I will be hosting a live session about "flation" on FxStreet.com with the theme of The great "Flation" debate - What's coming and how to profit from It. The date/time of the session is Thursday, July 28 at 15:30

GMT 11:30 EST.

Click here to register or to submit a question in advance. Get your questions in now and plan on being there!

On the day of the session you can enter the live session using

this link. To access the chat room, please choose a nickname and press the "connect" button. When you enter the room, you may be adverted with a security warning. If that were to be the case, just answer YES.

For those reading this blog regularly, much of the discussion topic has been covered in previous articles but hopefully I packaged it up in a nice neat way (but it is long). I have also added some new comments and ideas from Stephen Roach, David Rosenberg at Merrill Lynch and others.

During the session I will field questions submitted in advance as well as live questions submitted real time. If you have burning questions now is your time to ask them. Without further ado, here is the article for discussion:

The debate over inflation, deflation, hyperinflation, disinflation, stagflation and just plain "flation" have been raging now for months on end and if anything have heated up recently. Ok Mish, let's step back. Why should anyone care? If we are going to hell in a hand basket when the housing bubble pops (and it will) does it matter how we get there?

Yes, it does matter. Steps need to be taken to protect your money and smart investment choices certainly differ as to where we are headed and how we get there. In other words it is best to be positioned for the type of "flation" that is about to occur.

Before we proceed it is best to define some terms.

The classical definition of inflation and deflation from Ludwig von Mises

The Theory of Money and Credit is as follows:

"In theoretical investigation there is only one meaning that can rationally be attached to the expression inflation: an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange value of money must occur. Again, deflation (or restriction, or contraction) signifies a diminution of the quantity of money (in the broader sense), which is not offset by a corresponding diminution of the demand for money (in the broader sense), so that an increase in the objective exchange value of money must occur. If we so define these concepts, it follows that either inflation or deflation is constantly going on, for a situation in which the objective exchange value of money did not alter could hardly ever exist for very long."That snip was from an excellent article entitled

SCYLLA & CHARYBDIS THE SCOURGE OF MANKIND by Douglas V. Gnazzo.

Mr. Gnazzo goes on to write:

And now the tricky part: a definition of hyperinflation. Supposedly they, whoever they are, have not decided on an exact definition. Most often it refers to the monetary condition where the supply of money cannot keep up with the rising demand for money, which in turn causes prices and interest rates to go up as well.

But there is more to it than that. For now, suffice it to say that hyperinflation is inflation that has run amuck, the creature that is no longer under the master’s restraint. The following discussion will examine the two beasts: Scylla and Charybdis: deflation; and hyperinflation; and if there is an “unless” scenario.

In the above definition it is stated that inflation is “an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange value of money must occur.”

Fiduciary media – sounds pretty impressive but it’s not. Fiduciary media is a fancy word for money substitutes: stuff that isn’t actually money, but represents claims on money. All those checks we write would be an example; all those computer entries on the ledger would be another. Mr. Gnazzo goes on to explain monetary inflation, price inflation, asset inflation, savings, credit and other terms. I will accept all of the definitions as stated and discussed by Gnazzo. Stagflation is a wimpy term that Gnazzo did not address but is generally used to describe rising interest rates and a stagnant economy. Disinflation, another term Gnazzo did not define is generally accepted as a slowdown in the rate of inflation. Finally,

dictionary.reference.com defines reflation as "inflation of currency after a period of deflation".

Hopefully that is enough terms as I just can not take any more!

OK Mish, what investments are best and when?

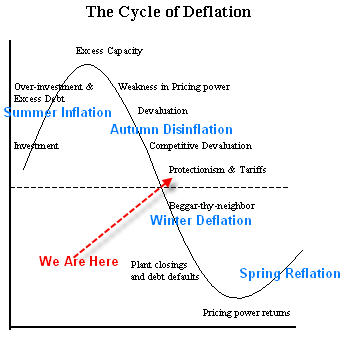

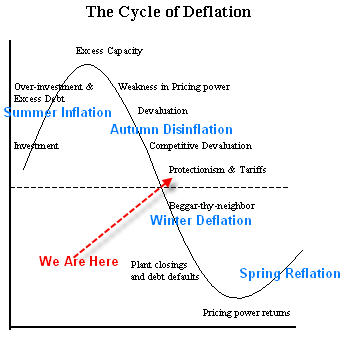

Let's make a grouping of four, calling them Spring, Summer, Autumn, and Winter otherwise know as the Kondratieff Cycle:

Spring:Inflation/Reflation - Bonds and interest rate products do poorly, commodities do well

Summer:Hyperinflation/Stagflation - commodities do well, most everything else is horrid

Autumn:Disinflation - bonds and stocks both do extremely well, commodities do poorly

Winter:Deflation -Treasuries and interest rate products do well, most everything else horrid

Following is a chart of the Kondratieff Cycle (K-Cycle for short).

Notice where I placed the arrow.

Certainly if we are headed into Spring, and even more so into summer the very last place you want to be is in treasuries and interest rate products in general.

If we are headed into Winter or are already there, the last thing you want to be doing is shorting treasuries. You also do not want to be long equities or long much of anything for that matter.

OK Mish what gives? If we are headed into Winter as you suggest, why are stocks rising pretty much world wide and more importantly why are commodities currently doing so well?

Those are good questions as well as important questions.

Please bear in mind that not every country is on the same cycle at the same time. Japan has been in Winter (deflation) for going on 18 years and may indeed be coming out of it soon. Note too that K-Cycles apply best to capitalistic economies as opposed to command economies like China.

Also note that the CRB commodities index is very heavily weighted towards energy. Oil, and energy products in general) are subject to peak oil constraints as well as geopolitical factors. One can not blame peak oil shortages or weather or geopolitical concerns as inflation. Indeed soybeans skyrocketed up a couple of years ago on bad weather and soybean blight and crashed last year on perfect weather. It is totally nonsense to blame all rising prices on "inflation" and dismiss all falling prices as "productivity" as some prominent names have done. Indeed if one looks at corn, soybeans, lumber, sugar, cotton, and coffee, one would be very hard pressed to make a case for sustained inflation.

Finally, please note that the FED has been well aware of the problems of Japan and acted in advance (by slashing interest rates to 1%) to prevent the US from falling into deflation. Greenspan in all his hubris, declared the defeat of deflation. That alone should scare those believing in inflation half to death. No one has been more wrong, more often than Greenspan.

Greenspan accomplished nothing more than creating additional bubbles in junk bonds, equities, and most importantly housing. Those bubbles will be deflated away, not inflated away, or every Tom, Dick, and Harry chasing real estate at absurd prices will be correct. I view that as very unlikely to say the least.

In short, it is highly unlikely that we have completed the Winter deflation cycle. It is far more likely we have temporarily interrupted the cycle. This has led to a phenomenon that I call "a False Spring" and it has also led to a preponderance of conundrums everywhere. Given the length of the Autumn disinflation and massive stock market bubble along with it, it also seems highly unlikely that we have wiped away those excesses in a few short years since the Naz bust. Indeed, given the fact that consumer debt and optimism were never flushed, "highly unlikely" does not seem anywhere near strong enough. When the housing bubble pops, our early Spring Groundhog will be frightened by his own shadow and go running for cover. Liquidity will dry up and there will be hell to pay for the excesses of the past 20 years.

As of right now we are still in a

"crisis of excess liquidity" but remember that

liquidity and complacency are both at their maximum right before a crash. Is 1929 too far back to remember? I am afraid that it is. However 2000 should not be, but apparently it is as well. We have transferred a stock bubble into a housing bubble where people are paying absurd prices for condos and houses sight unseen. That is the affect of the "False Spring". The consequences will be devastating when the housing bubble pops.

For additional discussion of the K-Cycle and the recent "False Spring" please refer to

The Kondratieff Cycle.

Mish, is there any more evidence to support your theory that we are headed into Winter as opposed to having just experienced Winter and are now heading out of it?

Yes indeed there is.

I discussed the current situation at length in

Same Data / Different InterpretationThe deflation debate heats upInflationists RespondFor those lacking in time to read all of those articles, let me sum up the basic scenario that I envision that no inflationist has yet to respond to in any meaningful way:

Here is the nut hyperinflationists need to crack:

1. Falling home prices

2. Falling wages

3. Stagnant employment or rising unemployment

4. Slowing world economy

5. No incentive for the FED to bail out consumers at the expense of banks

6. The K-Cycle is not likely to be defeated by throwing more money at the problem.

7. At some point lenders refuse to lend or borrowers stop borrowing. That time will be at hand when housing plunges. Look at current events in the UK as a prelude for what will happen here.

Here are the inflationist scenarios as best as I can since no one else seems willing to take it on.

Here are two scenarios that will work:

Scenario A:

A1)Increasing demand for commodities from China.

A2)Housing prices stay strong and economic activity picks up worldwide.

A3)US wages rise

A4)Rents rise

A5)Demand for goods in the US stays strong

A6)Demand for goods in Europe picks up

A7)Demand for goods in China picks up

It may not take all of those but it would take a lot of them to be consistent with sustained inflation.

Scenario B:

B1)Increasing demand for commodities from China in the face of a US housing bust

B2)Consumers keep spending money and banks keep lending even as asset prices fall

B3)Should consumers stop spending in the face of job losses associated with the housing bust, the FED goes on a mad printing spree.

B4)Since the FED can print but not force the consumer horse to drink (increase borrowing), a "helicopter drop" is issued (whereby Congress passes laws that literally gives money away to consumers)

B5)The "helicopter drop" is done in the US only and other countries refuse to finance it. (If everyone did it the US$ would not drop).

B6)Banks and other creditors have no say in this and are destroyed along with the FED in the hyperinflation that takes over.

B7)The consumer is bailed out at the expense of big creditors like Citycorp, American Express, Visa, MasterCard, etc.

B8)The business cycle is defeated. There will never be a recession again.

B9) Consumers never need to save again but are bailed out by rising asset prices.

Again it may not take all of those but it would take the crucial ones: The FED and Congress acting together to bail out consumers at the expense of creditors. It would probably have to be a US related thing only to force the dollar to get smashed vs. other fiat currencies.

That is what I am looking for: A logical scenario that addresses the full implications of a housing bust, or some sort of scenario that addresses the full implications of a FED that voluntarily produces hyper-inflation.

I have three times challenged hyperinflationist Puplava to a debate on these issues. He has not responded. On Puplava's July 23rd netcast he was asked why he would not respond to the debate. Puplava replied that there was nothing to respond to... that he would not respond to a list of items .... and that we have not seen deflation since the great depression. Here is a direct quote

"In order for me to respond there has to be something to respond to.... you can not respond to laundry lists. There is nothing of merit to respond to".His response to the question was curious to say the least. I responded to a 14 point "Laundry List" of Puplava's in

Same Data / Different Interpretation. I also responded to a second Puplava "Laundry List" in

The deflation debate heats up where Puplava gave his list of ten reason why hyperinflation is coming. Are laundry lists are only acceptable if they support hyperinflation viewpoints? I also found it interesting that Puplava had praise for Precther who sees the issue as a matter of timing and that hyperinflation is eventually coming "It's just a matter of timing".

Yes indeed. It is just a matter of timing. I agree with both Puplava and Prechter on that. Some people think the business cycle (K-Cycle) can be defeated others do not. Hyperinflationists say we have not seen deflation since the late 20's early thirties therefore we are not going to see it. Hmmm. Given the length of time of the cycles, might it just not be about time for another K-Winter?

The mistake of hyperinflationists is projecting into the future what they see in front of their noses, as if it can go on forever. Note too that in a complete K-Cycle inflation is rising for three of the four periods so by definition inflationists are right most of the time. By the time we hit the third season (Autumn) there are no (relatively speaking) deflation believers left and we are scorned by the masses. Hyperinflationists simply will not look at the number one cause of deflation: an unsustainable credit boom that inflates illiquid assets such as real estate, and produces overcapacity on all or nearly all manufactured goods.

In that regard, housing has boomed and is now falling in Australia, the UK, and some places in China. Topping signs are also present right now in the US. Overcapacity is rampant in China on nearly all goods. Those are the seeds of deflation, not inflation.

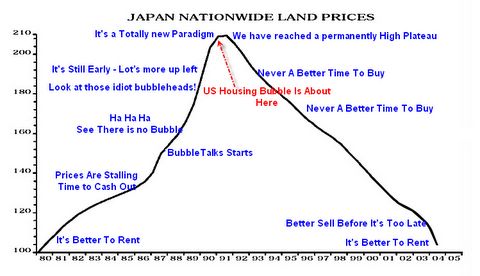

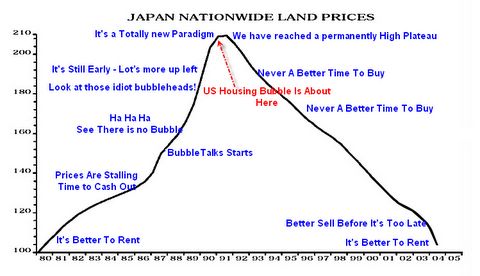

Following is a chart showing where the US currently is in the housing cycle.

Please mentally move that arrow to the exact top and that is about where I think we are. What is interesting about housing bubbles is that most of the time they are local. One region peaks, and on a different time scale another one peaks. When the Oil boom ended and housing crashed in Texas it did not affect prices in Chicago, Boston, Miami, or LA. Take a look at us now. We have property bubbles in California, Florida, Las Vegas, Chicago, Milwaukee, Minneapolis, and other cities too numerous to mention. When was the last time we saw speculation in real estate this high?

The answer is the mid to late 20's, especially Florida. We have land speculation not seen since then. Unbuildable swamp land in Florida is once again being sold for tens of thousands of dollars. People are buying houses and condos sight unseen. Here we are staring into the jaws of an enormous property bust (one that even the hyperinflationists see) but all hyperinflationists can see is "We have not seen deflation since the early 30's". No deflation since the 30's huh? Is it a coincidence that we have not had huge real estate speculation, mammoth overcapacity, and an enormous credit bubble since then either? I think not.

Here is my take.

Hyperinflationists refuse to respond to the implications of a housing bust in conjunction with overcapacity and a blowoff top in credit speculation for one reason only. They can't (at least not in any logically believable scenario).

The biggest argument the inflationists seem to have is money supply: it never seems to go down. But... Can money supply rise and prices still fall through the floor? Of Course! Witness Japan. Japan suffered the deflationary affects of a property bust for the last 18 years even though the Japanese government was printing like mad. Japan went from being one of the world's biggest creditors to a nation with a national debt about 250% of their GDP.

With that thought, let's once again return to the classical definition of inflation and deflation from Ludwig von Mises as shown earlier:

"In theoretical investigation there is only one meaning that can rationally be attached to the expression inflation: an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange value of money must occur. Again, deflation (or restriction, or contraction) signifies a diminution of the quantity of money (in the broader sense), which is not offset by a corresponding diminution of the demand for money (in the broader sense), so that an increase in the objective exchange value of money must occur. If we so define these concepts, it follows that either inflation or deflation is constantly going on, for a situation in which the objective exchange value of money did not alter could hardly ever exist for very long."If one ponders the Mises definition, then one can finally relate to the 18 year deflation in Japan while Japan's national debt rose from zero to 250% of GDP.

In short, the FED can print but it can not force people to borrow or banks to lend. In a housing bust just what demand will there be for money from people that have jobs, that banks would be willing to lend to, in an ocean of overcapacity? The bottom line is that we are indeed headed for a Japanese style liquidity trap as explained in

UK / US Housing and the upcoming liquidity trap.

In

Which Flation Is It? Pater Tenebrarum discusses viewpoints of Austrian scholar Frank Schostak in a Mises article entitled

"Does a falling money stock cause economic depression?" ... an excellent article with many charts depicting the 30's depression's macroecnomic and monetary data - which prove, beyond a shadow of doubt, that the Fed was priming the pump madly at the time, contrary to popular mainstream economic misconceptions. but it didn't work - a deflation of both the money stock and bank credit, as well as a vicious price deflation ensued. note that prices at one point registered an aggregate annual decline of over 10%). as an added bonus, there's a chart detailing the change in the BoJ's holdings of government securities during the 1990's - which contradicts Saville's contention that Japan relied 'mostly on fiscal deficit spending' as opposed to monetary pumping. it relied in fact on both.Consider these supporting opinions from highly respected economist Stephen Roach:

In

Inflation Phobia Stephen Roach writes:

Two years ago, the core CPI slowed to just 1.2% in the six months ending February 2004 before rebounding quickly back toward 2% by the final quarter of the year. For reasons noted above, in the face of a China slowdown, downside risks to the core CPI hint at an outcome that might even go beyond the concept of just a deflation scare. The next time, it may be the real thing. So much for inflation phobia!In

Inflation Convergence Stephen Roach writes:

the increasingly powerful forces of worldwide pricing convergence suggest that domestic attempts to exercise pricing leverage will encounter stiff global headwinds in a climate where non-US world inflation is likely to remain subdued. Consequently, barring the unlikely reversal of globalization, I continue to believe that persistently low global inflation will prevent a meaningful deterioration on the US inflation front. Needless to say, that has especially important implications for Fed policy and fixed income markets -- underscoring what I still believe could be a surprisingly bullish outlook for bonds.

Finally, in

No Bottlenecks without a Bottle Stephen Roach writes:

At work, in my view, is the globalization of disinflation. Our old closed-economy models have been rendered increasingly obsolete by the emergence of far more powerful cross-border influences on pricing. With those three article Roach joined the deflation camp. Many treasury bears are convinced the capitulation of Roach and Bill Gross, in conjunction with the repeg of the RMB by China marks the beginning of the end for US treasuries and the US dollar. The plain fact of the matter is there are forces at work that provide powerful resistance to any sort of sustainable inflationary bout.

David Rosenberg, chief ecomomist for Merrill Lynch would also seem to agree.

Every week Mr. Rosenberg puts out

"Dave's Top Ten" 10 major macro themes of the past week. Following is point number 5 for the week of July 22, 2005:

5. We do not know why so many believe that the Fed is so accommodative:

Yes, credit spreads are tight but we're not convinced that is saying

anything about the state of monetary policy. The real funds rate is now in

positive terrain based on any inflation measure you want to use at a time

when there is still an output gap—which we estimate at 1.5%—does not

represent a loose monetary stance. That the economy is cruising along

near potential and core inflation trends are low and showing signs of

rolling over. The dollar has firmed this year, notwithstanding yesterday's

FX move by China. Raw industrial commodity prices are well off their

highs. And the money supply numbers, which fell sharply on the July

11th week, are extremely well contained—y/y growth in M1 now at

0.6%; 3.5% for M2; 1.1% for MZM and 4.9% for M3. These are not the

conditions for higher inflation and not the conditions, in our view, for a

sustained selloff in the bond market.

The rest of the list is very interesting as well. I highly recommend reading it.

With those excerpts from various highly regarded economists, let me quickly sum up the three biggest headwinds for inflation:

1) a busting of the housing bubble

2) global wage arbitrage

3) overcapacity

Those headwinds are so formidable that calls for hyperinflation in the face of them seem silly at best. If the world's biggest reflation effort in history along with interest rates at 1% failed to produce hyperinflation, it is borders on nonsensical to believe that a housing crash (the single most deflationary thing I can think of) will bring about hyperinflation.

As usual, timing is everything but the odds seem overwhelming that we will see a destruction of credit and deflation in asset prices before any possible hyperinflation scenario.

Investments that will do well in a deflationary environment are as follows:

1) Treasuries

2) Gold

3) Cash

On the aggressive side, shorting stocks in the financial sector AFTER the housing bubble pops should be a winning strategy. One might also consider investing in interest rates futures in the US and UK. Multiple cuts are already priced in for the UK right now but buying the dips in Short Sterling futures (UK interest rates futures) may be a good idea. I am in Sept 2007 futures as well as a stash of Sept 2006 calls that are now quite deep in the money.

An extremely conservative play would be investing in a ladder of US treasuries 1-yr, 2-yr, and 5-yr, rolling them over as they expire. US treasuries are the single most universally despised asset class right now. Sentiment against them is extreme. It would indeed be fitting if that was one of the best performing asset classes over the next several years. The caveat will be that treasuries do well in Autumn and Winter. When Spring finally does come you better be out of them.

Japan will likely head out of deflation first. At some point shorting Japanese government bonds will be an enormous winner. The same case can be made for US treasuries but not until we go thru Winter. That can be a long time as evidenced by Japan.

Also remember the primary goal in a deflationary period is to protect what you have. He who loses the least will win the most.

Let me offer one final thought from SCYLLA & CHARYBDIS THE SCOURGE OF MANKIND.

History is replete with bouts of both hyperinflation and deflation. One distinction that history shows, however, is that hyperinflation ends the life of a currency – it no longer is accepted as the medium of exchange. Although deflation is wrought with pain and suffering, defaults, bankruptcies, job losses, depressions, etc.; the currency is not destroyed or ended. The slate of debt is wiped clean, and the game begins anew, another cycle of boom and bust in paper fiat land. Hyperinflation destroys the currency; deflation prolongs the life of the currency. The first ends the currency game; the second allows the game to continue.Given that hyperinflation will not only "end the game" as Gnazzo cleverly puts it, it would also put the FED out of business and bail out debtors at the expense of big banks like JPM and Citycorp. Is that really likely? I have no doubt the FED will try and inflate. The operative word is "try". Even though it is rational to believe they will try, it is not rational to believe they will continue to inflate if it means "the end of the game". The rational conclusion therefore is that the Bernanke "Helicopter Drop" theory is nothing more than a big bluff.

He is the bottom line: The vast preponderance of evidence suggests that we are heading into or are already in K-Winter. Winter was interrupted by a "False Spring", the FED will not "End The Game" by bringing about hyperinflation, and the normal boom bust K-Cycle is still intact.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/