Notes:

- The above link points to a 92 page PDF document.

- It will take some time to read, but it is well presented and definitely worth a look.

- There are two options presented by the tax panel. One is called "The Simplified Income Tax Plan"; the other is called "The Growth and Investment Tax Plan". Many features are the same under both plans but there are differences especially when it comes to savings.

- Some of the differences between the plans as well as my conclusions are discussed below.

The panel's recommendations are a very good start at reform but the proposals could in theory be even simpler (i.e. a flat tax or consumption tax). However, the modifications suggested by the panel vs. the present tax nightmare are quite substantial. The panel attempted in good faith to address many fairness issues and come up with recommendations that stand a chance at getting passed. That is the key. A theoretical better solution would do no good if Congress would not pass it.

No doubt the national association of realtors (among others) will be all stirred up over some of the recommendations, such as reducing the interest deduction allowed for homes. As long as that deduction must remain (and for political reasons it probably must remain in some form), the idea to limit home deductions yet spread them out so that more people qualify seems more fair than the current system. Allowing interest rate deductions on second homes never made any sense and the panel was wise to reject that totally. The idea to cap the deduction also makes sense.

Personally, I do not think it should be the goal of government to encourage the purchase of certain asset classes at all. In that regard, I believe one of many reasons housing is not affordable now, is the fact that there are currently 80 bills that encourage "affordable housing". If it was up to me, I would scrap them all, right along with Fannie Mae.

That said, there is "ideal" and there is "possible". The panel's proposals are far more likely to fly than any kind of "flat tax" that might eliminate all deductions such as interest paid on mortgages. A flat tax would likely be viewed by many as "too radical". There are just too many vested interest groups that would pick apart such proposals.

The AMT is eliminated.

Everyone should applaud the panel’s recommendation to eliminate the nightmare known as the Alternative Minimum Tax (AMT). With the Panel’s recommendations, millions of taxpayers would no longer have to take on a complex series of calculations just to determine whether they are entitled to a tax benefit or whether it is taken away by the AMT. Here is what the panel had to say:

The AMT is an entirely separate tax system with its own definitions, exclusions, deductions, credits, and tax rates. It is the most vivid example of the wasteful complexity that has been built into our system to limit the availability of some tax benefits. The AMT was conceived as a way to make all Americans pay tax, regardless of their tax shelters and avoidance efforts. But over time, the AMT’s simple mission has been made more complex and less effective. For example, as part of the 1986 tax reform effort, lawmakers who eliminated the state sales tax deduction nonetheless preserved an itemized deduction for state and local property and income taxes – but only for those paying under the regular tax system. For those subject to the AMT system, the income and property tax deductions were eliminated as well. At that time, this rule had little significance for most taxpayers, but it is increasingly relevant as the reach of the AMT, which is not indexed for inflation, has grown.

Eliminating the AMT would free millions of middle-class taxpayers – 21.6 million in 2006 and 52 million in 2015 – from filing the forms, preparing the worksheets, and making the seemingly endless calculations required to determine their AMT liability. In 2004, an individual had to fill out a 12-line worksheet to see if he needed to file Form 6251, a 55-line form with eight pages of instructions. Those eight pages of instructions also tell the individual to redo many regular tax forms and schedules, including Forms 4952 (Investment Interest Expense Deduction), 4684 (Casualties and Thefts), 4797(Sales of Business Property), and Schedule D (Capital Gains and Losses) using the AMT rules. The individual may also have to fill out and file Forms 8582 (Passive Activity Loss Limitation) and 1116 (Foreign Tax Credit) on an AMT basis. The taxpayer also has to fill out a 48-line form (Form 8801) to determine whether he is entitled to credits for prior AMT payments. Finally, the instructions warn that if the taxpayer claimed the standard deduction for regular taxes, he should recalculate his regular and AMT taxes using itemized deductions because while the standard deduction is not available under the AMT, some itemized deductions are, but only if the individual itemizes for purposes of the regular tax.

Personal Exemptions, Child Tax Credits, Earned Income Credit, and the Marriage Penalty have all been addressed.

A recommendation was made to consolidate the standard deduction, personal exemptions, child tax credit, and head of household filing status into a single “Family Credit”. A recommendation was made to consolidate the earned income tax credit and refundable child tax credit into a single “Work Credit”. Both of these are good ideas. These ideas will eliminate many complex forms replacing them with a simpler one, while encouraging more people to work as opposed to stay on welfare.

Other highlights:

The Panel's recommendations would simplify the tax treatment of Social Security benefits and help reduce the marriage penalty as follows: options would make all marginal tax rate brackets, the Family Credit for married couples, and the Social Security benefits deduction thresholds exactly twice the amount for singles. By providing marriage penalty relief, the Panel’s options help reduce the barriers faced by potential second earners.

Reducing Disincentives to Save

It was encouraging to see the panel address the savings rate.

Household saving is crucial to the health of our economy and to the financial health of American families. An income tax reduces the return to saving because it taxes the income that saving generates. An individual who earns a dollar today pays taxes on those wages. If he then consumes the after-tax proceeds, he will not pay any further taxes. In contrast, someone who earns the same amount today, pays the same taxes on his wage income, but then decides to save the proceeds will be subject to additional tax in the future on the investment income generated from savings. A person weighing whether to spend money today or save it for the future may compare how much he can buy today against what he will be able to buy in the future with his savings. If the return on savings is subject to tax, current consumption will be less expensive than future consumption financed from savings. The tax on savings therefore operates like a penalty for those who choose to save.

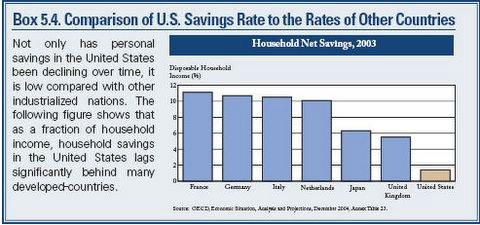

Following is one of the charts presented in the PDF:

Mish readers will not that the chart is way out of date. The current national savings rate is -1.6% (as in we are spending more money than we are making which of course is not only staggering on an national basis but also unsustainable).

The panel's recommendation is to simplify and expand opportunities for tax-free savings for retirement, health, education, and housing. Following is the pertinent discussion:

The Simplified Income Tax Plan would nearly eliminate the double tax on corporate profits by excluding dividends paid out of income earned in the U.S. In addition, 75 percent of capital gains on sales of stock in U.S. corporations would be excluded from income.

Under the Growth and Investment Tax Plan, the return to savings not held in these tax-preferred savings accounts would be subject to a flat rate tax of 15 percent. In addition, the simplified employer-sponsored accounts would use a “Roth IRA,” or prepayment approach, while the Simplified Income Tax Plan would use a “traditional IRA,” or postpayment approach. These two approaches provide similar incentives for savers, but they have different near-term tax revenue consequences. The overall tax burden on capital income would be lower under the Growth and Investment Tax Plan than under the Simplified Income Tax Plan, although some types of capital income might have a lower tax burden under the Simplified Income Tax Plan.

Both of the Panel’s recommended options would remove existing disincentives to save. These options would provide opportunities for Americans to save in a simple and efficient manner by replacing the tax code’s plethora of savings incentives with a unified system that would make tax-free savings for education, health, a new home, or retirement flexible, convenient, and straightforward. The tax code’s redundant savings incentives and accounts would be combined into three simple and flexible accounts for savings. The creation of these three simple saving opportunities significantly reduces the bias against saving and investment that exists under the current system. In addition, the Panel proposes changes to the administrative rules for some employer plans that would point workers in a pro-saving direction. The plans would allow most Americans to prepare for their future financial security free of tax. Not only would these accounts provide simpler and expanded opportunities to save, the playing field for tax-preferred savings would be leveled by eliminating exclusions under current law that allow some taxpayers to save an unlimited amount tax-free through life insurance, annuities, and executive deferred compensation arrangements. The Panel’s plans also would include a refundable Saver’s Credit that would give low-income Americans a strong incentive to save by matching contributions to savings accounts.

These approaches would diminish the need for taxpayers to hire tax professionals to help them navigate the tax code’s multitude of incentives. Americans would be able to make investment decisions based on their preferred investment strategy and no longer would be required to jump through hoops to make sure that they maximize their after-tax returns. Taxes would play a less prominent role in household savings decisions.

Given the partisan nature of Congress, as well as the likely nitpicking by groups feeling they were "unfairly picked on" by the proposed changes, the question remains as to what will happen in Congress over these proposals. The devil will be in the details as worked out by Congress, and therein lies another problem.

It can and has taken years just to address this mess and there might not be another chance for years more to come. The temptation for Congress to meddle with the Panel's recommendations will be extremely high. Lobbyists will be all over many if not all of these proposals in one second flat.

Is this proposal really revenue neutral?

The biggest problem I have with the set of proposals is simple: I fail to see how it can possibly be tax neutral. Let's see: we are getting rid of the AMT, reducing the marriage penalty, encouraging more tax free savings, and eliminating double taxation of dividends. In return, there is a reduction of part of the home interest deduction, elimination of deductions for state and local income taxes, and ending preferential treatment of employer provided fringe benefits such as childcare, life insurance premiums, and education costs. Even though part of the home interest reduction was eliminated, the plan was broadened such that more people who do not itemize are likely to benefit than before.

I can easily believe some recommendations are revenue neutral (like replacing Earned Income Credit and other complicated nonsense with a single "work credit"), but others such as eliminating the AMT seem to take a huge "leap of faith". The panel ended its discussion on the AMT with the conclusion that the AMT could be eliminated because they were "broadening the tax base". I am not exactly sure how any of their proposals did just that, at least enough to matter considering that the revenue generated by the AMT is expected to exceed regular tax revenues by 2013. It's too bad the report did not put a "price tag" on each proposal. Then again, putting a price tag on each proposal might have encouraged too much Congressional bickering. Perhaps it best to just take that "leap of faith".

To the extent that this plan is not revenue neutral, I certainly am all in favor of slashing the military budget, pulling all of our troops out of Iraq, Europe, Japan and South Korea, and reducing military expenditures enough to pay for any shortfalls. While we are at it, I would eliminate funding for the arts, a lot of foreign aid, bridges to nowhere in Alaska, crop subsidies, and probably a ton of other needless expenses as well.

Then again, even if the plan is revenue neutral, I am still in favor of slashing the military budget, pulling all of our troops out of Iraq, Europe, Japan and South Korea, reducing military expenditures, elimination of funding for the arts, cutting back on foreign aid, canceling projects that would build bridges to nowhere in Alaska, etc etc etc in order to help balance the budge deficit. It's high time we see some sense of fiscal responsibility out of this administration.

The bottom line is what matters and here it is: The panel's recommendations were probably a "best effort" at producing a significant proposal that will simplify the tax code, make it fairer, and have some chance of making its way through Congress. All in all, Mish applauds the work of The President’s Advisory Panel on Tax Reform.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment