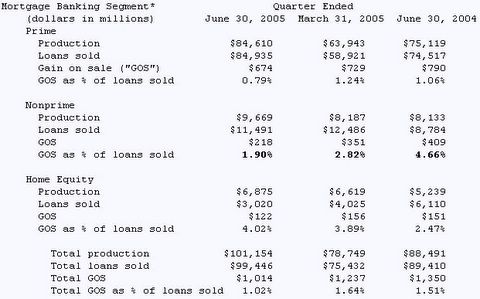

Let's start by taking a look at Gain on Sale (GOS) margins for Countrywide Financial Corporation from there most recent quarterly reporting. Here is a chart of GOS percentages on a quarter to quarter basis as well as a year over year basis:

GOS margins at Countrywide are dropping like a rock. With mortgages being the primary game in town, it seems every player must be fighting like mad to close the deal.

Here is an interesting chart on the trend in subprime spreads.

The above chart is from the article The Nonprime Mortgage Market in the United States By Richard F. DeMong, Ph.D., CFA.

Apologies are offered for not being able to locate a more recent chart.

On April 25, 2005 David Kogut, Senior Economist, Risk Policy, at Fannie Mae had this to say about delinquencies: "In an environment of rising mortgage payments and moderating home price growth, it is likely that delinquencies in this market will rise over the next one to two years."

Let's take a look at what has transpired since that statement was made.

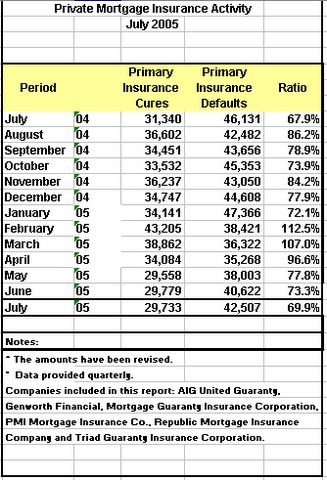

Following is a chart of Primary Mortgage Insurance Defaults:

Note that PMI defaults bottomed in April but have ticked up every month since then. Also note that cures (those that were in delinquent but managed to catch up), topped in February and have been declining ever since.

Since sub-prime mortgages do not necessarily require Primary Mortgage Insurance (the latter being dependent on % down payment), one might possibly argue that I am making an invalid correlation. On the other hand, perhaps the situation is even worse given the huge increase in defaults by stretched homeowners is happening regardless of whether or not they loans were sub-prime. At any rate, rapidly decreasing margins on sub-prime loans in the face of rising delinquencies sure suggests evidence of increasing complacency and excessive risk taking in the mortgage loan industry.

Mish, what percentage of loans will adjust in the next few years, and how much risk is there in that area. Those are good questions so let's see what Anton Haidorfer, Senior Economist at Fannie Mae had this to say back on May 31, 2005.

Anton Haidorfer, Senior Economist in Fannie Mae’s Mortgage Market Analysis group, has looked at mortgage-backed securities (MBS) data on loans originated in the 2002-04 period to try to determine what share would adjust over the next few years (see chart below). He finds that less than 10 percent of the prime conventional conforming (PCC) loans will reset within the next couple of years, rising to around 20 percent in 10 years (reflecting both a high FRM share and, of those who do use ARMs, a high share of fixed-period ARMs with initial rates set for five years or more). On the other hand, nearly 20 percent of Alt-A mortgages will reset within the next two years – rising to more than 40 percent within five years. And, at the extreme, nearly 60 percent of subprime loans will reset within the next couple of years, rising to around 70 percent within three years (reflecting a high share of 2/28 loans in the subprime market – that is, loans that have a fixed interest rate for the initial two years, then adjust annually after that).

Households that use subprime mortgages appear to be especially vulnerable, given the high share that will reset in the near-term. Moreover, this may be the group least likely to experience significant income increases that would make the mortgage payment hikes less burdensome. As an example of the potential payment shock in the subprime market, a typical 2/28 ARM originated in 2004 has an interest rate of 7.14 percent. On a $200,000 mortgage, that would represent a principal and interest payment of almost $1,350 per month. If that rate should rise by a full 200 basis points in 2006, as seems almost certain, the payment would increase to $1,613 – a hike of nearly 20 percent (and it would be even more if the borrower had an interest-only loan where there was no principal repayment in the first two years, and the entire amount would then amortize over the remaining 28 years of the life of the loan).

Here is the source for the above chart.

This is the bottom line:

Lenders are extremely complacent in the face of ever increasing risk. Margins are shrinking as customer quality is dropping, interest rates are rising, and home prices are stalling or even dropping in some areas. A rude awakening is in store for both borrowers and lenders when this credit bubble pops.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment