Here are some of highlights (in italics) followed by my comments in normal print.

Highlights

Countrywide wrote in its official comment on the proposed [lending] guidelines. Requiring lenders to qualify borrowers on the true cost of a loan, the company said, "would tend to defeat the intended function of the loan and would significantly reduce the number of borrowers that could qualify."The Role of Government

Countrywide missed the boat by a mile with that feeble comment. The original stated intent of products such as pay option arms and interest only loans was to balance payments for people with widely fluctuating incomes month to month not to get the most people to "qualify". Once marketing took over, however, the products eventually took on a life of their own.

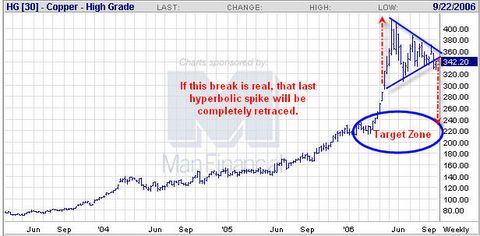

In a bubble, "the financing gets progressively worse. At the end, you get nuttiness." Prices got so high that "the only way people could buy houses was by bending the rules". In the Orwellian parlance of the mortgage industry, loans that ignore the true ability of the borrower to pay for the loan are called "affordability" products.

That is one the best summations explaining the growth of toxic loans you will find anywhere. Attempts to make homes "affordable" encouraged speculation, flipping, lies, and fraud. Because of toxic loans, Fannie Mae, and 300 other programs designed to make housing affordable, home prices skyrocketed.

The amount of money to be made by appraisers, originators, real estate agents, and for a time flippers, was so staggering that nothing could stand in the way of bubble expansion. If it took liar loans and fraud to make a deal then liar loans and fraud you got. What finally burst the bubble was not an event per se but exhaustion. The pool of greater fools eventually dried up. I talked about that in The Exhaustion Process.

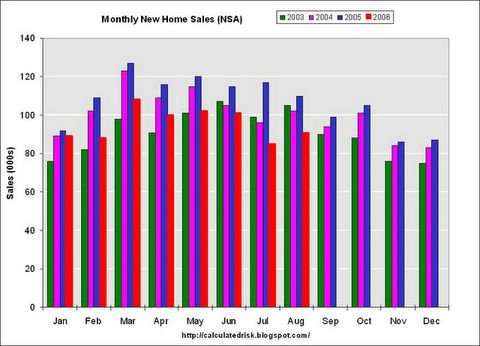

About one-third of the mortgages sold in the last year were devised to minimize the initial monthly payment to make it seem as if buyers could afford a more expensive home.

"Seem" is clearly the operative word.

"The guidelines will likely have a chilling effect on option ARM lending at regulated institutions," said Frederick Cannon, a banking analyst for Keefe, Bruyette & Woods. However, unregulated lenders such as investment banks and real estate investment trusts, could have a competitive advantage because they aren't covered by the new federal guidelines, he said.

I agree with the first sentence above but not the second. If the big lenders are shut out of the gravy train, they will soon find a way to stop anyone else from benefiting. That is unlikely to be necessary, however, since there is such a huge increase in defaults and foreclosures that the market was about to put an end to this nonsense anyway. In effect Congress shut the barn door after 49 of 50 cows already escaped.

The regulators face conflicting goals. They want to ensure the safety of the banking system without intervening too much in decisions about what products and services to offer. Protecting consumers from unfair and deceptive lenders is another goal that may be at odds with yet another goal: Increasing homeownership in the United States.

The dual goals of the regulators are a big part of the problem. Government has no business promoting home ownership over renting. Market forces should drive decisions. Instead we have an "Ownership Society", tax breaks, and GSEs while we also have a goal of "affordable housing". It is important to understand that the ownership society, GSEs, and tax breaks all act to drive up the price of houses. The goals are actually contradictory.

Regulators should have one goal: regulation of the industy to prevent fraud, unsound practices, and to ensure the safety of the banking system.

I discused the role of government in the housing bubble on May 18, 2005 right near the peak of insanity in Should the government sell bread, orange juice, or mortgages?

What would you think if the government decided that that the price of bread was way too high and decided to open up a chain of bakeries to sell bread at the "correct" price? Here is another one: what if the government decided that Florida orange juice was priced too high and started selling orange juice by the barrel at the "correct" price? If either of those happened would you be standing on top of a mountain and screaming with all your might about the insanity of it all? I think you would and so would I. Well how come there is no screaming about this?Yes Mish readers right at the tip top of the bubble the HUD was "absolutely emphatic about winning back our share of the market" that has slipped away to subprime lenders."

The Washington post reports that Housing and Urban Development Secretary Alphonso Jackson has a message to sub-prime lenders: "We need to reach out" to African-American, Hispanic and other first-time buyers with better loan concepts, more flexible guidelines and quicker service, said Jackson in an interview. "I am absolutely emphatic about winning back our share of the market" that has slipped away to subprime lenders."

Excuse me! Since when is it the business of the federal government to "win back" market share on housing loans? How is this any different that the federal government opening up bakeries to compete against the outlandish price of bread by private bakeries?

As of today we now have guidelines in place to prevent such nonsense. I have no doubt those guidelines will not apply to HUD. If you want a prime example of "Lenders Gone Wild" look no further than HUD.

In Lending Guidelines / Credit Squeeze I posted some comments from a friend of mine in the industry, Ramsey Su. He has some additional thoughts out this afternoon. Here goes.

Thoughts from Ramsey Su

Notes to myself, Sept 30, 2006.Thanks Ramsey! Everyone appreciates the work you do in helping to sort out these guidelines. If I can follow up, here are a few thoughts of my own to tack on.

The meat of the guidelines can be found in 2 paragraphs (pages 11 and 12).

For all nontraditional mortgage loan products, an institution’s analysis of a borrower’s repayment capacity should include an evaluation of their ability to repay the debt by final maturity at the fully indexed rate, assuming a fully amortizing repayment schedule. In addition, for products that permit negative amortization, the repayment analysis should be based upon the initial loan amount plus any balance increase that may accrue from the negative amortization provision.

Furthermore, the analysis of repayment capacity should avoid over-reliance on credit scores as a substitute for income verification in the underwriting process. The higher a loan’s credit risk, either from loan features or borrower characteristics, the more important it is to verify the borrower’s income, assets, and outstanding liabilities.

Switching back from a FICO based to a ability-to-pay underwriting standard is alone a monumental change. Compounding that with using fully indexed rate and fully amortized repayment, this will close the door on the irresponsible practices of the last 3 years.

To slam the door tight:

Risk layering – lenders are free to so whatever they like as long as they use MITIGATING FACTORS such as higher FICO, lower LTV and DTI ratios.

Reduced Documentation – no more stated income loans unless there is a reason for it. “W-2, pay stubs or tax return” borrowers are going to have a tough time justifying why they need to go to low/no doc route. Lenders are going to have an equally tough time pushing these products. Is this the end of the disguised Alt-A loans?

Simultaneous Second-Lien Loans – though these 80-20s may be toxic, the new qualifying standards would pretty much remove most of the toxins. I suspect that borrowers not suitable for this loan product is not going to get pass the other guidelines to get here.

The end of the flippers:

Non-Owner-Occupied Investor Loans – this guideline limits LTV using debt service plus reserve underwriting, similar to any income property loan. I would guess that if you want to buy a house or condo as an investment, you are going to need at least 40% in down payment to qualify.

Subprime. Here is the paragraph pertaining to subprime on page 13:

Lending to Subprime Borrowers – Mortgage programs that target subprime borrowers through tailored marketing, underwriting standards, and risk selection should follow the applicable interagency guidance on subprime lending.9 Among other things, the subprime guidance discusses circumstances under which subprime lending can become predatory or abusive. Institutions designing nontraditional mortgage loans for subprime borrowers should pay particular attention to this guidance. They should also recognize that risk-layering features in loans to subprime borrowers may significantly increase risks for both the institution and the borrower.

In addition to the rest of the guidelines, subprime loans raised the issue of predatory or abusive lending practices.

How many subprime loans are “sold” to, versus “applied for” by the borrowers? In other words, had it not been that cold call, the flyer in the mail, the spam email, would some of these subprime loans ever be made?

Since many of the big subprime lenders such as Accredited, New Century and Novastar are not regulated by the 5 agencies here, it is important to see who regulates them and what they are doing. Here is the best answer I can find. Similar guidelines are likely going to be adopted by the states in the immediate future.

I saw the video of Rotellini’s presentation in front of the Senate. She appeared to be far more aggressive than the other regulators on the panel. This could be one big nightmare for the non-regulated lenders because they now have to deal with 49 different states.

In addition, under the consumer protection section of the guidelines, lenders are going to be watched more closely on Truth in Lending Art (TILA) compliance.

One final section of the guidelines that interested me was the Management Information and Reporting paragraphs. Basically, the reporting systems will bring down all the different types of loans for monitoring purposes. This could be extremely beneficial to see which lender is more at risk than others.

This report, though released in Feb, remains the best measurement for past sins. So how many of these loans originated during the last few years are no longer in compliance with the guidelines?

Going forward, how many lenders are going to underwrite new loans based on these guidelines? Are there buyers out there for loans not in compliance with the guidelines, buyers who will somehow “indemnify” the originators for being not in compliance? Who are going to take out the borrowers facing recast?

In summary, I opine that just the confusion alone is going to put a pause on all these non-traditional mortgages. This will accelerate the already rising default rates. The lenders are going to blame the regulators for too stringent guidelines while regulators are going to blame the lenders for risky underwriting practices. Aside from M&As, I simply do not see any reward in owning mortgage related stocks.

Those new guidelines have given Wall Street what it wants and needs: a convenient scapegoat to blame for continued slowdowns in housing as well as a falling stock market once it finally tops out. If the market starts falling now, it will not be because of those guidelines, oil prices, terrorism or anything else that happens. The market, like housing, will likely die from simple exhaustion.

The "blame game" has just started, however. Sports fans might think of it as being in the bottom half of the first inning with the regulators currently at bat. By the time we get to the third or fourth inning lawyers will be having have a veritable field day as the bulk of the fraud from this boom surfaces. It will be a strange game to watch unfold. Every team will get a chance take part. Unlike a normal game of baseball, however, in the "blame game" the batting order and the team at bat can change randomly at any time. But keep your eye on the ball as Bernanke should be coming up to bat soon.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/