Georgia, Colorado and Indiana Post Nation’s Highest First-Quarter Foreclosure RatesSpeaking about foreclosures, Mike Morgan at MorganFlorida had this to say:

National foreclosure filings continued to climb in the first three months of 2006, evidence that more U.S. homeowners are struggling to stay current on their monthly mortgage payments.

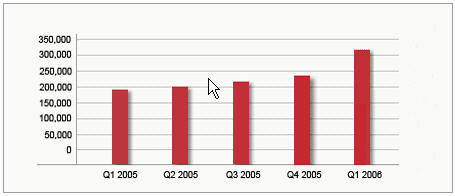

A total of 323,102 properties nationwide entered some stage of foreclosure in the first quarter of 2006, a 72 percent year-over-year increase from the first quarter of 2005 and a 38 percent increase from the previous quarter, according to the RealtyTrac™ U.S. Foreclosure Market Report. The nation’s quarterly foreclosure rate of one new foreclosure for every 358 U.S. households was higher than in any quarter of last year.

Georgia, Colorado and Indiana post highest foreclosure rates

Despite a 19 percent decrease in new foreclosures in March, Georgia documented the highest state foreclosure rate in the first quarter of 2006 — one new foreclosure for every 127 households. The state reported 24,419 properties entering some stage of foreclosure, more than two times the number reported in the previous quarter and nearly three times the number reported in the first quarter of 2005.

Colorado’s quarterly foreclosure rate of one new foreclosure for every 138 households registered as the nation’s second highest state foreclosure rate. The state reported a total of 13,267 properties entering some stage of foreclosure in the first quarter of 2006, more than twice the number reported in the previous quarter and a 96 percent increase from the first quarter of 2005.

With one new foreclosure for every 165 households, Indiana documented the nation’s third highest state foreclosure rate in the first quarter of 2006. The state reported 15,261 properties entering some stage of foreclosure, an 84 percent increase from the previous quarter and more than twice the number reported in the first quarter of 2005.

Other states with first-quarter foreclosure rates ranking among the nation’s 10 highest included Nevada, Michigan, Texas, Ohio, Tennessee, Utah and Florida.

Texas, Florida and California report most foreclosures

Texas reported the most first-quarter foreclosures of any state, 40,236, and Florida reported the second most with 29,636. California was a close third with 29,537 properties entering some stage of foreclosure in the first quarter of 2006, but the state’s quarterly foreclosure rate of one foreclosure for every 414 households was below the national average.

“Foreclosures have now increased in four consecutive quarters and are on track to go above 1.2 million in 2006, which would push the nation’s annual foreclosure rate to more than 1 percent of U.S. households.” The following chart says it all.

Builders are already trying to compete with all of the flippers they greedily sold homes to over the past few years. Now they face a huge wave of new competition from foreclosures. Here is a link to a blog that picks up some of my ramblings: A Tsunami Wave of Foreclosures The blogger does his homework, and this piece just touches the subject of foreclosures. We’ve seen a 300% increase in foreclosures, and even a hire number of pre-filings for foreclosures.Default Research is reporting Los Angeles Foreclosures Increase Dramatically in the First Quarter Of 2006.

I keep telling myself that I maybe am too negative. How can it be this bad and no one in the media is hitting it on the head? But then some report comes out that demonstrates I am too conservative. If you look at the numbers and consider the fundamentals, we are facing a very bleak housing market. The sales drops reported by builders are just the beginning. As speculators start to realize they are still writing mortgage and tax checks on empty properties with prices dropping, more of these people will start dropping price. As foreclosures start to flood the market, prices will drop even faster. Banks will “absolutely” not hold property. They will sell at auction, no matter what the price is. This process takes time, but look for mind boggling foreclosure numbers this Summer.

A year ago I analogized the coming housing bubble to the room of 1,000 donuts. Even if they are free, how many can you eat before you get a belly ache? Even if they are all hot, fresh Krispy Kremes . . . and they are not! Well, now add to the 1,000 donuts another 1,000 donuts from foreclosures, and your stomach should start turning just from the thought. It is no different in the housing market. When you have built tens of thousands of homes for people that are NOT going to use them, you have a bloated market without enough end users . . . at any price.

Add to the problem an increase in mortgage rates and a hit to the budget for gasoline, and home buyers have lost a huge number of their buying power.

I can’t imagine builders even hitting 50% of their numbers from last year in regard to NET sales. I’d like to say they will be off more than 75% within the next 6 months, but my friends tell me I am to negative.

Am I?

Mike

The number of foreclosures in Los Angeles County increased by 63 percent in the first quarter of 2006 compared to 2005, according to Default Research, the rapidly growing real estate research company for foreclosure properties.

"With rising interest rates, the economy slowing down in that part of California, and a quarter of L.A. residents working at jobs that do not pay a living wage, the significant increase in foreclosures is a very alarming trend in the largest county in the nation," said Serdar Bankaci, president and chief executive officer of Default Research, Inc.If homebuilders did not have enough trouble already, please consider IRS Limits Home Down-Payment Gifts.

Bankaci also noted that single family homes and duplexes were hit the hardest, increasing 77 percent and 88 percent respectively, underscoring the tough battle that the average L.A. homeowner faces to retain their property.

"The rising foreclosures are due to the 'average Joe' buying a house he cannot afford because of inflated home prices. Then, with the rising interest rates, he cannot pay for the mortgage," said Bankaci. "Many of the homeowners used 'aggressive financing' to buy homes they could not afford."

With Default Research's timely leads, their customers are able to approach and assist homeowners in distress, often allowing them to stay in their homes and overcome foreclosure.

"Our leads erase that financial problem and help both parties realize financial success in the process," said Bankaci, whose company provides foreclosure data that arrive two to three weeks ahead of the competition.

Default Research is the national leader in real estate research. Their clients include real estate investors, mortgage brokers and bankruptcy attorneys. More information about Default Research can be found at their website: www.defaultresearch.com.

Default Research is adding a "monster of the midway" county next month -- Cook County in Illinois. The expansion continues for the rapidly growing real estate research company Default Research which will begin offering leads for Cook County next month. With the addition of Cook County in Illinois, Default Research now covers eight of the ten largest counties in the nation.

In the past five years, a number of large nonprofit organizations -- including Nehemiah Corp. of America, of Sacramento, Calif., and AmeriDream Inc., of Gaithersburg, Md. -- have doled out hundreds of millions of dollars of cash down-payment assistance to mostly low- and moderate-income home buyers. According to industry estimates, as many as 625,000 people were assisted by charities with their down payments between 2000-05. The programs have been widely viewed as helping to increase the nation's homeownership rates, which rose to 69% last year from 67% in 1999.If this ruling is enforced, home builders will no longer be able to provide down payment “gifts” to questionable buyers for the explicit purpose of buying their homes at unquestionably inflated prices. Attempting to collect back taxes would add insult to injury.

The programs have been contentious because in an effort to increase sales, the money for the down-payment assistance came mainly from large home builders and individuals selling their homes.

In its ruling yesterday, the IRS said charities funded largely by home builders and other sellers no longer qualify for tax-exempt status because the benefits of the programs are going to sellers and profit-making entities. In its statement, the IRS said it has found "that organizations claiming to be charities are being used to funnel down-payment assistance from sellers to buyers through self-serving, circular-financing arrangements."

The ruling could shut down some of these charities, unless they can find new ways to fund their giving. An IRS official said in an interview yesterday that the agency could seek to obtain back taxes from some of these seller-funded programs.

Fact's to Consider

- Foreclosures are adding to supply.

- Flippers are adding to supply.

- Home builders are still adding to supply.

- An IRS ruling may reduce demand.

- Investor psychology has changed, reducing demand.

You are in a room with 1,000 donuts and fresh deliveries are coming every day.

How many can you eat?

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment