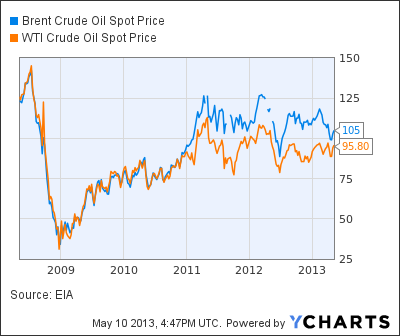

Brent WTI Spread

Note the drop in the spread between the US West Texas Intermediate (WTI) crude future and the Brent future, a benchmark price of European, African and Middle Eastern oil.

The futures diverged sharply in late 2010 and are now converging.

US Crude Exports to Canada Triple

Bloomberg reports Brent Pressured by U.S. Tripling Crude to Canada.

U.S. oil exports are poised to reach the highest level in 28 years as deliveries to Canada more than triple, helping bring down the price of the global benchmark Brent crude relative to U.S. grades.Does This Debunk Peak Oil?

The shipments will rise to at least 200,000 barrels a day by the end of the year, according to Ed Morse, head of global commodities research at Citigroup Global Markets Inc. Exports were 59,600 in 2012 and haven’t averaged more than 200,000 since 1985. The U.S. restricts companies from sending American crude abroad, with Canada an exception.

The premium for Brent, used to price European and West African crude, over U.S. West Texas Intermediate narrowed to less than $8 a barrel this week from $25.53 in November.

Exports to Canada doubled in February from a year earlier to 124,000 barrels a day, the highest level since 1999, according to U.S. Energy Information Administration data. Canadian refineries might be able to process “a couple hundred thousand barrels a day” from the U.S., Adam Sieminski, the EIA’s administrator, said in an interview in Houston.

Gasoline Prices

The government probably won’t change export rules while parts of the country still pay $4 a gallon for gasoline, said Stacey Hudson, a senior research associate with Raymond James & Associates Inc. in Houston. Shipments to Canada are a way to tap into a foreign market while avoiding that debate.

Inquiring minds may be wondering if this debunks peak oil theory. No it doesn't. Here's a quick three-point explanation.

- US energy consumption has fallen yet price is still high.

- High prices allows for marginal production.

- New techniques allows production in previous unworkable oil fields.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

No comments:

Post a Comment