Note: Click on any picture for enhanced resolution.

The only "strong" chart was vehicle sales but then again GM lost over a thousand on every car they sold. Nonetheless, some have suggested that the Chicago PMI is just slowing down because of those sales and inventory will have to be built back up again.

I disagree. Take a good hard look at those sales. I think we had a blowoff top, that GM is producing vehicles that no one will want, especially with rising gas prices. More to the point, pure exhaustion will likely set in. If you disagree with that latter statement, please take a look at that chart and tell me what possible pent up demand for autos there can possibly be, except perhaps to dump SUVs for something more gas efficient. Unfortunately, GM is gearing up to produce more SUVs.

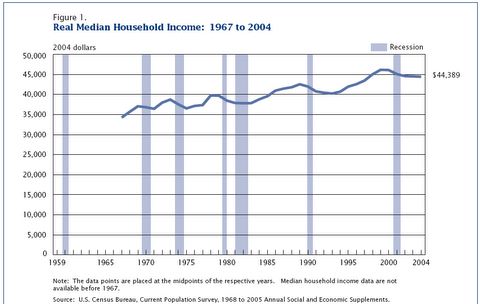

Obviously income never ticked up but somehow poverty did. The official poverty rate in 2004 was 12.7 percent, up from 12.5 percent in 2003. In 2004, 37.0 million people were in poverty, up 1.1 million from 2003. From the most recent low in 2000, both the number and rate have risen for four consecutive years, from 31.6 million and 11.3 percent in 2000 to 37.0 million and 12.7 percent in 2004, respectively.

In 2004, 45.8 million people were without health insurance coverage, up from 45.0 million people in 2003.

Was this really a recovery? If so for who? If this was supposed to "trickle down" I think somehow it "trickled up" instead.

Health insurance costs have skyrocketed, but fewer are insured. Is that supposed to happen in a recovery?

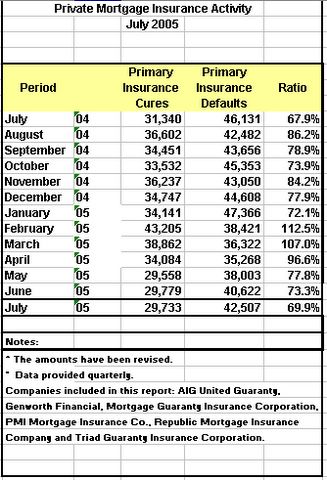

That final chart should be the clincher. Housing defaults have risen for four straight months and "cures" (those that were delinquent but have now caught up) have declined for six straight months.

Sad to say, but as pathetic as this recovery was (and it was pretty pathetic), it is now over. Housing has likely peaked and one million out of work people in New Orleans and skyrocketing gasoline prices likely just tolled the final bell for this trainwreck. The only open questions are: Will the New Orleans trainwreck cause the FED to pause sooner than it would have, and if so will that delay the recession until 2007. I think the first is likely but the second is not.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment