Manufacturing in the U.S. expanded at the slowest pace in more than three years last month and construction spending unexpectedly declined because of a deteriorating housing market.Bloomberg reported "construction spending unexpectedly declined because of a deteriorating housing market".

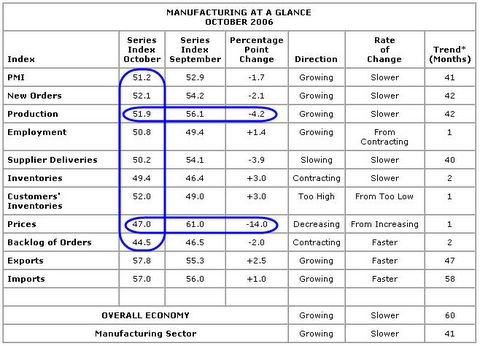

The Institute for Supply Management's factory index fell to 51.2, lower than forecast, from September's 52.9. A reading higher than 50 signals expansion. A measure of prices paid for raw materials dropped to the lowest in more than four years. Outlays for construction fell 0.3 percent in September following no change, the Commerce Department said in Washington.

Manufacturers are providing little spark for the economy, which grew the least since 2003 last quarter. Together with weaker consumer confidence reported yesterday, the figures spurred traders to begin wagering the Federal Reserve will cut interest rates by the end of March.

"You can see the evidence of economic slowing here almost every day," said Roger Kubarych, senior economic adviser at HVB America Inc. in New York and a former Fed economist. The Fed is "going to have to come off this bias toward tightening very soon. The risks of an economic slowdown are very great."

Fed policy markers may take comfort in the drop in the index of prices manufacturers pay for raw materials, which suggests inflation pressures are subsiding. The index fell to 47, from 61 in September. The measure is down 26 points over the last two months, the biggest back-to-back drop since records began in 1948.

Economists expected the overall index to rise to 53, according to the median of 72 forecasts in a Bloomberg News survey. Estimates ranged from 49 to 56.

A build-up in inventories is pushing some companies to cut production as a way to clear their shelves. Caterpillar Inc., the world's largest marker of earthmoving equipment, started cutting back inventory in its third quarter and said on Oct. 20 that it expects a "sharp drop" in truck engine sales.

"We have work to do on our production facilities," Caterpillar Chief Financial Officer David Burritt said in an interview on Oct. 20. "We see our business entering a pause, if you will, but beyond that we're optimistic about the future."

I am wondering how anyone could possibly have expected to construction spending to stay elevated in the face of the housing bust. Yet somehow we have a "big surprise" over these numbers.

It seems that very few see the massive recession that is coming. Instead we see "optimism about the future" from Caterpillar with similar optimism reiterated every 15 minutes by the cheerleaders on CNBC. I will have more on this theme in my next post.

October ISM Chart

The above chart is courtesy of Institute for Supply Management

Pay particular notice of the prices paid for raw materials component. It fell from 61 in September to 47 in October. "The measure is down 26 points over the last two months, the biggest back-to-back drop since records began in 1948" yet all the inflationists on Silicon Investor and other places are still harping about about double digit inflation.

Once again the deflation key to me is an actual credit contraction as opposed to a decline in prices. Yet I am nearly stunned at how those perpetually fixated on prices are ignoring ISM data and the housing collapse while closely monitoring trivial data such as the NYT increasing home delivery charges. Yes someone actually posted that on my blog as proof that deflation was not happening.

Pricing Power

This collapse in ISM prices paid should really not have been a surprise to those watching the trends. On August 16th in Intermediate vs. Finished PPI I asked "Where is the pricing power?" A table in the above link shows that for months on end it was extremely difficult to pass on price increases. While raw materials costs were soaring at that time, the intermediate PPI showed rising input costs simply were not being passed on. The situation was unstable. This was resolved by a break in the expected direction: south. The reason that direction should have been expected was (and remains) a sustained downturn in housing. A consumer led recession is going to follow.

NAHB

David F. Seiders, Chief Economist for the National Association of HomeBuilders is reporting Economic Growth Continues to Slow, But Recession Is Unlikely

As expected, growth of real gross domestic product (GDP) slowed further in the third quarter, according to the “advance” estimate released by the Commerce Department on Oct. 27. Third-quarter growth slipped to an annual rate of 1.6%, marking the second consecutive quarter of below-trend economic performance.Now just what kind of nonsense is that? Does anyone really think the NAHB "expected" the GDP to slow to 1.6%? Of course it was really more like .9% on account of auto production. But more to the point, where is the evidence that the "housing contraction now appears to be behind us, and the overall economy should strengthen in 2007 "?

It’s likely that GDP growth will remain somewhat below trend in the final quarter of this year (we’re projecting 2.7%), and RFI will once again exert a significant drag on economic growth.

However, the worst of the housing contraction now appears to be behind us, and the overall economy should strengthen in 2007 — steering clear of recession and carrying the expansion forward for years to come.

Indeed there is every indication that the housing bust is gaining steam. The yield curve sure is not suggesting anything close to a strengthening economy in 2007. Furthermore, we have not yet seen the effect of construction layoffs, rising foreclosures, and the inevitable spillover into consumer spending and commercial construction that tends to follow residential construction with a 6-12 month lag.

Europe

The Financial Times is reporting Eurozone inflation at 7-year low.

Eurozone inflation has fallen to its lowest level since November 1999 and economic confidence has reached a five-year high. However, German consumers have again spoilt the upbeat picture with September’s retail sales down on a year earlier.Once again we see the term "unexpectedly weak". Does anyone anywhere (except us bears that no one listens to) ever expect bad news? Does anyone see what is coming? German spending on big ticket items actually soared recently because of a huge VAT (value added tax) increase that takes place in January. With everyone scrambling earlier to purchase big ticket items ahead of time, one might think we might see a slowdown into the end of the year and certainly in the first half of next year.

The overall upbeat data on Tuesday highlighted the strength of economic activity in the final months of the year. However, the fall in the inflation rate, to 1.6 per cent in October from 1.7 per cent in September, added to the presentational problems facing the European Central Bank.

The ECB will almost certainly keep its main interest rate unchanged at 3.25 per cent on Thursday but has signalled that another quarter percentage point rise is highly likely in December – even though inflation is within its target of a rate “below but close” to 2 per cent.

The unexpectedly weak German retail sales figures suggested that economic recovery still lacks a broad domestic dynamism in Europe’s largest economy.

Perhaps we see a pickup in December getting all the bulls lathered up before the bottom falls out in January. Someone remind me to check in January if the bottom falling out of German consumer spending in 2007 was "expected" or not. For the record, I expect it to.

What has me laughing at that article however is the idea that "the fall in the inflation rate, to 1.6 per cent in October from 1.7 per cent in September, added to the presentational problems facing the European Central Bank."

The question here is "Do we want lower inflation or not?" If we do, should we really be worried about "presentational problems" simply because no one is expecting lower inflation?

Nightmare Scenario

Let's now turn our focus to the nightmare deflationary scenario facing the Fed. Stage one is the housing bubble bust now underway. Stage two is a massive loss of construction jobs. Stage three is a massive loss of white collar jobs.

MSN is reporting Pressure builds on U.S. business to outsource.

Pressure on the U.S. labor market from the outsourcing of traditionally white-collar jobs is just starting to build, according to a new study.In fighting the dotcom bubble bust the Fed unwittingly (or wittingly whichever you prefer) created an even bigger bubble in housing. As long as home prices rose and consumers could service that debt things were OK. Well home prices are no longer rising and cracks are in the consumer dike are appearing as evidenced rising foreclosure rates. A housing related jobs bust is 100% guaranteed to follow. That slowdown is likely to put additional pressure on companies to maintain earnings anyway they can. Heaven help us if the method chosen is outsourcing of additional white collar jobs.

Fortune 500 companies could potentially save $58 billion annually, or some $116 million per company, by offshoring general and administrative jobs, according to the Hackett Group, a strategic advisory firm.

The study estimates that increased use of cheaper overseas labor could affect up to 1.47 million back-office jobs, or nearly 3,000 at a typical Fortune 500 company.

Some of the job functions that can now more readily be shipped overseas than they could several years ago include IT, finance, human resources and procurement, the group said.

"Over the past few years, the resources available offshore have matured to an extent no one could have imagined, creating a paradigm shift that companies can ignore only at their peril," said Julio Ramirez, Hackett managing director.

The education base and skill set, and with it the potential savings on labor costs, is on the rise in India, China, the Philippines, Pakistan, Eastern Europe, Brazil and other emerging countries, the Hackett study contends.

The bottom line is simple. There is no conceivable action the Fed can take to replace jobs lost by a general economic slowdown, a housing slowdown, and increased outsourcing of white collar jobs. The mother of all credit bubble busts is coming and when it does it will not have anything remotely to do with inflation.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment