India HPI

click on any chart for sharper image

India home prices have been going up at a compound annual growth rate (CAGR) of 26% since March of 2009.

Mumbai and Delhi

Shenoy reports Mumbai is growing at a CAGR of 30%, and Dehli is up 47% from a year ago and 250% since March 2009.

Note the transaction volume in Delhi. Transaction volumes and prices are interesting in Bangalore and Chennai as well.

Bangalore and Chennai

Shenoy has details on five other cities as well. Inquiring minds may wish to take a look.

He writes "While India as a composite country is not at a bubble stage right now, it’s important to note that various bubbles are building up in individual cities. If any of these bubbles worsens, then it is likely that other cities will follow. There are no un-correlated prices in a crisis."

I would suggest that India as a composite certainly is in a housing bubble. The overall HPI shows just that.

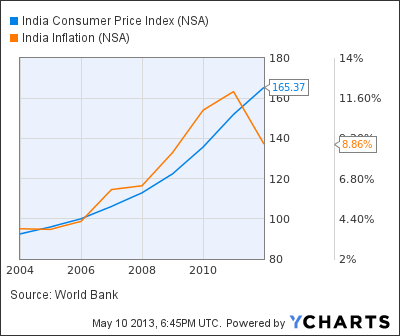

India Inflation

India Consumer Price Index data by YCharts

Home prices have increased far more rapidly than reported inflation, which I propose is hugely understated.

Inflation measures typically do not reflect actual property prices and certainly do not reflect other asset bubbles.

For a discussion, please see Hugely Negative Real Interest Rates Fuel Yet Another Housing Bubble; A Word About "Inflation" and Treasury Yields.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

No comments:

Post a Comment