Mish,Thanks Michael.

Here is a synopsis of the mortgage side of things here in Orange County and for that matter California in general.

What people don't see, the NAR in particular, is the upcoming train wreck. I am talking about all the sub prime loans for refinances as well as purchases that were taken out 2 to 3 yrs ago and are now all coming due to reset. My guess is that 99% of all sub prime loans are all done on a 2 or 3 yr fixed interest only type program. People thought that it made no sense to take a 30 year fixed loan those homes when the short term rates were a lot lower, but they were all wrong.

The time bomb is about ready to go off. All of the subprime loans taken out 2 to 3 years ago have margins of at least 5% or higher and usually based on the London LIBOR program. Those loans are starting to reset now at fully indexed rates somewhere in the high 9% to 10% range. When those loans were initiated 2 to 3 years ago, they all had start rates of high 5% to low 6%. As of now, the LIBOR alone stands at 5.388 for the 6 month and 5.336 for the 1 year. Take those LIBOR indexes and add the margins to see what is going to happen.

Here is a case in point. One of my clients who took out an interest only subprime loan from another lender just received her reset notice. Her current margin is 5.25% and her index for the 6 month LIBOR index is 5.388%. This means her new interest rate will shoot up to 10.638%. Her note states that her first adjustment cannot go higher than 9.2%. So she will be at 9.2% for the next 6 months. With an initial loan balance at $251,000 at 6.2% interest only, she had a monthly payment of $1,296.83. In December her new payment will be $1,924.33 for the following 6 months before it adjusts again. This is a $627.50 jump in monthly payment. She simply can not afford this payment.

Given her low credit score near 550, she is fortunate to still have equity that will allow her to refinance at all. Even still it is a tough task because not only does she have a bad score, she also a late pay on her record. The best option any sub prime lender would give her was 8.5% but she can not even afford that. The only option left is a Neg Am Option Arm Pick a Pay Loan where her payment is based on an payment rate of 2% but with a fully indexed adjustable rate of 7.4%. She will go negative if she cannot make the interest only portion of this loan. She also needs cash, $75, 000.00 of cash. Mish, that is your typical home ATM machine at work.

These Option Arm, Neg Am Pick a Pay Loan programs were one of the things keeping the home building bubble and mortgage lending bubbles going for the last 3 years. Without these products, the market (at least in California) would have collapsed 3 years ago. Instead the bubble just got bigger and bigger and we will see even a greater collapse when it comes. Ninety percent of those who take an interest only loan can only afford the interest only part and not only that, there entire lifestyles are planned around that payment.

Lenders don't really want people to pay the principle off anyway unless there is a prepayment penalty on it. Prepayment penalties are another scam in and of themselves. You can bet the lenders have made a killing on these 6 month interest prepay penalties. Bear in mind that once someone is subprime the odds of that ever being corrected are slim. Refinancing on better terms is usually not an option. Average credit scores for this group on the whole have not improved much if indeed at all over the last few years. I would guess that 80 to 90% of sub prime borrowers stay sub prime borrowers. Those borrowers are in a hole so deep they will never cleanup their credit to get A-paper rates. To top it off, many of them end up paying multiple prepayment penalty each time they need more money. They simply can't wait for their prepay period to expire. Ultimately it is a death spiral to bankruptcy.

Ask any Realtor out there if they know or really care about the types of loans there clients are getting. They may say yes but my assumption is they just want to make the sale. Ask any mortgage loan officer if he or she cares about what loan program they put their client in. Many will say yes but the reality is that they just want to close the loan and get their commission. First greed took over. Now it is a matter of survival.

Here is another reason why these loans are pushed: Lenders pay a lot of rebate on the back end on these loans which fuels the greed even more. Mortgage professionals can make up to 3.5% back end points on these loans while their client's minimum payment stays the same. When you are talking about the high loan amounts in California, the money to be made by pushing someone into one of these programs is huge. So are the temptations. Some lenders went so far as to put on their rate sheets that the maximum a broker or mortgage loan officer can make is $50, 000.00 on a given loan.

Initially investors and flippers loved these loans because their payment was so low that by the time they could flip a home there out of pocket expenses were nothing. It all works well when the market is going up. When it stops or even falls, say good bye!

Everyone is in same box. Realtors need sales, homebuilders need sales, and mortgage brokers need sales. Unfortunately those needs too often come before their clients needs. In the end, the bankruptcies and foreclosures that result from this mess will just keep adding to inventory, ultimately forcing home prices lower. We are only in the first year of decline. From where I sit things will get a lot worse before they can get better.

Michael J. Dorff

Trans World Financial

Huntington Beach, Ca. 92646

Monday evening Mike Morgan puts himself in the shoes of a home builder and sees a giant catch 22. Stay tuned.

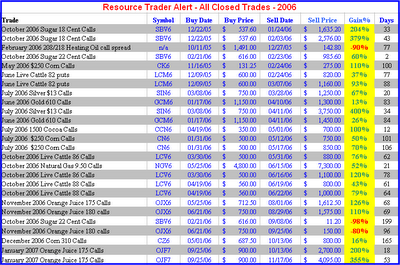

In the meantime I am doing one last plug for Kevin Kerr's Resource Trader Alert (RTA). Last week I posted a chart of Kevin Kerr's trades for 2006 and judging from the Email and blog postings there were many skeptics. For convenience I am repeating the chart of trades for 2006, followed by his track record for 2004 and 2005 that I did not post earlier.

Click on the chart for a better view.

In the above table there are 23 winners and 3 losers. One of the losses has a date of 2005 but it was an options spread and a portion of that spread was closed for a loss in 2006. Agora's legal department insisted the loss be included in trades for 2006.

Inquiring might be wondering about 2005 and 2004. RTA had 35 trades for 2005. The scorecard was 29 winners and 6 losers. For 2004 RTA had 10 trades, everyone was a winner.

2006 - 23 wins 3 losses

2005 - 29 wins 6 losses

2004 - 10 wins 0 losses

Note that RTA is strictly an option picking service as opposed to futures, so your full risk for each and every trade is known in advance.

Money Back Guarantee

Agora is currently offering a complete money back guarantee good for an entire year. Here is that guarantee:

As a special member and as part of this limited invitation, you'll have the right to cancel at any time during your membership. Yes, at any time. Even on the last day of your membership, for a refund of your full purchase price.

Disclosure

Many of you know that I have a relationship with Agora, so yes I stand to benefit if someone signs up. But if anyone is aware of a better track record on commodities than the one I posted above then please let me know.

Note to skeptics

I know that some of you are skeptics but the record is what it is. Some responses on my blog wondered about the meaning of "closed trade". Yes the record does include expired trades with options going to zero. That happened twice in 2005 but not at all in 2006 or 2004. Others wondered why that happened so infrequently and the answer is that Kevin likes to buy a lot of time so he only needs to be eventually correct as opposed to correct this month. His track record is such that he is usually eventually correct. Finally, remember there is a money back guarantee. You have the option of signing up and watching the trades without even taking them, just to monitor how things go for a while. At any point if you decide the service is not for you, you can close it out for 100% of your money back.

Past performance is of course no guarantee of future results, but for those interested in commodity trading with a limited predefined risk for each trade, with a right to a complete refund anytime for a full year, on a service with track record as good as Kerr's, please click here to signup now. Prices are set to rise Midnight November 27, 2006.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/

No comments:

Post a Comment