The report shows domestic commercial banks reported a further net easing of lending standards and terms over the past three months.

In response to the special question about changes in terms on mortgage loans to purchase homes, notable net fractions of domestic institutions reported that over the past two years they had eased a number of terms, including the maximum size of primary and second mortgages, spreads of mortgage rates over an appropriate market base rate, and the maximum loan-to-value ratio.

Here are some highlights of the survey:

- Nearly 10 percent of respondents, on net, reported having eased their credit standards on loans to large and middle-market firms.

- About 30 percent of domestic respondents reported that they had reduced the costs of credit lines in October.

- Almost all domestic banks that reported having eased their lending standards and terms in the October survey cited more-aggressive competition from other banks or nonbank lenders as an important reason for doing so

- Almost 40 percent of domestic banks, on net, reported that over the past two years they had increased the maximum size of primary mortgages they were willing to provide.

- About 30 percent, on net, indicated that over the same period they had increased the maximum size of second mortgages.

- Adjustable-rate loan fundings for the month were $23 billion, up 42 percent from October 2004. Year-to-date adjustable-rate fundings totaled $214 billion.

- Nonprime loan fundings totaled $3.9 billion in October, which compares to $3.3 billion for the same period last year. Year-to-date nonprime fundings were $36 billion.

- Pay-option fundings for the month were $8.5 billion, as compared to $3.4 billion in October 2004.

- Interest-only loan volume was $8.9 billion for the month of October 2005, which compares to $5.9 billion, for the same period a year ago.

The LA Times recently discussed The hidden perils of pay-option loans. Let's take a look.

Borrowers with dangerous adjustable rate mortgages that give them the option of paying just about any way they like may find the loans even more perilous — and more expensive — than they ever imagined.Mish, is that what this is all about: greed on behalf of the lender and stupidity on behalf of the borrower? That seems likely but it really is impossible to say. Perhaps it is more like stupidity on behalf of both the lender and borrower to be taking risks like this at the pinnacle of this bubble in the face of repeated FED warnings. At any rate please remember the excuse the lemmings gave in the survey before they followed each other off the cliff: "Almost all domestic banks that reported having eased their lending standards and terms in the October survey cited more-aggressive competition from other banks or nonbank lenders as an important reason for doing so."

For starters, borrowers may find that as the rates on their mortgages adjust, they could be paying as many as three or four percentage points more than they would had they chosen a different type of adjustable mortgage.

Perhaps even worse, once borrowers realize they acted unwisely, they may not be able to get out of their loans without paying a hefty penalty. Even if you sell your house, you could be required to pay a prepayment fee totaling six months' interest to terminate the mortgage.

In exchange for all this, the broker who put his client in this precarious position is getting paid three times as much as he would had he placed the borrower in a more consumer-friendly adjustable mortgage.

Typically, lenders who actually fund the mortgage pay brokers a half-point — 0.5% of the loan balance — when they bring in borrowers who want a so-called payment-option ARM. But if the loan carries a prepayment penalty, they'll pay the broker a larger incentive.

These kinds of extreme charges are not attached to any mortgage other than pay-option ARMs, a loan that allows the borrower to choose from four different payment options each month.

Borrowers can pay the absolute minimum as calculated by a complicated formula. They can make an interest-only payment based on the fully indexed rate but with nothing going toward the outstanding balance. Or they can make a full interest and principal payment based on either a 15- or 30-year payment schedule.

Borrowers are drawn to pay-option ARMs because of their 1% start rate. But what they often don't realize — and sometimes aren't being told — is that while their payment doesn't change for a year, the rate starts adjusting after the first 30 days.

Of course, with these loans, the payment doesn't change until after 12 months. But because the rate moves on a monthly basis, the result is what's known as "negative amortization." That means that whatever the difference between what you pay and what you owe is added to the loan balance.

For pushing such an unfriendly loan on uninformed borrowers, mortgage brokers are paid handsomely, as are loan reps who work for lenders themselves.

"The kind of stuff going on out there is wrong," says Mitch Ohlbaum, a West Hollywood mortgage broker. "I think these loans work well when explained and priced properly. The problem is that no one is educating borrowers on what they are getting into."

A regular person with a regular job will fall behind very quickly if he makes interest-only payments. "People who know what they make each month have no business in a loan like this. They will get demolished."

What this most assuredly boils down to is:

- Fear of losing a deal

- Desire to increase market share or "make the numbers" regardless of risk

- Plain out and out greed

- Belief that Greenspan (or Bernanke) will bail them out if anything goes wrong

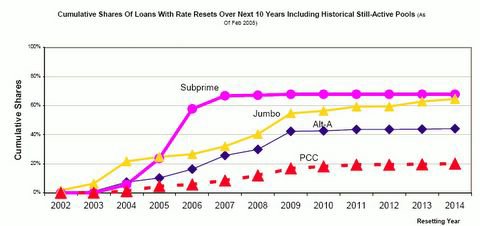

It seems like this is starting to matter right now, but even if not, it is going to matter sooner rather than later. Much sooner in fact, as evidenced by this chart.

Some time within the next year 60% of all of the outstanding subprime adjustable loans are going to reset. This is going to be a rude awakening to many who will see monthly mortgage payments skyrocket. Worse yet, given rising inventories and falling or stagnant home prices it is going to be hard to sell.

Right now it does not seem to matter. That is the way it always is. Nothing matters until it matters, and the corollary is that it never matters until the bitter end. Right now it seems that the fat lady is singing but few hear the tune.

Mish, Saxon Capital just reported, what did they have to say?

That is a good question so let's take a look.

Saxon Capital, Inc. Reports Third Quarter 2005 Operating Results .

"During the third quarter, we continued to see the unfavorable market conditions that we discussed in the second quarter", said Michael L. Sawyer, Chief Executive Officer of Saxon. "The continued rise in short-term interest rates, and accelerated prepayment speeds, coupled with the extended period of muted market pricing increases continue to adversely effect our results. We remain committed to prudent management through these times, concentrating on reducing general and administrative expenses, growing our centralized retail origination platform, focusing on capital preservation, and ensuring a strong balance sheet."

Well so much for honesty as the following chart shows.

Is Saxon being punished for honesty while CFC is taking on more risk?

Unfortunately I have no answer to that question other than perhaps CFC's day of reckoning is coming.

Mish readers might recall that we previously discussed Saxon Capital in Are we headed for a "credit derivatives event"?

In their last conference call Saxon was saying:

- "At the point in time WHEN the credit event comes, AND IT WILL we will be very well placed to take advantage of what happens next"

- "I am concerned about the level of capital" of our competitors "to service the bonds as those portfolios age"

Meanwhile, from The Economist Global Agenda, Buttonwood is asking With a pfffffffft or a fizzle?

What could give this scenario an uglier twist is the sharp increase in funny loans to funny borrowers over the past few years. “Subprime lending” to people who would not normally be able to make the grade is running at about $500 billion a year. Much of it takes the form of variable-rate, interest-only and negative-amortisation loans. Both debtors and creditors are now more exposed to interest-rate changes.Indeed. Hot potato is the name of the game.

Banks have been happy to lend to marginal debtors, safe in the knowledge that they could unload many of the loans either on one of the quasi-governmental housing agencies (Fannie Mae, Freddie Mac) or to private investors in asset-backed securities. Many of these loans end up in collateralised debt obligations (CDOs, which slice up bundles of referenced loans into tranches of different riskiness for different investors). Japanese and European investors have been especially enthusiastic buyers of this sort of paper, but there are signs of battle fatigue now: spreads have widened sharply over the past couple of weeks.

Take what you can when you can and pass the trash if you can.

Can this go on forever?

Not likely if the following headline is the start of any kind of trend:

Swiss pension fund shifting away from U.S.

Switzerland's $15.5 billion state pension fund plans to reduce its investment in U.S. bonds and dollar-denominated debt because of concern that rising U.S. government debt and interest rates may hurt the U.S. economy.Fannie Mae is a "time bomb".

Higher market interest rates could lead to defaults on loans by homeowners and affect mortgage finance companies including Fannie Mae and Freddie Mac, Eric Breval, managing director of the Swiss pension fund, said during a recent interview in Geneva. Assets will be shifted into euro-denominated bonds, he said.

U.S. government debt stands at a record, and Congress has increased its scrutiny of Fannie Mae and Freddie Mac amid concern that their debt may be too large, posing risks for the economy. Together, the two companies own or guarantee almost half of the $7.6 trillion U.S. mortgage market.

"There is a greater risk in the U.S. than elsewhere," Breval said. "When you see some institutions such as Fannie Mae and Freddie Mac and the time bomb they are sitting on, something may happen there one day, and we want to be less exposed."

I couldn't have said that better myself.

But the party continues. Right now money is still flowing into stocks and the market seems bound and determined to have a year end party. Who am I to argue? All I can say is that it will be one hell of a hangover when the party ends.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment