationary, not inflationary times as the following chart shows.

The Kondratieff Cycle

Global Tripwires

In Tripwires Stephen Roach of Morgan Stanley had this to say:

Investors are nearly unanimous these days in dismissing the mounting economic and political tensions of an unbalanced world -- arguing that it is in everyone’s best interest to keep the game going. The retort of increasingly smug US fund managers is typically something along the lines of, “What else are the Chinese going to buy -- euros?”In From Beijing to Dubai Roach writes.

At the same time, I worry about an even more treacherous aspect of the endgame. An earlier era of globalization was brought to a tragic end by two world wars in the first half of the 20th century. While history rarely repeats itself, the rhymes never cease to amaze me.

Nation-specific rivalries have given way to threats coming from the amorphous terrorist ranks. Add in the current tensions associated with widening income disparities, real wage stagnation in developed countries, and the growing outbreak of trade frictions and protectionism, and today’s world looks far from secure. The tripwires of globalization are now being set.

My travel schedule is planned months in advance. It was only by happenstance that I found myself in both Beijing and Dubai this past week -- two of the more recent flashpoints in a US-led pushback against globalization. What I found in both cities unsettled me -- disappointment and frustration over America’s attitude toward two of its major providers of foreign capital. The feedback from Beijing and Dubai is that this image is going rapidly from bad to worse -- something a saving-short US economy can ill afford.The Bluff Is Admitted

China is deeply troubled over the outright hostility from an increasingly xenophobic US Congress. The Chinese don’t believe that US politicians appreciate the potential risks that still lurk in this transitional economy. Instead, they are pressuring China as if it were operating from a position of much greater strength. China remains very much a tale of two economies -- a booming coastal region and a lagging interior. Most in Washington view China from the lenses of Beijing and Shanghai, and conclude that these two thriving metropolises personify the emergence of a powerful and mighty nation. What they don’t realize is that only 100 km away from either city lurks a China that has changed very little in the past thousand years. Yes, 560 million Chinese now live in urban centers around the country, although probably less than half these city dwellers have seen meaningful improvement in their standard of living over the past 30 years. Meanwhile, the rural population of some 745 million Chinese still tries to get by on $1-2 per day.

When I pointed this out to Senators Graham, Coburn, and Schumer in Beijing, Senator Schumer said, “I understand the structural point, but China still has to give.”

The editorialist in me says, if Washington -- or for that matter, beleaguered US manufacturers -- really wants China to give, then it needs to make that argument from a position of a macro strength and boost America’s national saving rate. Until, or unless, that happens, US-led China bashing is nothing short of political hypocrisy.

In Dubai, I was met by a similar sense of consternation. Fresh from the wounds of the rejected Dubai Ports World transaction, several major private equity investors in the UAE were blunt in expressing their sudden loss of appetite for US assets.

In the broad scheme of things, Dubai is a small player in the world of international finance. But to the extent that the Dubai backlash is emblematic of similar distaste from other Middle East investors -- hardly idle conjecture, in my view -- the repercussion cannot be minimized. Net foreign direct investment into the United States hit $128 billion in 2005 -- an increase of $22 billion from the inflows of 2004. If that trend now starts to reverse course, America’s already daunting current-account financing problem will only get worse.

From Beijing to Dubai, there is a growing undercurrent of economic anti-Americanism. The irony of it all is truly extraordinary: The US has the greatest external deficit in the history of the world, and is now sending increasingly negative signals to two of its most generous providers of foreign capital -- China and the Middle East. The United States has been extraordinarily lucky to finance its massive current account deficit on extremely attractive terms. If its lenders now start to push back, those terms could change quickly -- with adverse consequences for the dollar, real long-term US interest rates, and overly indebted American consumers. The slope is getting slipperier, and Washington could care less.

When I am researching a piece like this, I often gather material over the course of several weeks or even longer. I had been working on this "bluff theme" since the mid-March so I was especially pleased to find Inside the China Debate by Stephen Roach.

For me, the highlight of the annual China Development Forum always comes at the end of the gathering -- the traditional meeting with the Premier. Sometimes this exchange is tightly scripted, but at other times, it offers considerable food for thought. This was one of the latter examples. In a free-wheeling response to intense questioning from the assembled group of outside experts, Premier Wen Jiabao left little doubt of the strong resolve of the Chinese leadership in facing a series of daunting challenges in the years ahead.Going "All In"

[In response to the last question of the meeting by Steve Roach about "Globalization and Mistrust: The US-China Relationship at Risk"] The Premier was especially animated and intense in framing his response. “China views this relationship as very important,” he said, “and takes these risks very seriously.” He was emphatic in re-emphasizing the limited role that foreign exchange policy could play in tempering the US saving shortfall and related trade imbalance -- in effect, implying no major change in the RMB exchange rate. At the end of his discourse, he leaned forward, looked me straight in the eye, and stated with great emphasis, “You can take this message back to the American people: It is unfair to make China a scapegoat for structural problems facing the US economy.”

Three Senators in Beijing

The next morning, as luck would have it, I had the opportunity over breakfast to run Premier Wen’s comment by three US politicians who just happened to be in town -- Senators Schumer, Graham, and Coburn. Schumer and Graham, of course, are co-sponsors of a bill (S. 295) that would impose 27.5% tariffs on all Chinese imports into the US unless there was an RMB currency revaluation of a like amount. They were steeped with confidence that this bill had overwhelming support in the Senate and most likely comparable support in the House. And since it played to the angst of middle-class US wage earners, they did not expect the first veto of a politically-weakened President Bush to be exercised on this issue.

Chuck Schumer is a very smart and savvy man. He is using the bully pulpit of a prominent politician to put so much pressure on China that it will have no choice other than to give. Nor does he have much doubt that this approach will work. “This is exactly what I did in Japan in 1986,” he said -- apparently the last time he was in Asia. “It worked in Japan and it will work in China.”

In the end, Schumer doesn’t want tariffs -- he wants to go down in history as the man who made China blink. But he is perfectly prepared to play high-stakes political poker in order to achieve this objective. So is the rest of the US Congress. The big risk is that China calls Washington’s bluff and the two parties start to stumble down the very slippery slope of trade frictions and protectionism.

“I care deeply about the loss of US manufacturing jobs to China. [Said Schumer] If I am successful in cutting our trade deficit with the Chinese, not only will those jobs come back home but I will have succeeded in boosting US saving and cutting excess consumption. My bill can do all that and more.”

I am rarely speechless, but at that point, I started to choke on a huge bite of watermelon. “Let me get this straight,” I gasped, “tariffs will boost saving?” Too late -- he was already off to face the ever-present battery of cameras and microphones.

That article had me laughing out loud. Not only do we see that the actions of Schumer are a bluff, but he openly admitted in public that he was indeed bluffing. Somehow he expects it to work. Why? What kind of arrogance is that?

This is tantamount to flipping over your hole cards in a game of Texas Hold’Em and disclosing to the table that you hold the two of clubs and the seven of diamonds. (To non-poker players, an unmatched 2-7 is the worst start one could have. If you had such a poor hand you would not show your cards then brag that you were going to win the pot).

China, not the US is holding the cards here. The US has 2-7 and China has paired aces. Is China supposed to fold? The problem goes beyond bluffing however, it shows arrogance and unwillingness to admit what the real problem is. The real problem that no one wants to hear about is rampant spending by US Congress and an administration that sees nothing wrong with blowing 500 billion dollars in Iraq attempting to be the world's policeman. The irony, as Roach points out is that China and others are lending us money at very favorable terms but we are complaining that the terms are "too favorable".

The danger of course is that Congress goes go "All In" and passes such a bill. Would President Bush sign it? WouldCongress be dumb enough to override that veto?

Another Bluff?

We have talked about this before but there is one more bluff that is worth another look at this time. In Deflation: Making Sure "It" Doesn't Happen Here Ben Bernanke states:

The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost. By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services. We conclude that, under a paper-money system, a determined government can always generate higher spending and hence positive inflation.I think Bernanke is going to regret that speech for the rest of his life.

If we do fall into deflation, however, we can take comfort that the logic of the printing press example must assert itself, and sufficient injections of money will ultimately always reverse a deflation.

In practice, the effectiveness of anti-deflation policy could be significantly enhanced by cooperation between the monetary and fiscal authorities. A broad-based tax cut, for example, accommodated by a program of open-market purchases to alleviate any tendency for interest rates to increase, would almost certainly be an effective stimulant to consumption and hence to prices. Even if households decided not to increase consumption but instead re-balanced their portfolios by using their extra cash to acquire real and financial assets, the resulting increase in asset values would lower the cost of capital and improve the balance sheet positions of potential borrowers. A money-financed tax cut is essentially equivalent to Milton Friedman's famous "helicopter drop" of money.

That said, the important questions are:

- Was that an ill advised bluff of some kind or was Bernanke really serious?

- If he was serious, would the rest of the FED go along with it?

On March 16 2006 Federal Reserve board governor Donald Kohn said Fed won't act to preserve high home prices

'Greenspan put' theory doesn't stand scrutinyIt seems to me that Kohn has a poor memory. The Greenspan Fed has injected money into every scare (real or imagined) during his entire tenure: The Long Term Capital Management crisis, a nonexistent Y2K scare, and the bursting of the Nasdaq bubble in which interest rates were slashed to 1% to "Make Sure 'It' Doesn't Happen Here" are just three examples.

The Federal Reserve has no intention of preserving all of the recent gains in home price values, said Federal Reserve board governor Donald Kohn on Thursday.

"If real estate prices begin to erode, homeowners should not expect to see all the gains of recent years preserved by monetary policy actions,' Kohn said in a speech prepared for delivery to a European Central Bank forum in Frankfurt, Germany.

In his remarks, Kohn attacked the popular 'Greenspan put' theory that Fed policy would always protect investors from sharp asset market drops while doing nothing to restrain these markets when prices rise.

"This argument strikes me as a misreading of history," Kohn said.

"Conventional policy as practiced by the Federal Reserve has not insulated investors from downside risk," he said.

The most important question now is this: Is Kohn bluffing (hoping to smoothly talk down housing prices without crashing them), or is Bernanke bluffing, or are they both somehow bluffing? Interestingly enough, Bernanke might go so far out of his way to prove that he is an "inflation fighter" that he exacerbates the deflationary debt trap he is clearly in. Regardless of who is bluffing whom, the pot size is now enormous and the entire US economy is at stake. Does anyone have any chips left or are they all in the pot? Perhaps there is room left for one more raise. We will find out soon enough, but if protectionism kicks in there simply will not be any winners in this game.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment