Here is one of them with a snip of text.

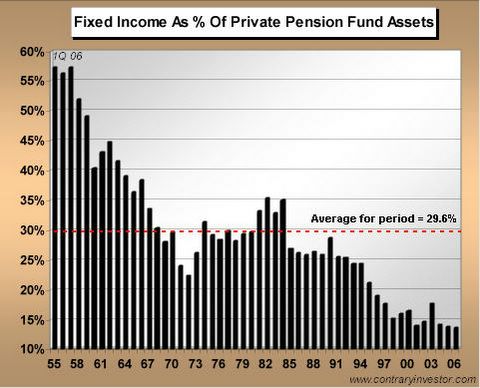

And although there are a lot of folks on the Street who have suggested that long maturity bond yields have stayed so low this cycle due to the need for pension funds to match their assets and liabilities (by buying long dated paper), that's pure garbage if one looks at the facts. As you can see below, private pension funds currently have their lowest allocation to fixed income anywhere over the last half century. These folks clearly have not been the buyers of bonds in any meaningful way.

The other charts showed that the percent of equities in private pension plans was about 45% but the percent of equities in public pension plans was a whopping 65%.

There are two ways of interpreting that chart.

1) All hell is going to break loose when foreign central banks stop buying US treasuries. Interest rates will soar.

2) Wow! Look at the enormous pent up demand in the US for fixed income.

Common wisdom is that #1 is going to prevail. I suggest #2 is the correct way to look at things. In spite of poor performance in equities, pension plans and investors in general are still in love with them. One of the arguments I often hear is "If you invest money at 5% you will lose to inflation". Perhaps that is true now but there is no guarantee that will hold true in the future. But either way the point is moot. There simply is no guarantee that equities are going to beat inflation either. The only meaningful reason to own equities is if they outperform treasuries.

Stock Market Year to Date

The S&P is down slightly for the year

The DOW is about flat

The NAZ is down about 10%

The RUT is about flat

The SPX is about where it was at the end of 1999.

Yet the love affair with equities continues while the demand for fixed income is at an all time low.

Boomers are headed into retirement.

It will be interesting to see how long it will take in the upcoming equity bear market before those boomers become more concerned about keeping what they have vs. trying to make more.

There are now multiple indications that time preferences are shifting away from risk.

One way to see that is on the underperformance of Naz.

Another way to see it is in the action of the Russell Small Cap Index.

Another way to see it is by looking at various emerging market funds such as the Templeton Russia Fund.

Of course it is always possible for sentiment to shift back towards risk but other anecdotal evidence in support of a more prolonged change in sentiment is the complete collapse in condo speculation, the bursting of various housing market bubbles, and the recent drop in retail sales.

MarketWatch is reporting U.S. RETAIL SALES fall 0.l% in June.

WASHINGTON (MarketWatch) - U.S. consumers cut back in June, sending RETAIL SALES down 0.1% for the month, the Commerce Department reported Friday. It was the second straight month of tepid RETAIL SALES. SALES rose 0.1% in May. RETAIL SALES are up 5.9% in the past year. Weak auto SALES led the decline in June, falling a surprising 1.4% measured by dollar volume. Excluding the drop in auto SALES, RETAIL SALES rose 0.3% in June after climbing a downwardly revised 0.7% in May. Economists were forecasting stronger SALES in June, with the consensus expectation of 0.4% for total SALES and for SALES excluding autos.

Time Preference Changes

- The underperformance of the Nasdaq all year

- A sudden change in the desirability of the Russell Index. It was up 15% January to May but gave it all back.

- Huge pullbacks in emerging markets such as India and Russia. The Templeton Russia Fund was up over 80 from January to the May high and at one point gave 100% of that back, a breathtaking plunge of 40%. It is still up on the year but the chart pattern seems technically weak.

- Complete collapse of the Florida housing market.

- Year over year home price declines in San Diego.

- Housing discounts fail to move houses nationally.

- Housing inventories have risen dramatically. Speculators want out but can not get out. There are no buyers in some previously hot markets.

- Retail sales slowed for the second consecutive month. Inflation adjusted sales are actually quite negative.

- Corporations are sitting in cash and unwilling to spend it on expansion

Bear in mind we are only in the first inning of a shift from risk towards risk aversion. The implications of that are likely to be severe as we head into the consumer led recession of 2007. If the secular bear market in equities has returned, the damage has barely started. Heaven help us, if a secular bear market in treasuries has started at the same time (as nearly everyone seems to think). Secular bear markets in treasuries are simply not good for equities to say the least. So far the trendline on treasuries have held (allowing a slight throw over on the 30 year long bond). Equity bulls had best hope those trendlines do not get busted badly.

Following is a chart of the $TYX which is the 30 yr long bond.

$TNX (the 10 year treasury note) only goes back to 1991.

Given how everyone loathes treasuries except foreign central banks (and FCBs are buying them for reasons other than profit) there could be a lot of life left in treasuries. Bull markets do not end with everyone hating that market. Yes the meat of the move is over given that 10 yr rates have fallen from 18% to a panic low near 3%, but there is no reason we can not retest that low if housing and the stock markets collapse. I suspect that will indeed happen and it will play out over a number of years.

On the other hand, the love affair with equities, junk bonds, and corporate bonds may just be ending now along with the collapse of the housing bubble. If we follow the path of Japan, it's a long long way down from here. When we get to the bottom, I suspect that time preferences for cash and treasuries and second houses is going to look a lot different than it does now. That is when the secular bull market in treasuries is likely to end.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment