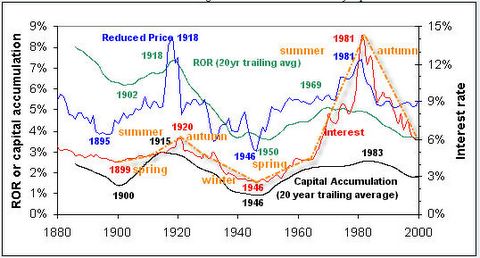

Microsoft Chief Executive Steve Ballmer sketched a dire portrait of the world economy on Friday, likening it to market conditions in 1837, 1873, and 1929, each of which involved bank failures, high unemployment, and a depression.Balmer is describing the K-Cycle. For more on the K-Cycle please see The Kondratieff Cycle Revisited. Here is a chart from the article showing a longer term view:

"This is a once-in-a-lifetime economic crisis," Ballmer told a retreat of House Democrats in Williamsburg, Va. "There is a lot of history around that, and frankly if you stop and think about it, 1837, 1873, 1929, 2008, it's almost exactly a whole lifetime between each of the major economic difficulties that we face."

Ballmer said that economic growth in the last 25 years was fueled by innovation, globalization, and debt--and that the current levels of debt were unsustainable. "In 1929, for example, just before the stock market crash, the private debt-to-GDP ratio was 160 percent," he said. "Last year, private sector debt as a percentage of the GDP: 300 percent, far more leverage."

His warning of a protracted downturn that could become a depression comes amid a stock market that is down by more than 40 percent from its October 2007 peak, and housing prices in many metro areas that have been falling consistently since July 2006--a feat not equalled since the Great Depression.

"In my view, what we now have will be a fundamental economic reset," he said. "The economy is going to have to re-establish itself at a level of spending that reflects the real value of underlying assets before we can all start growing again at a healthy rate."

click on chart for sharper image

????? (fu bu guo san dai)

The Chinese have an expression that can roughly be likened to what Steve Ballmer is saying. Here is the expression and the translation: ????? (fu bu guo san dai) Literally: Wealth does not pass three generations

Meaning: It's rare the wealth of a family can last for three generations (the 2nd may see the value of hard work, the 3rd, forget it).The Role Of Attitudes

[Mish Note: The following example is based in the South African currency of the Rand, but that does not detract from the message.]

Year zero: First generation: Wealth creation

Starting capital: Zero. The family income generators (2 parents) are hard-working and manage to invest 10% of their after-tax income equating to R30/month into the South African stock market. (Yes, this was pre-Union, but we did say "equating to"). Remember this is the sixties and an income of R300 is a very decent monthly wage.

Year 45: Second generation: Wealth preservation

The parents ensured that their three children didn't have to experience hard times. The children attended decent enough schools and were fortunate enough to mix with similarly privileged friends. There is general unease in the family however, as the second generation gain independence.

The pressures of wanting to keep up with the lifestyles of their wealthier friends, coupled with an unfortunate down-turn in the economy, results in a halt in savings and as a result the R10.5m family wealth no longer enjoys any debit order increases. In addition, the capital base is required to maintain an income for the folks who have now retired.

Year 75: Third generation: Wealth destruction

The second generation finally inherit the family wealth and it is split three ways. By this time the R45,000/month comfortable family living has ballooned to R600,000/month as a result of inflation. Each family now only enjoys income from a capital base of R110m and, because they themselves are approaching retirement they opt to de-risk their portfolios, which results in the capital invested unfortunately realising a more sedate 3% real rate of return.

After a torturous revelation later on in life, one of the 3rd generation children decided to carve out a career as a financial advisor. She made the following insightful observations:

1. Her grandparents did a fantastic job of consistently placing 10% of their monthly income into an equity investment over a 45 year period.

2. As they had generated sufficient capital to live off the dividend income there from, her grandparents had stuck with their equity investment throughout their retirement.

3. Unfortunately, her parents had failed to adopt a savings ethic and they had relied optimistically on their inheritances to generate their own retirement income.

4. The 3rd generation children (herself included) failed to comprehend the importance of generating an income and as a result were unable to adopt a savings plan or meet their own costs.

Time to start again.

Another interpretation of the expression involves the changing role of attitudes towards debt and asset accumulation over time. This is how I see it:

Few alive remember the great depression. Most boomers headed into retirement have seen rising asset prices all their lives. Those boomers thought they could live off their houses and/or investments in the stock market, expecting prices to rise forever, even though it was mathematically impossible for that to happen. Now, headed into retirement, boomers are realizing they are actually savings poor given that asset prices have crashed.

Moreover, children who have seen their parents wiped out in bankruptcy or foreclosed on are going to have a completely different attitude towards debt than their reckless parents did. Expect to see more frugality from parents and their children alike.

Three generations from now the lessons of today will have again been forgotten and the cycle will repeat.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

No comments:

Post a Comment