First-time jobless claims Soar

State unemployment benefits rose by 34,000 to 357,000

The number of U.S. workers applying for jobless benefits climbed by the highest amount in more than a year last week, to 357,000, the Labor Department said Thursday. First-time claims for state unemployment benefits rose by 34,000 to 357,000 for the week ending Nov. 25. The rise in claims is up from a revised 323,000 the prior week, the Labor Department said. The number of workers continuing to collect unemployment benefits jumped by 45,000 during the week ending Nov. 18, to 2.48 million. The four-week average of continuing claims also rose, by 18,750 to 2.45 million.Chicago PMI Contracts

Chicago PMI slows to lowest level since April 2003

Business activity in the Chicago region slowed to its lowest level in more than three years in November, according to Chicago purchasing managers index released Thursday. The Chicago purchasing managers index fell to 49.9% in November from 53.5% in October. This is the lowest level since April 2003. The drop surprised economists, who were expecting the Chicago PMI index to rebound slightly to 54.4%. Readings below 50 indicate contraction in the region. The employment index dropped to 49.4% from 57.0%. The prices paid index fell to 60.2% from 62.5% in October. The new orders index fell to 52.0% from 54.1%. Inventories fell to 57.7% from 67.2% in the previous month. The deliveries-diffusion index fell to 43.0% from 54.1%. This is the lowest since March 2001.Employee Compensation revised lower

It's all an illusion

A huge spike in wages and salaries in the second quarter proved to be an illusion, according to the latest data from the Bureau of Labor Statistics and the Bureau of Economic Affairs. The revisions released Wednesday show that growth in unit labor costs (and therefore in inflationary pressures) has been much lower than assumed. That's good news on the inflation front.Corporate Spending

But they also show that consumers don't have as much money as everyone thought they did ... $100 billion less on an annual basis.

The new data show that, instead of growing at a 7.4% annual rate in the second quarter, employee compensation actually grew just 1.4%. The revisions were reported by the BEA on Wednesday as part of its revision to gross domestic product data, based on updated BLS figures from tax records. Third-quarter compensation was also revised slightly lower.

Oh not to worry.

Corporate spending will rise to pick up the slack.

Right?

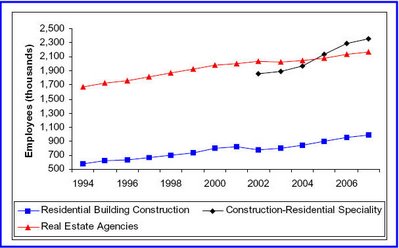

That is the mantra from the bulls but it is absurd. There is absolutely no reason to expand business heading into a recession. Once the current wave of in flight commercial construction is complete we are going to see massive layoffs. Those job numbers today are likely the start of it. But let's look at some other headlines to see what we can find.

Please consider Wolseley Cuts 2,000 U.S. Jobs to Tackle Housing Slump.

Nov. 29 (Bloomberg) -- Wolseley Plc, the world's biggest supplier of plumbing and heating equipment, said it cut 2,000 U.S. jobs after a housing slowdown reduced earnings.How about this headline: Sales Falloff Kills Staff Increase Plan.

November 30, 2006 -- Home Depot abruptly shelved a much-touted plan to improve customer service by hiring more store-level employees - just a month after rolling it out.For Home Depot to go from hiring plans to firing plans in a single month, things must have gone to hell in a handbasket in a hurry. There is no other rational explanation.

The about-face appears to be the result of a sales slowdown that is far more severe than the company anticipated, sources said. Rather than hiring additional employees, all stores - even those $40-million-plus high-volume locations - were told to cut staff hours by 200 per week because of falling sales.

The reason? Sales were falling short of internal projections, the result of a housing market that had stopped booming.

Inquiring minds might be wondering if this just a housing related thing. For an answer to that question please consider Pfizer to slash U.S. sales force 20 pct.

Pfizer Inc. said Tuesday it will cut its U.S. sales force by 20 percent, or 2,200 people, as part of a cost-cutting program to transform the company into a more nimble organization as it struggles with sluggish sales.Still the myth persists that corporate spending is going to pick up the slack. This belief is based on corporate cash levels. But if one looks at what corporations are doing (blowing their cash on buybacks at ridiculous prices and buying other companies for even more ridiculous prices, all while insiders are bailing like mad) then you have to be smoking something to think corporate spending is going to be a savior for this global trainwreck. It simply makes no sense to be expanding right into a recession that is obviously headed our way.

The drug company has 11,000 sales representatives, and the cuts will be made by the end of the year, according to company spokesman Paul Fitzhenry.

Even if a recession was not headed our way (it is but some refuse to believe it) can someone please tell me what we need more of?

Home Depots?

Lowes?

Pizza Huts?

Restaurants of any kind?

Strip Malls?

Furniture Stores?

Nail Salons?

Wal-Marts?

Office Supply Stores?

Grocery Stores?

Appliance Stores?

Auto Dealers?

Banks?

What? What? What?

Nothing is what. There is a veritable glut of every kind of store imaginable. The construction of all those places provided jobs. The staffing of all those stores provided jobs. Now what? Consumers are tapped out is what. Please don't try and tell me how expansion in India and China is going to save us either unless you tell me how many construction and retail jobs it will create here and how it will help tapped out consumers here.

Black Friday

Check out how quickly this story changed.

In NRF Black Friday Distortions we exposed as nonsense the Bloomberg headline U.S. Shoppers Spend 19% More on Thanksgiving Weekend.

Now just a few days later you have to laugh at this Business Week headline: Xmas Gloom?

'Tis a season retailers might not find so jolly. Despite massive discounting and earlier-than-ever openings, the Thanksgiving weekend kickoff to the holiday spending spree proved soft. Wal-Mart clouded Black Friday (so called because it's when retailers traditionally move into the black), announcing that it expected its worst November sales in over a decade. JPMorgan Chase retail analyst Charles Grom says that while industry sales momentum started strong on Friday, "it seemed to lack follow-through." Indeed, sales for the week fell 0.4% from the previous week, reports the International Council of Shopping Centers.Given the anemic job growth we have had this year even a slowdown in commercial expansion would cause a lot of hardship. But not only are we going to see a slowdown in commercial, we are going to see a veritable freefall in commercial activity. That will be on top of the massive slowdown in residential. But that is not the whole story because even places like Pfizer are wielding the axe.

"In 20 years doing consumer research on Christmas sales, I've never seen such bargain-driven shoppers," says America's Research Group's Britt Beemer. That won't help retail profits.

The government can play whatever games it wants with some numbers (like the recently revised up GDP numbers) but other numbers are hard and generally believable. One of the hard numbers is first time claims. Initial claims are not seasonally adjusted, not based on surveys, not guessed at, and not hedonically adjusted based on hat size of the applicant. Furthermore there is every incentive for someone who is eligible to apply (to get benefits).

There has been a massive uptick in unemployment claims including the 4-week average of claims. Real wages are down, claims are up, and we just hit our 19th consecutive month of negative savings. Bernanke is not going to know what hit him, once this traction really gets going. Discounting inventory buildup and fictional imputations we are likely in a recession right now.

Notes:

I did two more podcasts this week.

One with Tom Jeffries on HoweStreet about Black Friday and Catch 22.

One on the Wall Street Examiner Real Estate Roundtable with Lee Adler myself and Steve Northwood about the real estate market.

Interested parties may wish to tune in.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/