By Shannon D. HarringtonLet's see if we can take this apart piece by piece.

The risk of owning corporate debt is the lowest in at least four years after housing data bolstered confidence that the worst of the residential real estate slump is over, according to traders who bet on corporate creditworthiness in the credit-default swap market.

"There's some optimism that credit quality will continue to remain strong and default rates will remain low," said Ira Jersey, a strategist at Credit Suisse in New York. "Homebuilders did pretty well because of housing starts and permit numbers. Certainly, with the jobless claims being low, people will have money to spend."

Credit-default swaps on homebuilders fell to the lowest in more than eight months as housing data lifted confidence that home sales are rebounding from last year's 18 percent drop, the worst plunge since 1990. A decline in the price of credit-default swap suggests improving perceptions of credit quality.

Contracts on $10 million in bonds of D.R. Horton Inc., the biggest U.S. homebuilder, fell to $65,100 from $73,000 Jan 12, CMA Datavision prices show. The price is the lowest since May.

"A lot of people are calling for the bottom of the market, and by mid-2007 we should see some sort of recovery," said CreditSights Inc. analyst Sarah Rowin in New York. "Although earnings are going to be down, the builders could come off relatively intact."

CDO Sales

The derivatives helped CDO sales surge last year to a record $497.1 billion, 81 percent more than in 2005, Morgan Stanley analysts said this month. The funds, which are sliced up according to risk and sold as bonds, appeal to investors because they can offer higher yields than the assets being pooled.

Credit-default swaps, which were conceived to protect bondholders against default and pay the buyer face value in exchange for the securities if a company does default, have become one of the best gauges of shifts in credit quality.

An estimated $26 trillion in the contracts are outstanding, the International Swaps and Derivatives Association said in September. Derivatives are financial instruments derived from stocks, bonds, loans, currencies and commodities, or linked to specific events like changes in the weather or interest rates.

Shannon Harrington: "The risk of owning corporate debt is the lowest in at least four years."

Mish: No the "risk" is not the lowest. Yield spreads have compressed because the willingness to take on risk is at its highest point in at least four years. Spreads between junk and investment grade debt have collapsed. Do not confuse optimism with risk. An inverted yield curve suggests this optimism is not warranted, nor is the bounce in housing starts that significant. This all reminds me of the continued optimism in JDSU and CIEN in the Nazcrash of 2001 before they eventually lost over 90% of their value.

Ira Jersey: "There's some optimism that credit quality will continue to remain strong and default rates will remain low. Certainly, with the jobless claims being low, people will have money to spend."

Mish: Well you certainly have that optimism part right but you are confusing jobless claims with money to spend. A negative savings rate for 18 consecutive months suggests that consumers are spending money they do not have. Also note that we are continuing to lose high paying manufacturing jobs for low paying jobs at Walmart and Pizza hut. Also note that Mortgage Equity Withdrawal (MEW) is drying up as a source of funding. That is less money in pockets to spend. Finally, even IF consumers had more money to spend, at some point they will stop spending it. Debt burdens are at an all time high. That debt must be paid off. For spending to dramatically rise, both jobs and wages (not just for the fat cats) have to rise. That is not happening as global wage arbitrage and outsourcing continues unabated.

Shannon Harrington: "A decline in the price of credit-default swap suggests improving perceptions of credit quality."

Mish: Exactly. Please do not confuse perceptions with reality. Do not confuse perceptions with risk either.

Sarah Rowin: "A lot of people are calling for the bottom of the market, and by mid-2007 we should see some sort of recovery. Although earnings are going to be down, the builders could come off relatively intact."

Mish: Does bottom calling mean it will happen or does it represent unwarranted optimism? How many bottom calls were there when the Naz started plunging from the peak over 5000? Has anyone bothered to look at cash and inventory levels on homebuilders? Sarah, please take a look at homebuilder corporate statements. They are running out of both cash and profits, while inventories are soaring.

Morgan Stanley: CDO sales surged last year to a record $497.1 billion, 81 percent more than in 2005. The funds, which are sliced up according to risk and sold as bonds, appeal to investors because they can offer higher yields than the assets being pooled.

Mish: We will take a look at the "appeal" of higher yields in a chart below.

International Swaps: An estimated $26 trillion in the contracts are outstanding, the International Swaps and Derivatives Association said in September.

Mish: Wow. On the theory that "the bigger the bet the safer things must be" this must be a sure sign that "Corporate Bonds Are Safe".

Let's take a look at a chart of Moody's Baa Corporate Bonds to see what it might be saying.

Moody's Baa Bonds

Above chart by sharelynx.com.

Moody's Baa Bonds

Baa - Bonds and preferred stock which are rated Baa are considered as medium-grade obligations (i.e., they are neither highly protected nor poorly secured). Interest payments and principal security appear adequate for the present but certain protective elements may be lacking or may be characteristically unreliable over any great length of time. Such bonds lack outstanding investment characteristics and in fact have speculative characteristics as well.Baa bonds are just one step above junk. Yields are close to 6%.

Bank Deals - Best Rates shows that you can get up 6.19% for 6 months at some places. Hmmm. Lets see, do you want 6.19% on a 100% guaranteed bet or approximately the same thing on bonds rated one step above junk? Inquiring minds want to know what if anything is "appealing" about the risk/reward shown in that chart.

On that thought the Mish telepathic question lines are open. Hmmm. I am being flooded with calls. Fortunately the ideas expressed are all similar. They go something like this. "Mish, you are trashing corporate bonds at a mere 6% or so but if I recall correctly you like 10 year treasuries that yield even less. Please explain"

10 Year Treasuries

Above chart by sharelynx.com, modified by Mish.

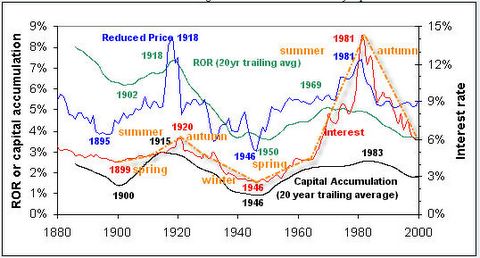

Some newcomers might be confused about the seasons on the above chart. Those seasons correspond to something called the K-Cycle. K-Cycles are long. The last K-cycle Autumn peak was in 1929. That was followed by the great depression. With companies going bankrupt in the early 1930's the last place you wanted to be was in corporate bonds. Those in treasuries did great. Safety vs. "perceived safety" is the key. Although I am not calling for another depression, I am merely pointing out that the economic conditions are very similar. This case was presented in 1929 Revisited.

Interest Rate Interpretation of the K-Cycle

K-Cycle longer term view

If we are headed into "winter" the last place you want to be is in junk bonds. Even if we are not headed into "winter" where is the risk/reward for junk bonds when you can get nearly the same yields in CDs?

No matter how you slice it, credit swaps have pushed corporate yield spreads far into the blatantly complacent level where risk is enormous and rewards are slim. That is exactly the opposite of what Shannon Harrington is suggesting.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment